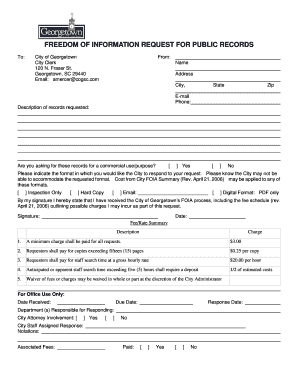

Get the free New Markets Tax Credit Program Allocation Agreement

Show details

This document serves as a draft Allocation Agreement for the New Markets Tax Credit (NMTC) Program, outlining the terms and conditions between the Community Development Financial Institutions Fund

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new markets tax credit

Edit your new markets tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new markets tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new markets tax credit online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit new markets tax credit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new markets tax credit

How to fill out New Markets Tax Credit Program Allocation Agreement

01

Begin by downloading the New Markets Tax Credit Program Allocation Agreement form from the official website.

02

Read the instructions carefully to understand the required information.

03

Fill in the applicant's legal name and contact information in the designated sections.

04

Provide details about the business plan and proposed investment strategy.

05

Include financial projections and any pertinent historical financial data.

06

Attach supporting documents that demonstrate community impact and alignment with program objectives.

07

Review the completed agreement for accuracy and completeness.

08

Submit the signed agreement by the specified deadline to the appropriate authority.

Who needs New Markets Tax Credit Program Allocation Agreement?

01

Community development entities (CDEs) seeking to attract investors for low-income area projects.

02

Businesses in economically distressed areas looking for funding opportunities.

03

Non-profit organizations focused on community revitalization initiatives.

04

Investors interested in tax benefits associated with investing in qualified low-income projects.

Fill

form

: Try Risk Free

People Also Ask about

What are new markets tax credits?

The New Markets Tax Credit Program (“NMTC Program”) provides investment capital for operating companies and real estate development projects in order to foster job creation and community development in low-income communities throughout New York State.

What is the new market tax credit in Ohio?

The Ohio New Markets Tax Credit Program provides a tax credit to Community Development Entities to incentivize and attract private investment in economically distressed communities. Up to $10 million in tax credits are available in what is the 14th round of the program.

What are the benefits of NMTC?

Through the NMTC Program, businesses can benefit from low-cost capital, which in turn can benefit communities in the form of jobs created or greater access to community goods and services.

What is the new market tax credit program in Ohio?

New Markets Tax Credit Benefits The NMTC Program incentivizes community development and economic growth through the use of tax credits that attract private investment to distressed communities. As of the end of FY 2023, the NMTC Program has: Generated $8 of private investment for every $1 of federal funding.

What is the Ohio homebuyer tax credit?

The mortgage tax credit is in addition to the IRS home mortgage interest deduction. If you use the tax credit with a loan through OHFA's first- time homebuyer program, you receive a tax credit of 40% of the home mortgage interest. The maximum annual tax credit is $2,000.

What is the $750 tax credit in Ohio?

Scholarship Donation Credit If you file as single or married filing separately, the maximum credit is $750. If you file as married filing jointly, the maximum credit is $1,500. You may qualify if a Pass-Through Entity (PTE) that you have ownership interest in donated money to an approved SGO.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is New Markets Tax Credit Program Allocation Agreement?

The New Markets Tax Credit Program Allocation Agreement is a contract between the Community Development Financial Institutions (CDFI) Fund and the allocatee, which outlines the terms and conditions under which tax credits can be allocated to eligible projects in low-income communities.

Who is required to file New Markets Tax Credit Program Allocation Agreement?

Entities that have been awarded New Markets Tax Credits and wish to allocate those credits to investors or projects are required to file the New Markets Tax Credit Program Allocation Agreement.

How to fill out New Markets Tax Credit Program Allocation Agreement?

To fill out the New Markets Tax Credit Program Allocation Agreement, one must provide accurate information regarding the allocatee, the amount of tax credits being requested, and detailed information about the proposed projects or investments, following the specific guidelines set forth by the CDFI Fund.

What is the purpose of New Markets Tax Credit Program Allocation Agreement?

The purpose of the New Markets Tax Credit Program Allocation Agreement is to facilitate the investment of private capital in low-income communities by providing tax credits to investors, ultimately aiming to spur economic development and job creation.

What information must be reported on New Markets Tax Credit Program Allocation Agreement?

The information that must be reported includes details about the allocatee, the amount of credits allocated, projected outcomes of the investments, information about the targeted low-income communities, and compliance with federal and state regulations.

Fill out your new markets tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Markets Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.