OK Osage Casino W2G and Win/Loss Form 2016-2025 free printable template

Show details

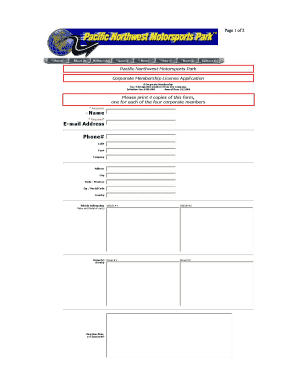

W2G and Win/Loss Form. Tax Year:. W2G Form. W2G Report. Win/Loss Statement. Bartlesville. Hominy Pachuca. Ponca City Sand Springs. Mistook.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK Osage Casino W2G and WinLoss

Edit your OK Osage Casino W2G and WinLoss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK Osage Casino W2G and WinLoss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK Osage Casino W2G and WinLoss online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit OK Osage Casino W2G and WinLoss. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out OK Osage Casino W2G and WinLoss

How to fill out W2G and Win/Loss forms:

01

Obtain the W2G form from the Internal Revenue Service (IRS) or download it from their official website.

02

Fill in your personal information accurately, including your name, address, and social security number.

03

Provide detailed information about the gambling winnings you received during the tax year, such as the name and address of the establishment, the date of the winnings, and the amount won.

04

Report any federal income tax withheld from your gambling winnings, which can usually be found on the W2G form provided by the establishment.

05

Complete the win/loss summary section on the Win/Loss form by documenting your gambling activities throughout the year. List the dates, locations, and amounts won or lost for each gambling session.

06

If you had any gambling losses, make sure to keep supporting documents such as receipts, bank statements, or gambling logs to validate your claims in case of an audit.

07

Sign and date both forms, and make copies for your records.

Who needs W2G and Win/Loss forms:

01

Individuals who have received gambling winnings of a certain threshold set by the IRS during the tax year need to fill out the W2G form. This form is essential for reporting these winnings as income on their federal tax return.

02

Casinos, racetracks, and other gambling establishments are required to provide a W2G form to any person who has won a specific amount or more from gambling during the year.

03

The Win/Loss form is typically used by individuals who want to report their gambling activities throughout the year, whether they had winnings or losses. This form can help individuals track their net gambling income and may be required for filing state income taxes, especially in states that allow gambling deductions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the OK Osage Casino W2G and WinLoss in Gmail?

Create your eSignature using pdfFiller and then eSign your OK Osage Casino W2G and WinLoss immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit OK Osage Casino W2G and WinLoss on an iOS device?

Create, modify, and share OK Osage Casino W2G and WinLoss using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete OK Osage Casino W2G and WinLoss on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your OK Osage Casino W2G and WinLoss, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is OK Osage Casino W2G and WinLoss?

The OK Osage Casino W2G is a tax form used to report gambling winnings, while WinLoss refers to a statement that summarizes an individual's gambling winnings and losses during a specific period.

Who is required to file OK Osage Casino W2G and WinLoss?

Individuals who have gambling winnings that exceed a certain threshold set by the IRS are required to file the W2G form, while the WinLoss statement is generally provided to all players upon request.

How to fill out OK Osage Casino W2G and WinLoss?

To fill out the W2G form, you need to provide personal information like your name, Social Security number, the date of the gambling activity, the type of gambling, and the amount won. For the WinLoss statement, you need to list your total wins and losses over the specified time frame.

What is the purpose of OK Osage Casino W2G and WinLoss?

The purpose of the W2G form is to report gambling income for tax purposes, while the WinLoss statement helps players keep track of their gambling activities for personal finance management and tax reporting.

What information must be reported on OK Osage Casino W2G and WinLoss?

The W2G form must report the winner's name, address, Social Security number, the type of gambling, the date of the win, and the amount won. The WinLoss statement must detail the total wins and losses incurred by the player within a specified period.

Fill out your OK Osage Casino W2G and WinLoss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK Osage Casino w2g And WinLoss is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.