Get the free New Sales in Pennsylvania

Show details

Rates and Underwriting New Sales in Pennsylvania Rates and Underwriting vary by state. Please refer to the appropriate state specific handbook for information specific to your clients residence state.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new sales in pennsylvania

Edit your new sales in pennsylvania form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new sales in pennsylvania form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new sales in pennsylvania online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit new sales in pennsylvania. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new sales in pennsylvania

How to fill out new sales in Pennsylvania:

01

Gather all necessary documentation: Before filling out new sales in Pennsylvania, make sure to collect all the required documents, such as sales invoices, receipts, and any other relevant paperwork.

02

Understand the Pennsylvania sales tax laws: Familiarize yourself with the sales tax laws specific to Pennsylvania. This includes knowing the appropriate tax rates, any exemptions or exclusions, and the filing deadlines.

03

Register for a Pennsylvania sales tax license: If you haven't already done so, you will need to register for a sales tax license with the Pennsylvania Department of Revenue. This can typically be done online through their website.

04

Determine your sales tax nexus in Pennsylvania: Sales tax nexus refers to the connection between a business and a state that requires the business to collect and remit sales tax. Determine if your business has a nexus in Pennsylvania based on factors such as physical presence, economic presence, or fulfillment centers.

05

Calculate the sales tax due: For each sale made in Pennsylvania, calculate the sales tax amount based on the applicable tax rate. This might include state sales tax as well as any local or county taxes.

06

Fill out the appropriate sales tax return form: Pennsylvania requires businesses to file sales tax returns on a regular basis, usually monthly, quarterly, or annually. Use the correct form provided by the Pennsylvania Department of Revenue and accurately fill out all the required information.

07

Submit the sales tax return and payment: Once the sales tax return form is completed, submit it along with the payment of the sales tax due. This can generally be done online, by mail, or in-person at a local revenue office.

08

Keep accurate records: It's important to maintain detailed records of all sales made in Pennsylvania, including documentation of exempt sales and any accompanying paperwork. These records will be useful for future audits or inquiries.

Who needs new sales in Pennsylvania?

01

Individuals starting a new business: Entrepreneurs who are launching a new business in Pennsylvania may need new sales to generate revenue and establish their presence in the market.

02

Existing businesses expanding operations: Established businesses looking to expand their operations in Pennsylvania may need new sales to penetrate new markets, reach new customers, and increase their sales revenue.

03

Sales representatives or teams: Sales representatives or teams who are responsible for selling products or services in Pennsylvania may need new sales to meet their sales targets and earn commissions.

04

Companies offering new products or services: Companies introducing new products or services to the Pennsylvania market may need new sales to generate awareness, attract customers, and build a customer base.

05

Organizations experiencing low sales: Organizations experiencing a decline in sales may need new sales in Pennsylvania to rejuvenate their business, increase their cash flow, and improve their financial performance.

Overall, anyone involved in business activities in Pennsylvania, whether it's starting a new venture, expanding existing operations, or trying to boost sales, may need new sales to achieve their business goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new sales in pennsylvania to be eSigned by others?

Once you are ready to share your new sales in pennsylvania, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find new sales in pennsylvania?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific new sales in pennsylvania and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete new sales in pennsylvania online?

pdfFiller has made it simple to fill out and eSign new sales in pennsylvania. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

What is new sales in pennsylvania?

New sales in Pennsylvania refers to any sales transactions that have occurred within the state.

Who is required to file new sales in pennsylvania?

Businesses and individuals who have made sales in Pennsylvania are required to file new sales.

How to fill out new sales in pennsylvania?

To fill out new sales in Pennsylvania, you will need to report the details of each sale, including the date, amount, and description of the transaction.

What is the purpose of new sales in pennsylvania?

The purpose of filing new sales in Pennsylvania is to ensure that all sales transactions are properly documented and taxed.

What information must be reported on new sales in pennsylvania?

On new sales in Pennsylvania, you must report the date of the sale, the amount of the sale, and any relevant details about the transaction.

Fill out your new sales in pennsylvania online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Sales In Pennsylvania is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

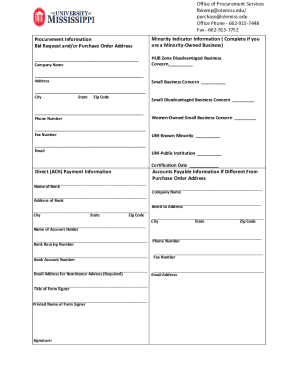

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.