Get the free Credit Reports or Credit Fraud:

Show details

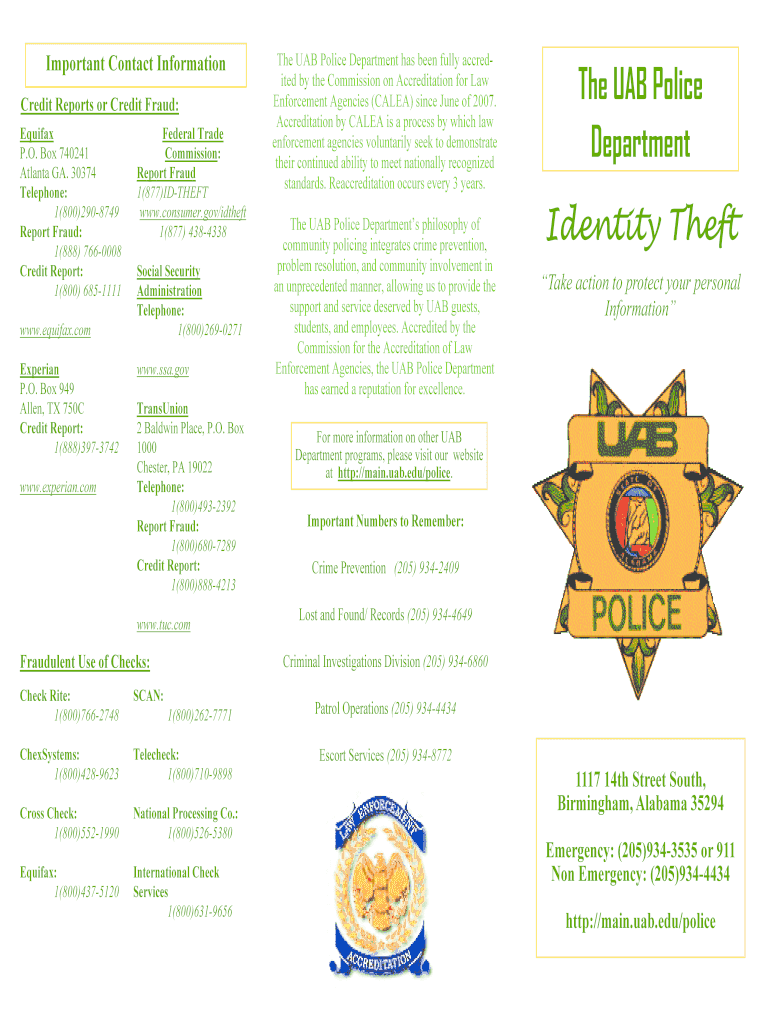

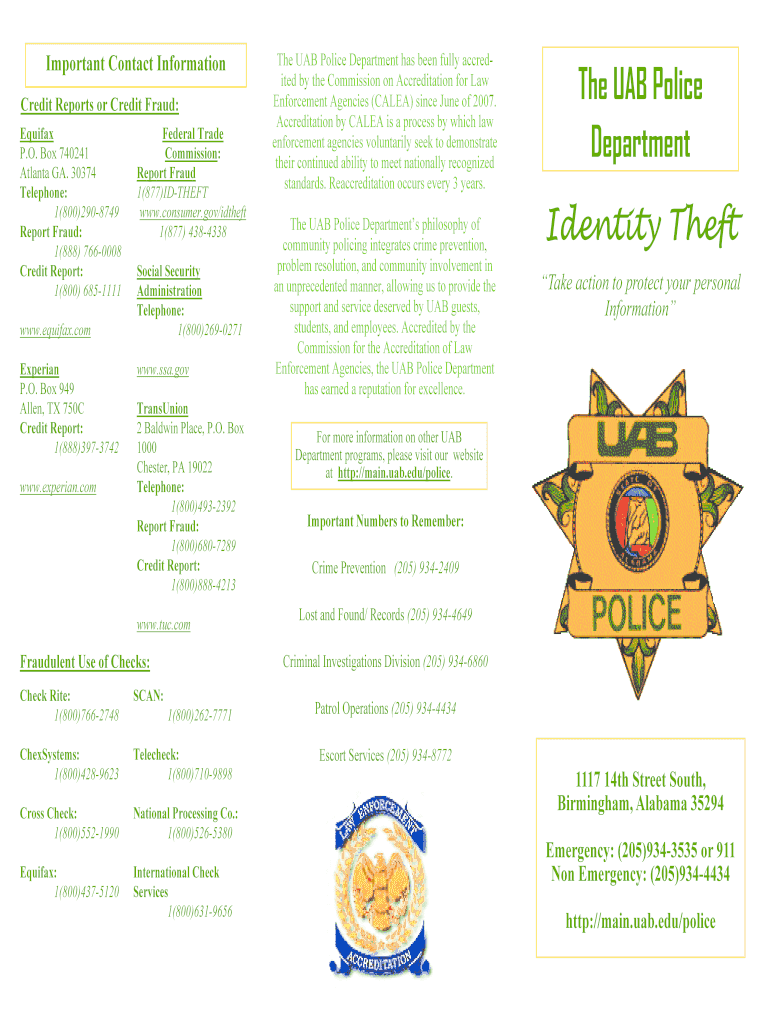

Important Contact Information

Credit Reports or Credit Fraud:

Equifax

P.O. Box 740241

Atlanta GA. 30374

Telephone:

1(800)2908749

Report Fraud:

1(888) 7660008

Credit Report:

1(800) 6851111

www.equifax.com

Experian

P.O.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit reports or credit

Edit your credit reports or credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit reports or credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit reports or credit online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit reports or credit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit reports or credit

How to Fill Out Credit Reports or Credit:

01

Gather all necessary information: Start by collecting all the required details, including personal information such as name, address, and social security number. Additionally, gather information about your financial accounts and payment history.

02

Review your credit history: Before filling out the credit report, go through your credit history thoroughly to ensure that all the information is accurate. Look for any errors or discrepancies that may need to be addressed with the credit bureaus.

03

Obtain a copy of your credit report: To fill out a credit report, you'll need a copy of your credit report. You can request this from the three major credit bureaus - Equifax, Experian, and TransUnion. Review the report to understand your credit standing and identify any areas that need improvement.

04

Begin with personal information: Start by entering your personal information accurately. This includes your name, address, and contact details. Double-check the information for accuracy before moving on.

05

Provide employment details: Add your current employment information, including your employer's name, address, and contact information. If you're self-employed, include information about your business.

06

List your financial accounts: Fill in the details of your financial accounts, such as bank accounts, credit cards, loans, and mortgages. Include the account numbers, creditor names, and account balances. Be sure to provide accurate information to maintain the credibility of your credit report.

07

Update payment history: Indicate your payment history for each account listed. This includes whether payments were made on time or if there were any late or missed payments. Pay extra attention to any negative remarks or delinquent accounts, as these can significantly impact your credit score.

08

Mention any disputes or corrections: If you've previously disputed any information on your credit report or requested corrections, provide details about these in the designated section. This allows the credit bureaus to investigate and update the information accordingly.

09

Understand credit utilization: Credit utilization refers to the amount of credit you're using compared to your credit limit. It's essential to fill in this information accurately, as it influences your credit score. Calculate your credit utilization ratio by dividing your total credit card balances by your total credit limit and enter the percentage in the appropriate section.

10

Include any additional information: If there are any specific circumstances or additional information that could explain certain aspects of your credit report, you can include these in the provided space. This can help lenders or creditors better understand your financial situation.

Who needs credit reports or credit?

01

Individuals applying for loans: Whether you're applying for a mortgage, auto loan, or personal loan, lenders typically request credit reports to assess your creditworthiness and determine if they should grant you the loan. Your credit history and credit score play a crucial role in the decision-making process.

02

Individuals seeking rental properties: Landlords often request credit reports before approving a rental application. They want to ensure that prospective tenants have a reliable track record of paying bills on time and managing their finances responsibly.

03

Individuals applying for credit cards: When you apply for a credit card, the card issuer reviews your credit report to evaluate the risk involved in extending credit to you. Your creditworthiness can determine the credit limit you'll receive and the interest rate you'll be charged.

04

Individuals looking for employment: In some industries, employers may request a credit report as part of the hiring process. This is particularly common in positions that involve financial responsibility, such as banking or accounting. The employer may use the credit report as an indicator of your trustworthiness and financial stability.

05

Individuals monitoring their own credit: It's always a good practice to regularly review your credit report to stay informed about your financial standing. Monitoring your credit can help you identify any errors, fraudulent activity, or areas where you can improve your creditworthiness.

Remember, maintaining good credit is essential for various financial transactions and opportunities. Filling out credit reports accurately and understanding the importance of credit can significantly impact your financial well-being.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute credit reports or credit online?

Filling out and eSigning credit reports or credit is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make changes in credit reports or credit?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your credit reports or credit to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit credit reports or credit in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your credit reports or credit, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is credit reports or credit?

Credit reports or credit is a record of an individual's or company's borrowing and repayment activity.

Who is required to file credit reports or credit?

Lenders, financial institutions, and credit bureaus are required to file credit reports or credit.

How to fill out credit reports or credit?

Credit reports or credit can be filled out electronically or in paper form with information such as personal details, credit history, and payment history.

What is the purpose of credit reports or credit?

The purpose of credit reports or credit is to provide a detailed overview of an individual's or company's creditworthiness and financial history.

What information must be reported on credit reports or credit?

Information such as personal details, credit accounts, payment history, credit inquiries, and public records must be reported on credit reports or credit.

Fill out your credit reports or credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Reports Or Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.