Get the free Long-Term Disability Insurance is Paycheck Insurance - pennsbury k12 pa

Show details

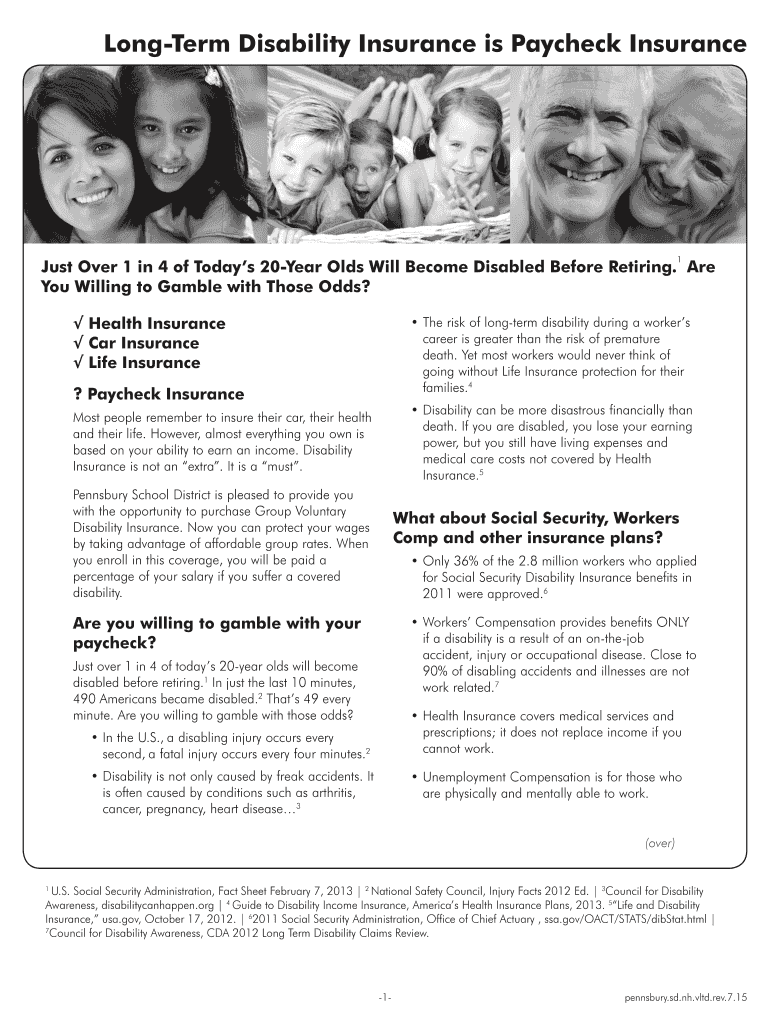

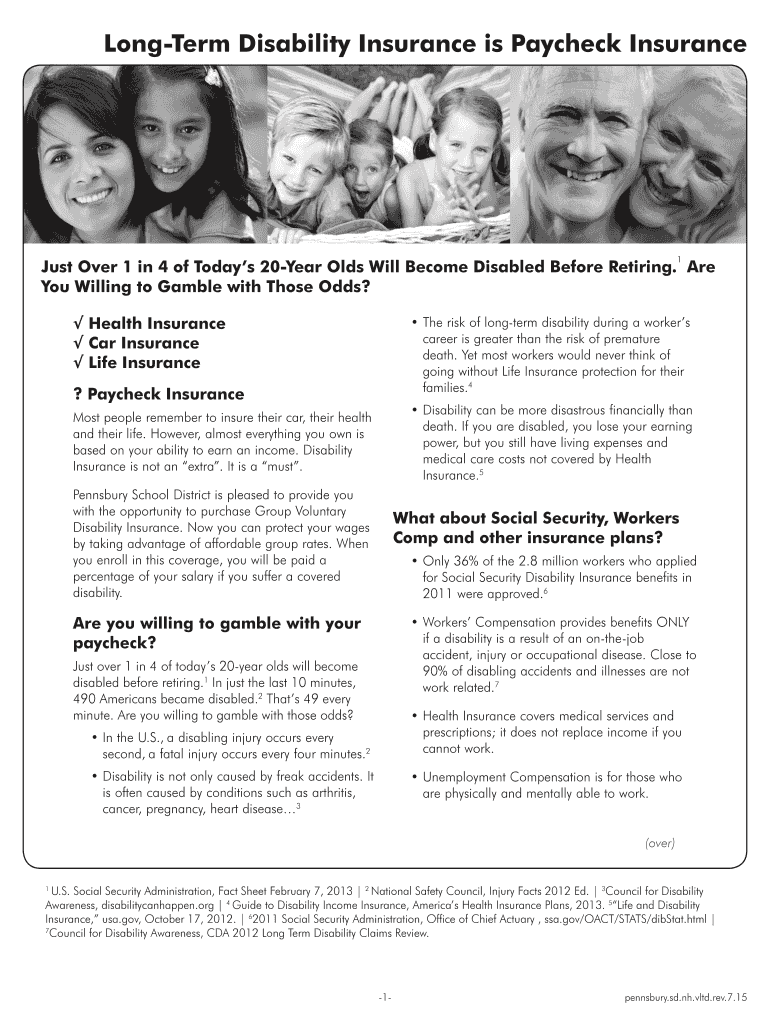

Longer Disability Insurance is Paycheck Insurance 1 Just Over 1 in 4 of Today's 20Year Olds Will Become Disabled Before Retiring. Are You Willing to Gamble with Those Odds? Health Insurance Car Insurance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long-term disability insurance is

Edit your long-term disability insurance is form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long-term disability insurance is form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit long-term disability insurance is online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit long-term disability insurance is. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long-term disability insurance is

How to fill out long-term disability insurance:

01

Start by gathering the necessary information: Before filling out the long-term disability insurance application, gather all the relevant information such as your personal details, employment information, medical history, and any additional documents required by the insurance provider.

02

Understand the policy: Read the policy thoroughly to familiarize yourself with the coverage, benefits, exclusions, waiting period, and any other important details. This will help you accurately complete the application and make informed decisions.

03

Provide accurate personal information: Fill out the application form using accurate personal information, including your name, address, contact details, and social security number. Double-check your information for any errors or inconsistencies.

04

Disclose your medical history: Most long-term disability insurance applications require you to disclose your medical history. Provide complete and honest information about any pre-existing conditions, past injuries, surgeries, or ongoing treatments. Remember to include relevant medical documents or reports if requested.

05

Detail your employment information: Provide accurate details about your current and previous employment, including job titles, responsibilities, salary, and any additional sources of income. This information helps insurers assess your eligibility and potential benefit amount.

06

Review the application: Carefully review the completed application form for any errors or omissions. Ensure that all the information provided is accurate and supported by relevant documents. Taking the time to review the application can help avoid delays or potential claim denials.

Who needs long-term disability insurance:

01

Individuals with dependents: If you have dependents who rely on your income to meet their financial needs, having long-term disability insurance can provide a safety net in case you're unable to work due to a disability. It ensures that your loved ones are taken care of even if you can't generate income.

02

Self-employed individuals: If you're self-employed, you may not have access to employer-sponsored disability coverage. Having long-term disability insurance can protect your income and financial stability if you're unable to work due to a long-term disability.

03

Individuals without sufficient savings: Without a substantial emergency fund or savings, a long-term disability can quickly deplete your financial resources. Disability insurance can help bridge the income gap and cover essential expenses during a prolonged period of disability.

04

Those with physically demanding jobs: If your occupation involves physical labor or poses a higher risk of injury, long-term disability insurance can provide financial protection in case an injury or disability prevents you from working.

05

Individuals without sufficient employer coverage: While some employers offer disability insurance, the coverage may be limited or insufficient. Assess your employer's disability benefits and consider supplementing it with a personal long-term disability insurance policy to ensure comprehensive coverage.

Remember, it's always advisable to consult with an insurance professional or financial advisor to determine the specific type and amount of long-term disability insurance that suits your individual needs and financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get long-term disability insurance is?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific long-term disability insurance is and other forms. Find the template you need and change it using powerful tools.

How do I fill out long-term disability insurance is using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign long-term disability insurance is. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I fill out long-term disability insurance is on an Android device?

Use the pdfFiller app for Android to finish your long-term disability insurance is. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is long-term disability insurance is?

Long-term disability insurance provides income replacement for individuals who are unable to work due to a disabling injury or illness.

Who is required to file long-term disability insurance is?

Employers may be required to offer long-term disability insurance to employees, but it is generally optional for employees to purchase.

How to fill out long-term disability insurance is?

To fill out long-term disability insurance, individuals need to provide personal information, medical history, and details about their occupation and income.

What is the purpose of long-term disability insurance is?

The purpose of long-term disability insurance is to protect individuals from financial hardship if they become unable to work long-term due to a disability.

What information must be reported on long-term disability insurance is?

Information such as medical records, current income, occupation, and details of the disability must be reported on long-term disability insurance.

Fill out your long-term disability insurance is online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long-Term Disability Insurance Is is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.