Get the free PBF 402 Bank Reconciliation Activity

Show details

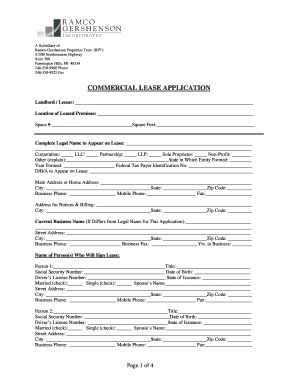

PBA 4.02 Bank Reconciliation Activity Name: FIRST BANK FIRSTCHOICE ACCOUNT MANDARIN BRANCH 4444 THIS STREET ANTON, STATE 000000000 CUSTOMER SERVICE 24 HOURS A DAY, 8880000000 ACCOUNT 12345678910 STATEMENT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pbf 402 bank reconciliation

Edit your pbf 402 bank reconciliation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pbf 402 bank reconciliation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pbf 402 bank reconciliation online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pbf 402 bank reconciliation. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pbf 402 bank reconciliation

How to fill out pbf 402 bank reconciliation:

01

Gather necessary documents: Collect all bank statements, canceled checks, deposit slips, and any other relevant financial records.

02

Compare bank statement with accounting records: Start by carefully reviewing your bank statement and compare it to your accounting records. Ensure that all transactions, including deposits, withdrawals, fees, and interest, are accurately reflected in your records.

03

Identify discrepancies: Note any discrepancies or differences between the bank statement and your accounting records. These may include missing transactions, errors in recording transactions, or unclear entries.

04

Reconcile deposits: Begin reconciling by comparing the deposits listed in your bank statement to those recorded in your accounting records. Tick off each deposit as you verify its accuracy. Identify any differences and investigate the reasons behind them.

05

Reconcile withdrawals: Similarly, verify and reconcile the withdrawals listed in your bank statement with your accounting records. Ensure that all transactions have been properly recorded and accounted for.

06

Account for fees and interest: Review any bank fees charged on your account and compare them to your records. Similarly, verify that any interest earned has been accurately recorded in your accounting records.

07

Address any discrepancies: If you encounter discrepancies during the reconciliation process, thoroughly investigate the reasons behind them. Check for errors in recording, overlooked transactions, or potential fraudulent activities. Make the necessary adjustments in your accounting records to correct any errors.

08

Finalize the reconciliation: Once all discrepancies have been addressed, ensure that your ending bank statement balance matches your accounting records. Make any additional adjustments if required to achieve reconciliation.

09

Keep documentation: Maintain clear and organized documentation of all bank reconciliations performed. This will help in audits, financial reporting, or future reference.

Who needs pbf 402 bank reconciliation?

01

Small businesses: Small businesses with multiple financial transactions need pbf 402 bank reconciliation to ensure the accuracy of their accounting records and identify any discrepancies.

02

Accountants and bookkeepers: Accounting professionals and bookkeepers use pbf 402 bank reconciliation to verify the accuracy of their clients' financial records and ensure that the bank statements match the recorded transactions.

03

Financial institutions: Banks and other financial institutions often require businesses and organizations to submit bank reconciliations to ensure the accuracy of their accounts and transactions. Pbf 402 bank reconciliation provides the necessary documentation for these requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pbf 402 bank reconciliation in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your pbf 402 bank reconciliation and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send pbf 402 bank reconciliation to be eSigned by others?

Once your pbf 402 bank reconciliation is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Where do I find pbf 402 bank reconciliation?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific pbf 402 bank reconciliation and other forms. Find the template you want and tweak it with powerful editing tools.

What is pbf 402 bank reconciliation?

PBF 402 bank reconciliation is a process of comparing the transactions recorded in a company's bank statement with its own accounting records to ensure accuracy and consistency.

Who is required to file pbf 402 bank reconciliation?

All businesses and organizations that maintain bank accounts are required to file PBF 402 bank reconciliation.

How to fill out pbf 402 bank reconciliation?

To fill out PBF 402 bank reconciliation, one must gather the bank statements, accounting records, and any other relevant documents, then compare and reconcile the transactions.

What is the purpose of pbf 402 bank reconciliation?

The purpose of PBF 402 bank reconciliation is to detect errors, discrepancies, or fraud in the accounting records and address them promptly.

What information must be reported on pbf 402 bank reconciliation?

The information reported on PBF 402 bank reconciliation includes bank account balance, outstanding checks, deposits in transit, bank fees, and any other adjustments.

Fill out your pbf 402 bank reconciliation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pbf 402 Bank Reconciliation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.