Get the free LIKE KIND EXCHANGE ANALYSIS - East Coast Abstract

Show details

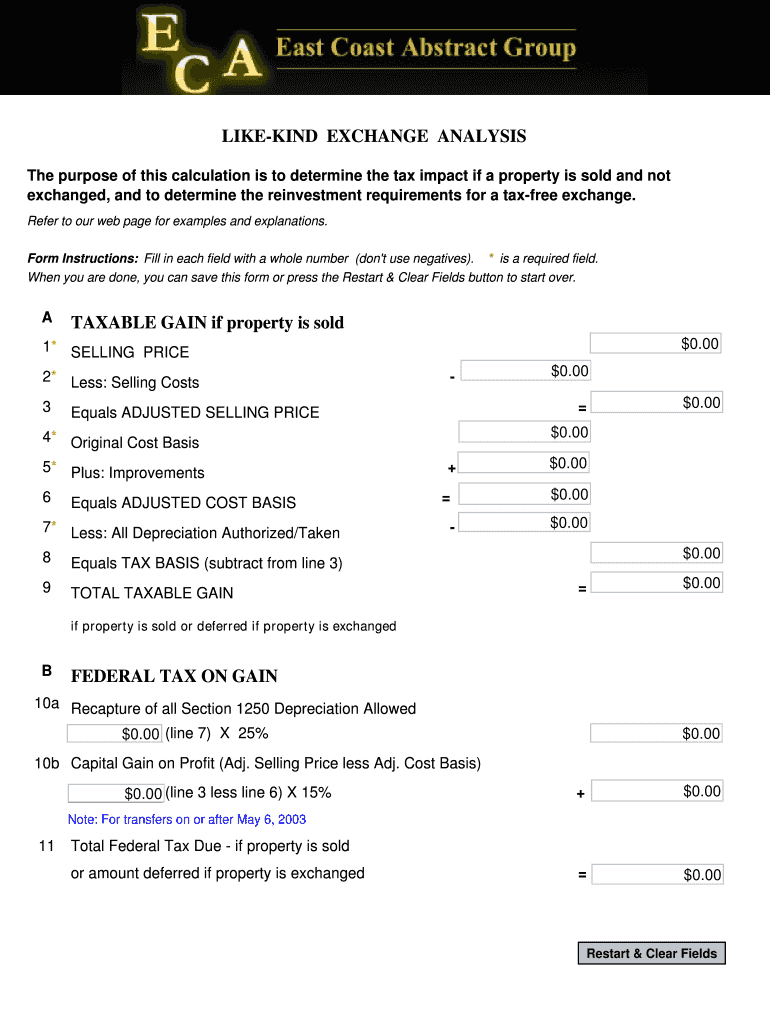

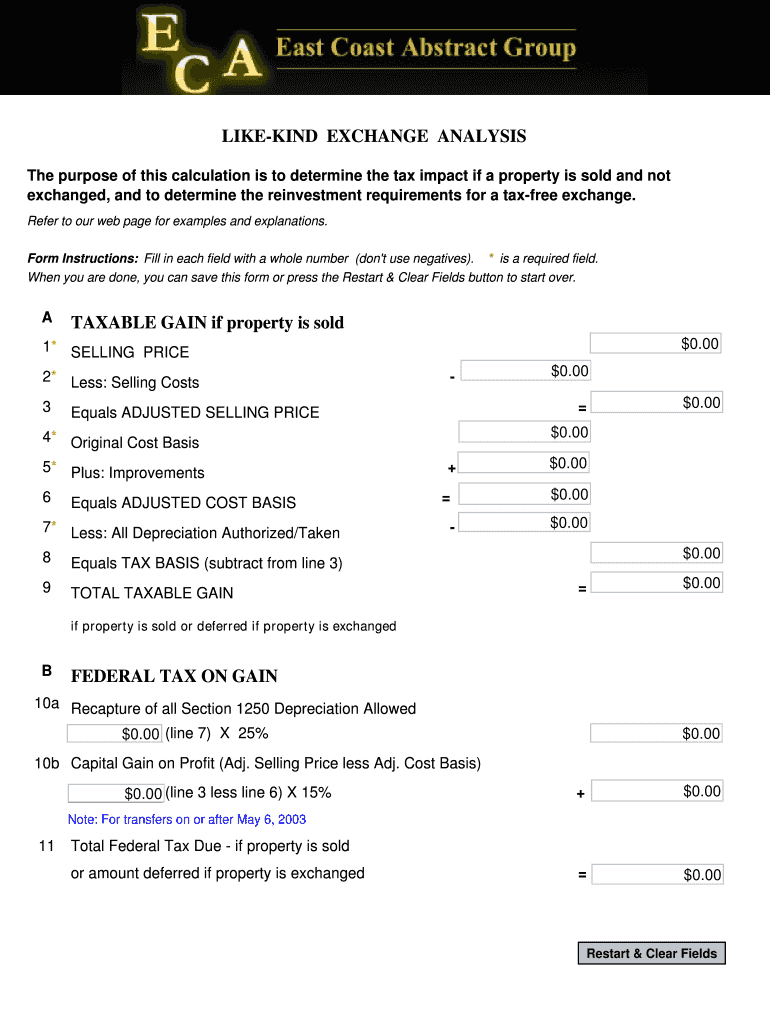

LIKENING EXCHANGE ANALYSIS The purpose of this calculation is to determine the tax impact if a property is sold and not exchanged, and to determine the reinvestment requirements for a tax-free exchange.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign like kind exchange analysis

Edit your like kind exchange analysis form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your like kind exchange analysis form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing like kind exchange analysis online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit like kind exchange analysis. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out like kind exchange analysis

How to fill out like-kind exchange analysis:

01

Start by gathering all necessary documentation related to the like-kind exchange, such as the original purchase price of the property being sold and the replacement property being acquired, any improvements made to the property, and any depreciation taken on the property.

02

Identify the specific requirements and guidelines outlined by the Internal Revenue Service (IRS) for conducting a like-kind exchange. These requirements may include the type of property that qualifies for like-kind exchange treatment, the identification and timing rules for the exchange, and any restrictions on personal use of the replacement property.

03

Calculate the capital gains or losses incurred from the sale of the relinquished property. This can be done by subtracting the adjusted basis (original purchase price plus improvements minus depreciation) from the sale price. If there is a gain, it may be subject to capital gains tax unless it is reinvested in a like-kind property.

04

Determine the basis of the replacement property, which is typically equivalent to the basis of the relinquished property. This means that any gain deferred in the like-kind exchange will be recognized upon the subsequent sale of the replacement property.

05

Complete IRS Form 8824, Like-Kind Exchanges, providing all relevant information about the like-kind exchange, such as the description and value of the properties involved, the dates of the exchange, and any mortgage or debt assumed in the exchange.

06

File the completed Form 8824 along with your individual or business tax return for the year in which the like-kind exchange took place.

07

Retain all supporting documentation, such as purchase agreements, closing statements, and related correspondence, as these may be requested by the IRS to substantiate the like-kind exchange.

Who needs like-kind exchange analysis:

01

Property owners who are considering selling an investment property and acquiring another property of a similar nature.

02

Real estate investors or developers who frequently engage in property exchanges as part of their business activities.

03

Individuals or businesses looking to defer capital gains taxes by reinvesting the proceeds from the sale of an investment property into another like-kind property.

04

Tax professionals and advisors who assist clients in understanding and complying with the IRS requirements for conducting a like-kind exchange.

05

Financial institutions or lenders involved in financing transactions related to like-kind exchanges, as they may need to assess the financial viability of the property being acquired and the potential tax implications for their clients.

Note: It is recommended to consult with a tax professional or advisor familiar with like-kind exchanges to ensure compliance with IRS regulations and understand the specific implications for your situation. This content is provided for informational purposes only and should not be considered as legal or financial advice.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in like kind exchange analysis without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit like kind exchange analysis and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for signing my like kind exchange analysis in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your like kind exchange analysis directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete like kind exchange analysis on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your like kind exchange analysis, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is like kind exchange analysis?

Like kind exchange analysis involves evaluating a property exchange to determine if it qualifies for tax deferment under section 1031 of the Internal Revenue Code.

Who is required to file like kind exchange analysis?

Any taxpayer involved in a property exchange can benefit from conducting a like kind exchange analysis, but it is especially important for those looking to defer capital gains taxes.

How to fill out like kind exchange analysis?

To fill out a like kind exchange analysis, you will need to evaluate the properties involved in the exchange, calculate any potential capital gains taxes, and determine if the exchange qualifies for tax deferment under section 1031.

What is the purpose of like kind exchange analysis?

The purpose of like kind exchange analysis is to determine if a property exchange qualifies for tax deferment under section 1031, allowing taxpayers to defer capital gains taxes by reinvesting in a similar property.

What information must be reported on like kind exchange analysis?

The like kind exchange analysis should include details of the properties involved in the exchange, the calculated capital gains taxes, and the justification for why the exchange qualifies for tax deferment under section 1031.

Fill out your like kind exchange analysis online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Like Kind Exchange Analysis is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.