Get the free N ational Pension System NPS - Southern Railway

Show details

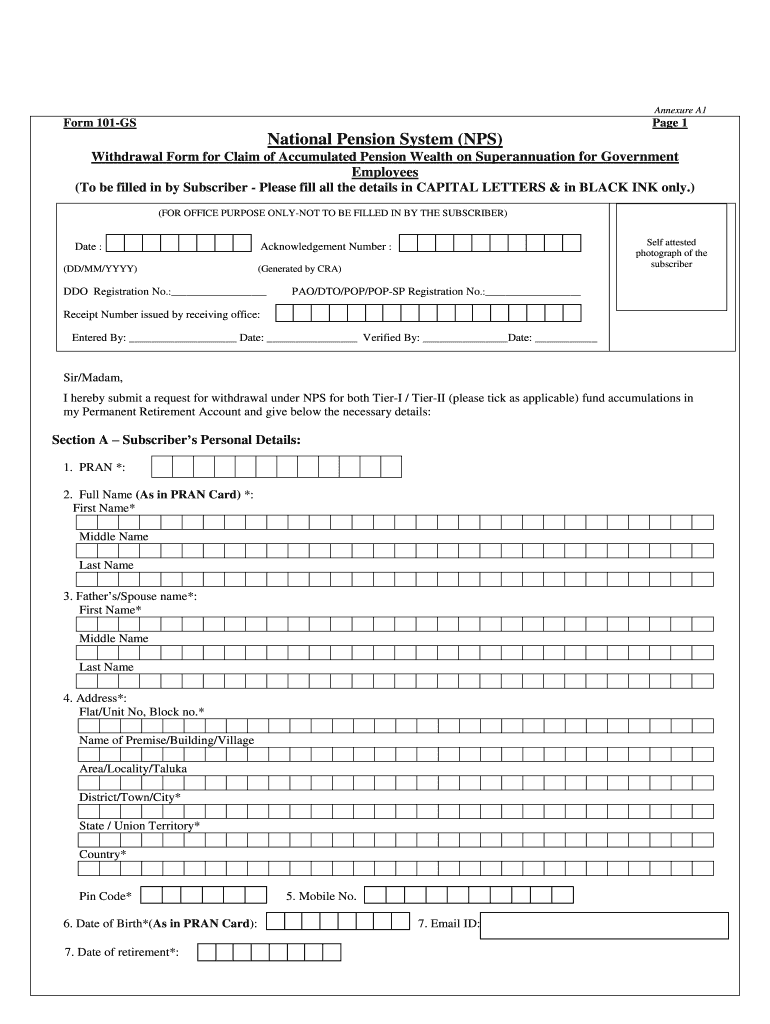

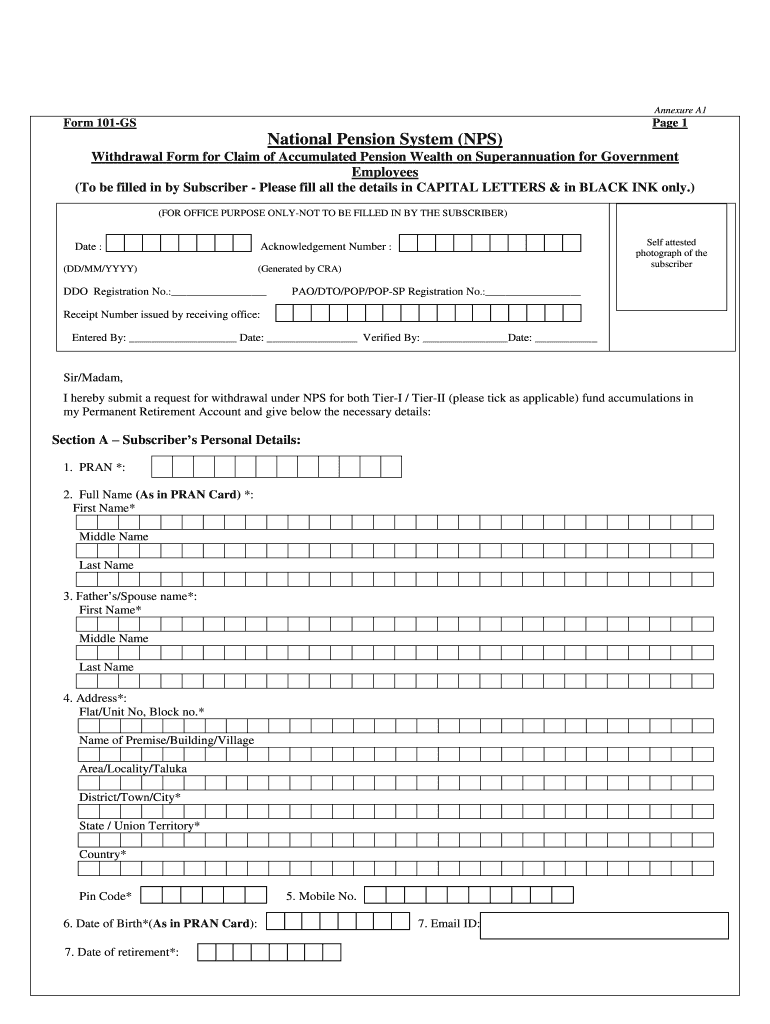

Appendix A1 Form 101GS Page 1 National Pension System (NPS) Withdrawal Form for Claim of Accumulated Pension Wealth on Superannuation for Government Employees (To be filled in by Subscriber Please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign n ational pension system

Edit your n ational pension system form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your n ational pension system form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing n ational pension system online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit n ational pension system. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out n ational pension system

How to fill out National Pension System:

01

Gather necessary documents: To fill out the National Pension System application, you will need documents such as your identification proof, address proof, bank account details, and PAN card.

02

Visit the official website: Go to the official website of the National Pension System and navigate to the application section.

03

Choose the type of account: Select the type of account you want to open under the National Pension System. You can choose either the Tier-I or Tier-II account, depending on your financial goals and requirements.

04

Fill in personal details: Provide your personal information such as your name, date of birth, gender, contact details, and Aadhaar number. Ensure accuracy while entering these details.

05

Nomination details: If you wish to nominate someone to receive the pension in case of your demise, fill in the required details of the nominee.

06

Investment details: Decide on your investment preference by selecting the investment option that suits your risk appetite – Auto Choice or Active Choice. If opting for Active Choice, provide details regarding the allocation of funds among different asset classes.

07

Make contributions: Specify the contribution amount you intend to make towards your pension account. You may choose either a fixed monthly contribution or an annual contribution.

08

Select the Point of Presence (POP): Choose a Point of Presence (POP) from the list of authorized banks and entities, which will facilitate your National Pension System account opening and subsequent transactions.

09

Review and submit: Double-check all the information filled in and make any necessary corrections. Once you are satisfied with the accuracy, submit the application.

Who needs National Pension System?

01

Individuals planning for retirement: The National Pension System is beneficial for individuals who want to build a corpus for their retirement and secure their financial future.

02

Salaried employees: Salaried employees can take advantage of the National Pension System as a supplementary pension scheme along with their Employee Provident Fund (EPF).

03

Self-employed professionals: Self-employed individuals such as consultants, freelancers, or entrepreneurs can utilize the National Pension System to create a retirement fund since they might not have access to employer-sponsored pension plans.

04

Individuals seeking tax benefits: The National Pension System offers tax benefits under Section 80CCD(1), where contributions made towards the scheme are eligible for deduction up to a certain limit. Additionally, an extra deduction under Section 80CCD(2) is available for contributions made by an employer.

05

Those looking for flexible investment options: The National Pension System provides the flexibility to choose between different investment options, catering to varying risk appetites and investment preferences. This makes it suitable for individuals who want to have control over their investment decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete n ational pension system online?

pdfFiller has made it simple to fill out and eSign n ational pension system. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make edits in n ational pension system without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your n ational pension system, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out n ational pension system on an Android device?

Use the pdfFiller app for Android to finish your n ational pension system. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is national pension system?

The National Pension System is a voluntary, long-term retirement savings scheme designed to enable systematic savings during the working life of individuals.

Who is required to file national pension system?

Individuals who wish to save for their retirement and receive a pension after retirement are required to file for the National Pension System.

How to fill out national pension system?

To fill out the National Pension System, individuals can open an NPS account with a registered Pension Fund Manager and contribute regularly towards their retirement savings.

What is the purpose of national pension system?

The purpose of the National Pension System is to provide financial security to individuals after retirement by creating a retirement corpus through regular savings.

What information must be reported on national pension system?

Information such as personal details, contribution amounts, beneficiary details, and investment preferences must be reported on the National Pension System.

Fill out your n ational pension system online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

N Ational Pension System is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.