PBGC 715 2019-2025 free printable template

Get, Create, Make and Sign pension benefit power attorney form

How to edit pension form 715 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pbgc power form

How to fill out PBGC 715

Who needs PBGC 715?

Video instructions and help with filling out and completing pbgc power

Instructions and Help about pbgc power form

All right my friends have got a lot of comments about pensions in the risk that are in a private pension this could be even a government pension too but most is a private pension that people are commenting on when I was talking about the pension getting a pension relative to a drunk a drop a lump sum and then annuitize in that with a private annuity, so I did want to take some time to go over this I think it's actually pretty important to understand the PGC the Pension Benefit Guaranty Corporation let me make sure I'm ok good because if you're looking at pent you need to know how it's insured for sure and if its insured and how much of it is insured those three things are pretty critical so were going to dive into that here today I welcome Heinrich wealth planning the place you come to learn about your pension information for sure so of a private pension or a government pension because I mean government pensions have an of this I've rescued don't get me wrong were not going to dive too deeply not here today, but there's significant risk that government pensions I've already over get to subscribe down below thumbs up comments to share the video the whole thing if you would, so the first thing were going to do is my man Alberto sent me this link for the PGC and I actually I think this is quite important to understand the PGC is a Pension Benefit Guaranty Corporation a US government agency, and they're the group that the funds is like the FDIC the financial Federal Deposit Insurance Corporation for banks, so banks pay a premium into FDIC and that's why they can put on their windows and your when you walk into a bank I'll say member FDIC that means they're paying a premium into FDIC to guarantee depositors X amount of dollars when they change it from one hundred to two hundred fifty thousand presumably they raise the premium that these banks these member banks how to pay credit unions have the same thing NCAA National Credit Union Administration I'm not sure they Association I guess same thing they're a member of NCAA member of FDIC that means they pay in a premium and how that premiums determined is my understanding is a risk the bank I mean how much risk is the FDIC taking because your bank is crappy or your bank is secure you know Coleman I don't know exactly how that works but with any insurance I'm sure it's the same thing PGC is the exact same thing so if you want to have the government ensure your pension you'll be part of the PGC and you pay a premium into the PGC it looks like unemployment insurance now unemployment insurance work said the companies pay a premium for unemployment insurance is based on the risk pool of the employees, so that's why a lot of companies don't want you to they don't want to fire you they want you to quit because if you quit a lot of people quit they're going to pay more premium to the unemployment insurance pool because when they fire you they have more and more people going to draw unemployment because if you're...

People Also Ask about

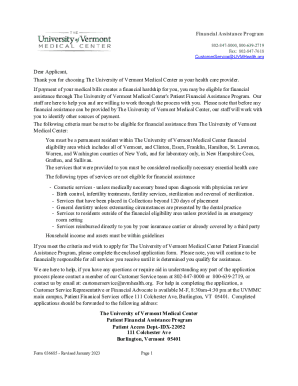

How does pension guarantee work?

How do I contact the pension benefit guaranty corporation?

Is my pension plan guaranteed?

How do I know if my pension is guaranteed?

How much of my pension is guaranteed by the PBGC?

What is the maximum guaranteed benefit for PBGC in 2023?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find pbgc power form?

How can I edit pbgc power form on a smartphone?

How do I edit pbgc power form on an Android device?

What is PBGC 715?

Who is required to file PBGC 715?

How to fill out PBGC 715?

What is the purpose of PBGC 715?

What information must be reported on PBGC 715?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.