Get the free Conforming Fixed Rate Product Guidelines

Show details

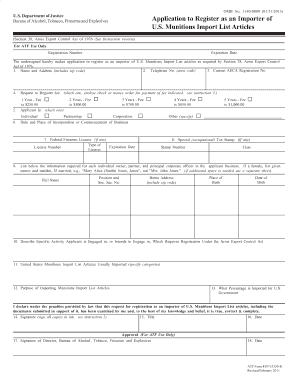

July 24, 2015, Conforming Fixed Rate Product Guidelines Purchase Primary Second Home Investment LTV w/o Sec Fin LTV w/Sec Fin CTV Credit Score 1 97 97 97 620 85 85 85 620 34 75 75 75 620 1 90 90 90

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign conforming fixed rate product

Edit your conforming fixed rate product form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your conforming fixed rate product form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit conforming fixed rate product online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit conforming fixed rate product. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out conforming fixed rate product

How to fill out a conforming fixed rate product:

01

Begin by gathering all the necessary information and documents, such as your personal identification, income verification, and credit history.

02

Fill out the application form with accurate and up-to-date information. Double-check all the details before submitting.

03

Provide proof of income, which typically includes pay stubs, bank statements, and tax returns. Ensure that these documents reflect a stable and sufficient income to qualify for the loan.

04

Disclose all your assets and liabilities, including bank accounts, investments, debts, and outstanding loans. This information helps the lender assess your financial stability and ability to repay the loan.

05

Provide details about the property you intend to purchase or refinance, such as its address, market value, and any additional features or amenities. This information helps determine the loan amount and terms.

06

Choose the desired loan term, which can range from 10 to 30 years for a conforming fixed rate product. Consider factors such as your financial goals, affordability, and future plans when making this decision.

07

Specify the loan amount you are requesting. This should align with your budget, down payment capabilities, and the property's value.

08

Review and understand the terms and conditions of the conforming fixed rate product, including the interest rate, monthly payments, any prepayment penalties, and any potential fees.

09

Submit the completed application along with the required supporting documents to the lender.

10

Await approval from the lender, which generally involves a thorough review of your application, credit profile, and property assessment.

Who needs a conforming fixed rate product:

01

Homebuyers who prefer stable and predictable mortgage payments for the long term may benefit from a conforming fixed rate product. This type of loan ensures that the interest rate remains the same throughout the entire loan term, offering peace of mind and the ability to plan ahead financially.

02

Borrowers looking to finance a property within the conforming loan limits set by the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac may consider a conforming fixed rate product. These loans often offer competitive interest rates and more lenient qualification requirements compared to jumbo or non-conforming loans.

03

Individuals or families who are planning to stay in their home for an extended period may find a conforming fixed rate product suitable. This type of loan provides stability, allowing homeowners to budget effectively without worrying about fluctuations in interest rates.

In conclusion, filling out a conforming fixed rate product involves providing accurate information, documenting your financial capacity, and understanding the terms of the loan. This type of mortgage is suitable for homebuyers seeking stability and predictability in their monthly payments, while also adhering to the conforming loan limits set by Fannie Mae and Freddie Mac.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my conforming fixed rate product directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your conforming fixed rate product as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send conforming fixed rate product for eSignature?

When your conforming fixed rate product is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I edit conforming fixed rate product on an Android device?

You can make any changes to PDF files, like conforming fixed rate product, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is conforming fixed rate product?

Conforming fixed rate product is a type of mortgage loan with an interest rate that remains the same for the entire term of the loan.

Who is required to file conforming fixed rate product?

Lenders and financial institutions are required to file conforming fixed rate product.

How to fill out conforming fixed rate product?

Conforming fixed rate product can be filled out by providing all the necessary information about the loan and borrower, following the guidelines provided by the regulatory authority.

What is the purpose of conforming fixed rate product?

The purpose of conforming fixed rate product is to provide borrowers with a stable and predictable interest rate for their mortgage loan.

What information must be reported on conforming fixed rate product?

Information such as loan amount, interest rate, term of the loan, borrower's information, and property details must be reported on conforming fixed rate product.

Fill out your conforming fixed rate product online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Conforming Fixed Rate Product is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.