Get the free Senior Bond Resolution

Show details

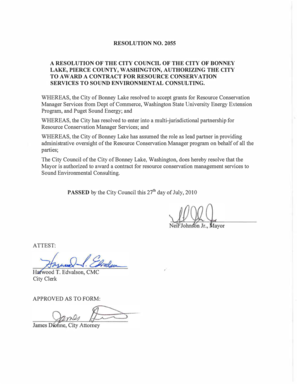

This document authorizes the issuance of $186,435,000 Senior Revenue and Revenue Refunding Bonds for the Regional Solid Waste System, outlining definitions, bond issuance details, revenues, funds

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign senior bond resolution

Edit your senior bond resolution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your senior bond resolution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing senior bond resolution online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit senior bond resolution. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out senior bond resolution

How to fill out Senior Bond Resolution

01

Begin by gathering all necessary information about the bond issuance including the total amount and purpose.

02

Clearly state the trust estate that secures the bonds, including any revenues and assets.

03

Define the terms of the bonds, including interest rates, payment schedules, and maturity dates.

04

Outline the rights of the bondholders, including any covenants or restrictions placed upon the issuer.

05

Specify the process for amending the resolution if needed and the conditions under which it can occur.

06

Signature lines for authorized individuals from the issuer must be included for validation.

Who needs Senior Bond Resolution?

01

Municipalities or governmental entities planning to issue senior bonds for financing.

02

Bond counsel or financial advisors assisting with the legal setup of the bond issuance.

03

Investors and bondholders who require clear terms and rights associated with their investment.

Fill

form

: Try Risk Free

People Also Ask about

What is the bail in resolution regime?

Bail-in is a key resolution tool, which allows the write-down of debt owed by a bank to creditors or its conversion into equity to absorb losses and stabilize the bank.

What is the bail-in regime in Canada?

The bail-in power gives CDIC the authority to recapitalize D-SIBs from within, by converting some or all of a failing D-SIB's bail-in debt into common shares in order to help restore it to viability.

What is the bail-in resolution process?

Bail-in is a key resolution tool, which allows the write-down of debt owed by a bank to creditors or its conversion into equity to absorb losses and stabilize the bank.

What is the meaning of bail-in?

A bail-in forces bondholders and other creditors of a company on the verge of failure to bear some of the burden by writing off debt they are owed or converting it into equity. This is in contrast to a bailout, the rescue of a firm by external parties like taxpayers.

What is the purpose of the bail-in clause?

A bail-In clause is used in times of bankruptcy or financial distress and forces the borrower's creditors to write-off some of their debt in order to ease the financial burden on the borrowing institution.

What is a senior bond?

A bond that has a higher priority than another bond's claim to the same class of assets in case of a default or bankruptcy.

What is the difference between a bond resolution and a bond indenture?

The Indenture is a contract between the issuer and the bond trustee. The Resolution, just like any other resolution or ordinance of a state or local government, is the evidence of an official action taken by the issuer with regard to the bonds.

What is the difference between senior bond and junior bond?

Senior Bonds are the bonds that are considered before other junior bonds in the hierarchy of payment during liquidation. Senior Bonds come with lower risk. Subordinate bonds come with higher returns and relatively higher risk.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Senior Bond Resolution?

Senior Bond Resolution is a formal agreement that outlines the terms and conditions under which senior bonds are issued and managed. It typically includes details on the rights of bondholders, interest payment schedules, and covenants the issuer must adhere to.

Who is required to file Senior Bond Resolution?

Entities that issue senior bonds are required to file a Senior Bond Resolution. This typically includes municipalities, corporations, and government agencies responsible for issuing debt instruments.

How to fill out Senior Bond Resolution?

To fill out a Senior Bond Resolution, the issuer must provide specific details such as the bond's principal amount, interest rate, payment schedule, provisions for redemption, and any covenants or agreements that apply to the bond issuance.

What is the purpose of Senior Bond Resolution?

The purpose of Senior Bond Resolution is to provide a legal framework that protects the rights of bondholders and ensures that the issuing entity operates within the agreed-upon terms, thereby maintaining trust and confidence in the bond market.

What information must be reported on Senior Bond Resolution?

Information that must be reported on a Senior Bond Resolution includes the bond's principal amount, interest rate, maturity date, payment terms, any security interests, and details about any financial covenants or other obligations of the issuer.

Fill out your senior bond resolution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Senior Bond Resolution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.