Get the free NEW T4a T23a T24a qrk - Kurt Versen Company

Show details

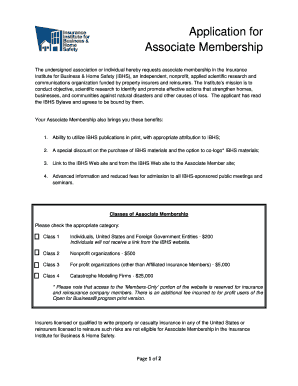

Primary Reflector Vented Housing Vent Slot Lamp holder Vertical Adjustment Rail Support T4142 DATE: PROJECT: TYPE: Rectangular Parabolic Splay Trim One 263242W Triple Tube Lamp 4 1/2 × 8 1/2 Apertures

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new t4a t23a t24a

Edit your new t4a t23a t24a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new t4a t23a t24a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new t4a t23a t24a online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit new t4a t23a t24a. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new t4a t23a t24a

How to fill out new t4a t23a t24a:

01

Start by gathering all the necessary information and documents. This includes the payer's name, address, and SIN (Social Insurance Number), as well as your own personal information like your name, address, and SIN. Make sure you have the correct forms for reporting income such as T4A for pensions, T23A for pension income splitting, and T24A for pension lump-sum transfers.

02

Begin filling out the forms by entering your personal information in the designated sections. This includes your full name, address, and social insurance number. Ensure that all information is accurate and up to date.

03

Move on to the payer's information. Fill in the name and address of the organization or individual who paid you. Again, ensure that this information is correct and matches the payer's records.

04

Next, proceed to report the specific income details. In the T4A form, you will need to report various types of income, such as pensions, annuities, self-employment income, and other income sources. Enter the appropriate amounts in the relevant boxes and provide any additional details or explanations as required.

05

If you are filling out the T23A form for pension income splitting, you will need to provide information about your spouse or common-law partner. This includes their name, address, and social insurance number. You will also need to indicate the percentage of income you wish to allocate to your spouse.

06

For the T24A form, which is used for pension lump-sum transfers, fill in the necessary details regarding the transfer, including the payer's name, address, and social insurance number. Include the total amount of the transfer and any amounts that were directly transferred to a registered retirement savings plan or a registered pension plan.

07

Once all the required information has been entered, review the forms to ensure accuracy and completeness. Double-check that all figures are correct, all sections have been filled out, and all necessary attachments (if any) have been included.

08

Sign and date the forms in the designated areas to certify the accuracy of the information provided.

09

Keep copies of the filled forms and any supporting documents for your records.

10

Submit the completed forms to the appropriate governmental agency or authority. This could be the Canada Revenue Agency (CRA) or any other relevant tax authority, depending on your jurisdiction.

Who needs new t4a t23a t24a?

01

Individuals who receive income from pension plans, annuities, self-employment, or other sources are required to fill out the T4A form to accurately report their income to the tax authorities.

02

Individuals who wish to split their pension income with their spouse or common-law partner should also fill out the T23A form. This allows for the allocation of income between partners, potentially reducing the overall tax liability.

03

Those who have received a lump-sum transfer from a pension plan or annuity and wish to report it accurately for tax purposes should complete the T24A form. This form ensures that the transfer is properly accounted for and any associated tax implications are appropriately addressed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit new t4a t23a t24a straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing new t4a t23a t24a, you need to install and log in to the app.

How do I fill out new t4a t23a t24a using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign new t4a t23a t24a and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit new t4a t23a t24a on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign new t4a t23a t24a on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is new t4a t23a t24a?

new t4a t23a t24a are tax forms used in Canada to report various types of income, such as pension, retirement, and annuity payments.

Who is required to file new t4a t23a t24a?

Individuals and organizations who make payments to individuals for services rendered or income earned are required to file new t4a t23a t24a forms.

How to fill out new t4a t23a t24a?

To fill out new t4a t23a t24a forms, you must include the payer's information, recipient's information, and details of the income paid or received.

What is the purpose of new t4a t23a t24a?

The purpose of new t4a t23a t24a forms is to report income payments to individuals for tax purposes.

What information must be reported on new t4a t23a t24a?

Information such as the payer's name and address, recipient's name and social insurance number, and the amount of income paid or received must be reported on new t4a t23a t24a forms.

Fill out your new t4a t23a t24a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New t4a t23a t24a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.