Get the free 10439 form

Show details

Exhibit 21. 1. 7-17 Form 1040 series with Form 10439 or IDT documentation attached - Added. Exhibit 21. 4 bed 2. 25 bath 1780 sqft house at 10439 62nd Ave S. Smashing and Form 17 provided. Terms of Sale cash out conventional FHA VA. Award Number N00014-13-10439 RSMAS Form Approved including the time for reviewing instructions searching existing data sources gathering. Please follow the instructions on the form carefully as failure to follow these instructions may cause your ballot not to...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 10439

Edit your irs form 10439 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 10439 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 10439 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 10439 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 10439 form

How to fill out 10439 form:

01

Start by obtaining the 10439 form from the appropriate source, such as the Internal Revenue Service (IRS) website or local tax office.

02

Read the instructions carefully to understand the purpose and requirements of the form.

03

Begin by filling out your personal information, including your name, Social Security number, and address.

04

Provide any necessary information regarding your filing status, such as whether you are single, married, or head of household.

05

Report your total taxable income for the tax year in the designated section. This may include income from various sources, such as employment, self-employment, or investments.

06

Calculate and deduct any applicable adjustments to income, such as student loan interest or self-employed health insurance.

07

If you have dependents, provide their information and claim any eligible credits or deductions associated with them.

08

Report any taxes you have already paid, such as through withholding or estimated tax payments.

09

Determine if you are owed a refund or if you owe any additional taxes. If a refund is due, indicate how you would like to receive it (check or direct deposit).

10

Sign and date the form, and attach any required schedules or supporting documents.

Who needs 10439 form:

01

Individuals who are eligible for the Retirement Savings Contributions Credit, also known as the Saver's Credit, may need to fill out the 10439 form.

02

The form is used to claim this non-refundable tax credit for making eligible contributions to retirement savings plans, such as 401(k)s or IRAs.

03

Taxpayers who meet certain income and filing requirements may qualify for this credit to reduce their overall tax liability and encourage retirement savings.

Fill

form

: Try Risk Free

People Also Ask about

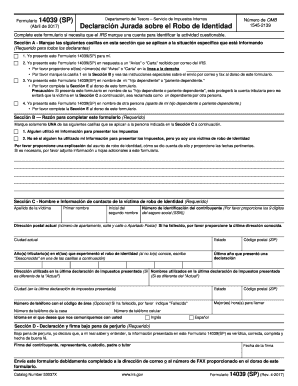

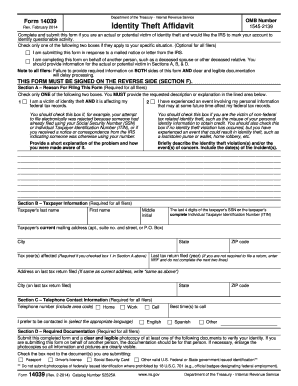

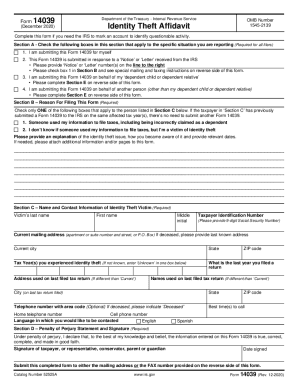

Where is IRS mailing address 14039?

Mail Form 14039 to this address: Internal Revenue Service, Stop C2003, Fresno, CA 93888. You may also need to file a police report and a complaint with the Federal Trade Commission on their website if you're a victim of tax return fraud.

What does the IRS do with form 14039?

First, the IRS will acknowledge your reported tax identity theft. Within 30 days after the IRS gets your Form 14039, you'll get a letter telling you that the IRS received your affidavit. During this time, the IRS may ask you to prove your identity, typically with letter 5071C.

How to fill out IRS form 14039?

How to Complete and Submit Form 14039. Explain your issue and how you discovered that your identity had been stolen in Section B. Attach any supporting documentation, such as a notice you received from the IRS, and submit it along with the form. You can't electronically file the IRS Identity Theft Affidavit.

What triggers IRS identity verification?

When the IRS suspects a return is fraudulent, the agency will request identity verification from the person whose name and address is listed on the return.

Where do I send Form 14039?

Mail Form 14039 to this address: Internal Revenue Service, Stop C2003, Fresno, CA 93888. You may also need to file a police report and a complaint with the Federal Trade Commission on their website if you're a victim of tax return fraud.

Who must file form 14039?

Only victims of tax-related identity theft should submit the Form 14039, and only if they haven't received certain letters from the IRS.

What is the purpose of Form 14039?

When a taxpayer believes their personal information is being used to file fraudulent tax returns, they should submit a Form 14039, Identity Theft AffidavitPDF, to the IRS.

What happens after you verify your identity with the IRS?

What happens after I successfully verify? We'll process your tax return. It may take up to 9 weeks to receive your refund or credit any overpayment to your account.

How do you know if your identity has been stolen?

Regularly check your credit report and bank statements. Check for the warning signs of identity theft — such as strange charges on your bank statement or accounts you don't recognize. An identity theft protection service like Aura can monitor your credit and statements for you and alert you to any signs of fraud.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 10439 form from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like 10439 form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Where do I find 10439 form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the 10439 form in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete 10439 form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your 10439 form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is 10439 form?

The 10439 form is a tax document used to report income and calculate tax liabilities for specific financial transactions or events.

Who is required to file 10439 form?

Individuals or entities who have participated in certain financial activities that are subject to reporting requirements are required to file the 10439 form.

How to fill out 10439 form?

To fill out the 10439 form, you must provide personal information, details of financial transactions, and any relevant tax credits or deductions, following the instructions provided on the form.

What is the purpose of 10439 form?

The purpose of the 10439 form is to ensure that the income from specific transactions is reported to tax authorities, assisting in proper tax assessment.

What information must be reported on 10439 form?

The 10439 form requires reporting of personal identification details, financial transaction specifics, income amounts, and any other relevant tax-related information.

Fill out your 10439 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

10439 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.