Get the free EASTERN 1031 STARKER EXCHANGE, L

Show details

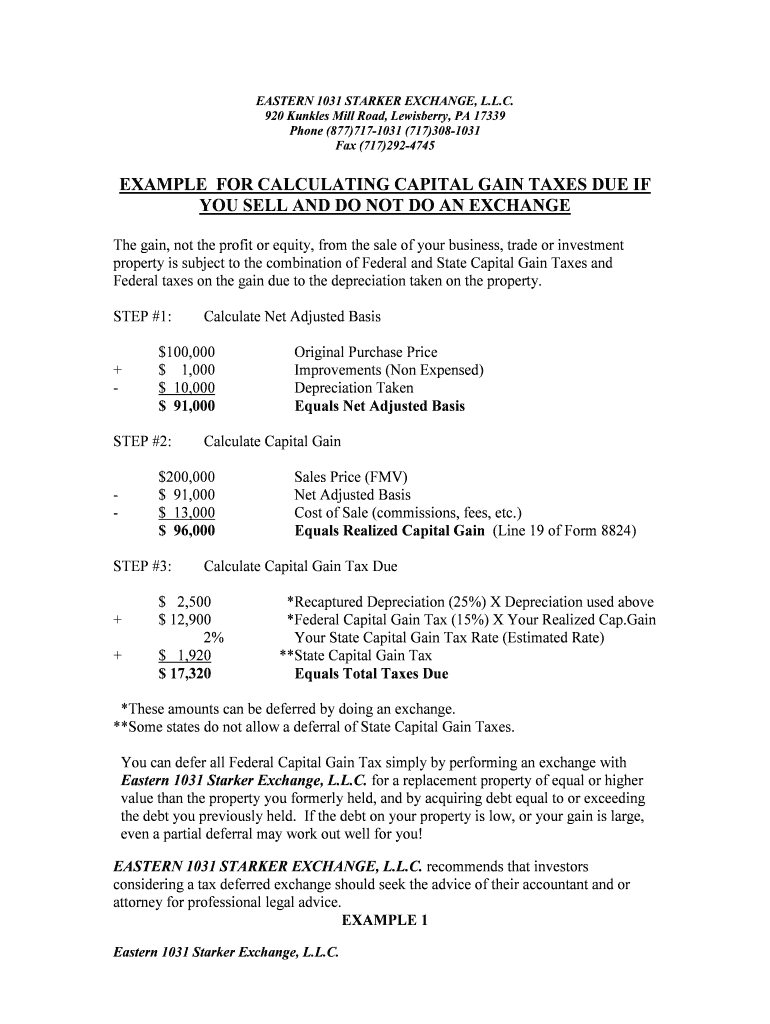

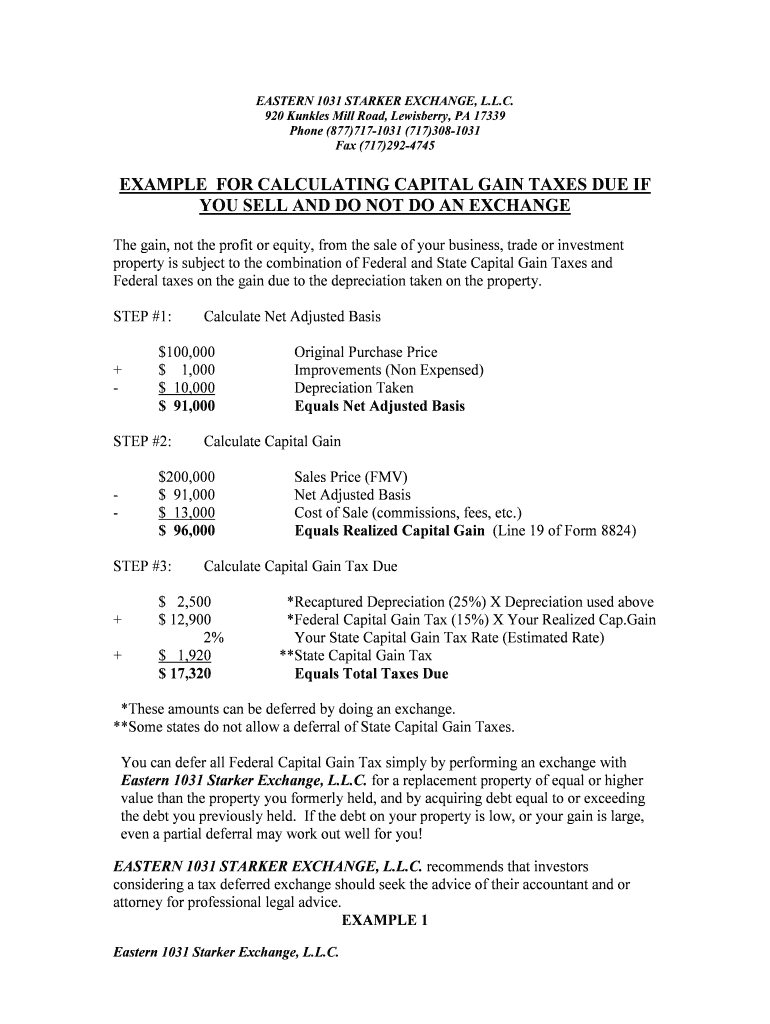

EASTERN 1031 STARKER EXCHANGE, L.L.C.

920 Bundles Mill Road, Lewis berry, PA 17339

Phone (877)7171031 (717)3081031

Fax (717)2924745EXAMPLE FOR CALCULATING CAPITAL GAIN TAXES DUE IF

YOU SELL AND DO

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign eastern 1031 starker exchange

Edit your eastern 1031 starker exchange form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your eastern 1031 starker exchange form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit eastern 1031 starker exchange online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit eastern 1031 starker exchange. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out eastern 1031 starker exchange

How to fill out an Eastern 1031 Starker Exchange:

01

Gather all necessary information and documents such as property details, purchase price, and identification of alternative properties.

02

Consult with a qualified intermediary who will guide you through the process and prepare the necessary documentation.

03

Identify the property you wish to sell (relinquished property) and the property you plan to acquire (replacement property).

04

Provide detailed information about the relinquished property including its fair market value, address, and description.

05

Determine the desired identification period within which you must identify potential replacement properties after the sale of the relinquished property.

06

Identify up to three potential replacement properties within the identification period and provide their detailed information.

07

Notify the qualified intermediary about the identified replacement properties within the specified timeframe.

08

Complete the sale of the relinquished property and have the funds transferred to the qualified intermediary.

09

Utilize the funds from the sale to acquire the replacement property within 180 days from the relinquished property sale.

10

Complete all necessary paperwork with the qualified intermediary to ensure compliance with the 1031 Starker Exchange guidelines.

Who needs an Eastern 1031 Starker Exchange:

01

Real estate investors who want to defer paying capital gains taxes on the sale of their investment properties.

02

Individuals or businesses who wish to exchange their property for another like-kind property to maximize their investment potential.

03

Those looking to diversify their real estate holdings while minimizing tax liabilities.

04

Property owners who want to take advantage of the tax deferral benefits provided by a 1031 Starker Exchange.

05

Investors who want to unlock the potential for greater returns through reinvestment in different properties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send eastern 1031 starker exchange to be eSigned by others?

Once you are ready to share your eastern 1031 starker exchange, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I edit eastern 1031 starker exchange on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign eastern 1031 starker exchange. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I complete eastern 1031 starker exchange on an Android device?

Use the pdfFiller app for Android to finish your eastern 1031 starker exchange. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is eastern 1031 starker exchange?

The Eastern 1031 Starker Exchange is a type of like-kind exchange under section 1031 of the Internal Revenue Code that allows taxpayers to defer paying capital gains taxes on the exchange of certain types of property.

Who is required to file eastern 1031 starker exchange?

Any taxpayer who wishes to defer capital gains taxes on the exchange of property may be required to file an Eastern 1031 Starker Exchange.

How to fill out eastern 1031 starker exchange?

To fill out an Eastern 1031 Starker Exchange, taxpayers must provide information about the relinquished property, replacement property, and follow IRS guidelines for like-kind exchanges.

What is the purpose of eastern 1031 starker exchange?

The purpose of an Eastern 1031 Starker Exchange is to allow taxpayers to defer paying capital gains taxes on the exchange of property, encouraging investment and economic growth.

What information must be reported on eastern 1031 starker exchange?

Taxpayers must report details of the relinquished property, replacement property, and the exchange transaction itself on an Eastern 1031 Starker Exchange form.

Fill out your eastern 1031 starker exchange online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Eastern 1031 Starker Exchange is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.