Get the free Beneficial Ownership Filings: Filing Form 4 FRB OMB Number: 71000091 FDIC OMB Number...

Show details

Beneficial Ownership Filings: Filing Form 4 FRB OMB Number: 71000091 FDIC OMB Number: 30640030 OCC OMB Number: 15570106 Statement of Changes in Beneficial Ownership of Securities Filed pursuant to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign beneficial ownership filings filing

Edit your beneficial ownership filings filing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your beneficial ownership filings filing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

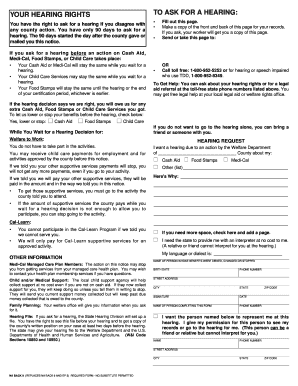

Editing beneficial ownership filings filing online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit beneficial ownership filings filing. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

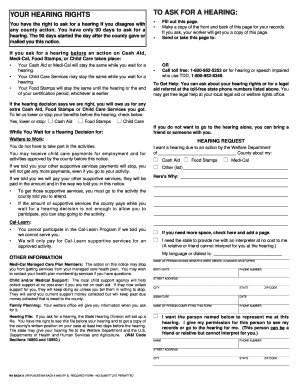

How to fill out beneficial ownership filings filing

How to fill out beneficial ownership filings filing:

01

Start by gathering all necessary information: Before starting the filing process, make sure you have all the required information at hand. This may include the names, addresses, and contact details of the beneficial owners, their ownership percentage, and any other relevant details.

02

Understand the legal requirements: Familiarize yourself with the legal requirements for beneficial ownership filings. This may vary depending on the jurisdiction or regulatory authority. Ensure that you have a clear understanding of what needs to be disclosed and what documents need to be submitted.

03

Complete the necessary forms: Once you have the required information and understand the legal requirements, proceed to fill out the beneficial ownership filings form. Ensure that you provide accurate and complete information to avoid any discrepancies or penalties.

04

Submit the filing: After filling out the necessary forms, it's time to submit the filing. Follow the instructions provided by the relevant regulatory authority or government agency. This may involve submitting the forms electronically, mailing them, or filing them in person.

05

Keep a record: It's important to keep a record of the beneficial ownership filings for future reference. Maintain copies of the filed forms and any supporting documents. This will help in case of audits or legal requirements in the future.

Who needs beneficial ownership filings filing:

01

Companies or corporations: Most jurisdictions require companies or corporations to file beneficial ownership information. This helps ensure transparency and prevent money laundering or other illicit activities. Companies of all sizes, whether private or public, may need to fulfill this requirement.

02

Financial institutions: Banks, credit unions, and other financial institutions often require beneficial ownership filings. This is to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. It helps these institutions assess the risk of potential money laundering or involvement in unlawful activities.

03

Non-profit organizations: In some countries, non-profit organizations, including charities and foundations, may also be required to file beneficial ownership information. This is done to increase transparency in the sector and prevent misuse of funds or illicit activities.

04

Real estate industry: The real estate industry, including developers, property management firms, and real estate investment trusts (REITs), may need to file beneficial ownership information. This is to prevent money laundering through property transactions and increase transparency in the sector.

05

Professional service providers: Some jurisdictions require professional service providers, such as lawyers, accountants, or company formation agents, to file beneficial ownership information. This helps ensure that these professionals are not facilitating illegal activities and are compliant with AML and CTF regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is beneficial ownership filings filing?

Beneficial ownership filings filing is the process of disclosing information about individuals who ultimately own or control a company.

Who is required to file beneficial ownership filings filing?

Beneficial ownership filings filing is typically required by companies, financial institutions, and other entities subject to anti-money laundering regulations.

How to fill out beneficial ownership filings filing?

Beneficial ownership filings filing can be completed by providing information about the beneficial owners, such as their names, addresses, and percentage of ownership.

What is the purpose of beneficial ownership filings filing?

The purpose of beneficial ownership filings filing is to increase transparency and prevent money laundering, corruption, and terrorist financing.

What information must be reported on beneficial ownership filings filing?

Information that must be reported on beneficial ownership filings filing includes the name, address, date of birth, and identification number of the beneficial owners.

How can I modify beneficial ownership filings filing without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your beneficial ownership filings filing into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute beneficial ownership filings filing online?

pdfFiller has made it simple to fill out and eSign beneficial ownership filings filing. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the beneficial ownership filings filing in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your beneficial ownership filings filing.

Fill out your beneficial ownership filings filing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Beneficial Ownership Filings Filing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.