Get the free Deficit Reduction Act (DRA) Fact Sheet

Show details

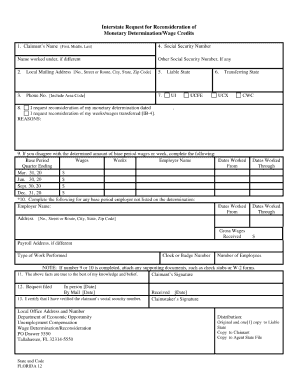

Deficit Reduction Act (DRA) Fact Sheet

Background

The Deficit Reduction Act of 2005 (DRA) requires nationals and U.S. citizens who are applying for Medicaid to prove their citizenship and identity.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deficit reduction act dra

Edit your deficit reduction act dra form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deficit reduction act dra form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deficit reduction act dra online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit deficit reduction act dra. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deficit reduction act dra

How to fill out deficit reduction act dra?

01

Familiarize yourself with the deficit reduction act dra form. Read through the instructions carefully to understand the requirements and purpose of the form.

02

Gather all the necessary information and documentation. The deficit reduction act dra form may require information such as your income, assets, debts, and expenses. Have all the relevant documents ready, including tax returns, bank statements, and proof of expenses.

03

Start by filling out the personal information section of the form. Provide accurate details about yourself, including your full name, address, social security number, and any other information requested.

04

Proceed to the income section. Here, you will need to report your various sources of income, such as wages, self-employment earnings, and rental income. Include any supporting documents, such as pay stubs or income statements.

05

Move on to the assets section. List all your assets, such as real estate, vehicles, investments, and bank accounts. Provide detailed information regarding each asset, including their value, ownership, and any outstanding loans or debts associated with them.

06

Complete the liabilities section. Include information about your debts, such as mortgages, credit card balances, student loans, and other outstanding loans. Be thorough and accurate when reporting these liabilities.

07

Proceed to the expenses section. Here, you will need to detail your monthly expenses, including housing costs, transportation expenses, healthcare costs, and any other regular expenses you may have. Provide accurate figures and include any supporting documentation if required.

08

Review and double-check all the information you have entered on the form. Ensure that everything is accurate and complete before submitting it.

09

Sign and date the form as required. Make sure to add your signature and any other necessary certifications or authorizations.

Who needs deficit reduction act dra?

01

Individuals or businesses facing financial hardships and seeking to reduce their debts and improve their financial situation may need the deficit reduction act dra.

02

Those with high levels of debt, including credit card debt, medical bills, or outstanding loans, may find the deficit reduction act dra beneficial in creating a structured plan to manage and reduce their debts effectively.

03

Individuals or businesses struggling to meet their financial obligations, such as making mortgage payments or paying off tax debts, may seek the assistance of the deficit reduction act dra to negotiate with creditors and establish feasible repayment plans.

04

People or businesses with irregular or fluctuating income may benefit from the deficit reduction act dra as it helps them develop a realistic budget and debt repayment strategy based on their specific financial circumstances.

05

Anyone interested in gaining a better understanding of their financial situation, creating a comprehensive plan to address their debts, and seeking professional advice on debt reduction strategies can consider the deficit reduction act dra.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is deficit reduction act dra?

The Deficit Reduction Act (DRA) is a federal law aimed at reducing the budget deficit by making changes to various government programs and policies.

Who is required to file deficit reduction act dra?

Certain federal agencies and departments are required to file reports under the Deficit Reduction Act.

How to fill out deficit reduction act dra?

The specific requirements for filling out the Deficit Reduction Act report can vary depending on the agency or department filing the report.

What is the purpose of deficit reduction act dra?

The purpose of the Deficit Reduction Act is to reduce the budget deficit through changes to government programs and policies.

What information must be reported on deficit reduction act dra?

The information that must be reported on the Deficit Reduction Act report typically includes budgetary data, program performance metrics, and proposed changes.

How can I edit deficit reduction act dra from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including deficit reduction act dra, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete deficit reduction act dra online?

With pdfFiller, you may easily complete and sign deficit reduction act dra online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out the deficit reduction act dra form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign deficit reduction act dra. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Fill out your deficit reduction act dra online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deficit Reduction Act Dra is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.