Get the free Linked Deposit Program Application Package

Show details

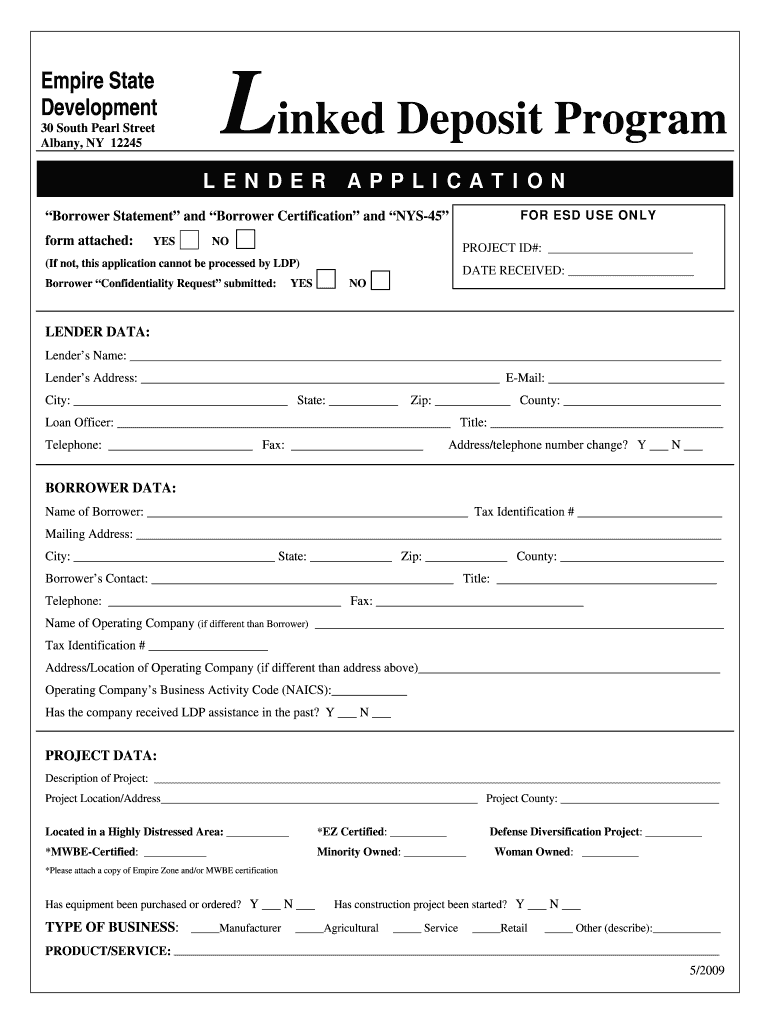

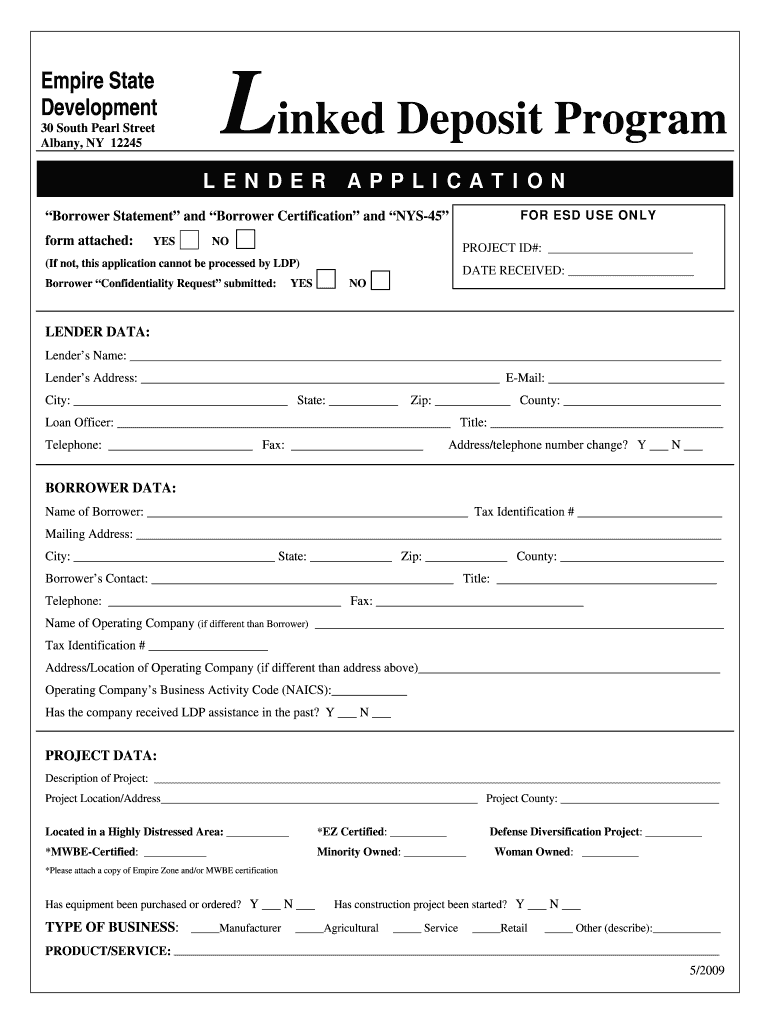

This document outlines the application process for lenders and borrowers under the Linked Deposit Program, detailing required information and submission guidelines.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign linked deposit program application

Edit your linked deposit program application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your linked deposit program application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing linked deposit program application online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit linked deposit program application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out linked deposit program application

How to fill out Linked Deposit Program Application Package

01

Obtain the Linked Deposit Program Application Package from the relevant agency or website.

02

Review the eligibility criteria to ensure you qualify for the program.

03

Fill out the application form with accurate personal information, including your name, contact details, and any business information if applicable.

04

Provide any required documentation, such as proof of income or identification.

05

Complete any additional forms that may be necessary for your specific situation.

06

Double-check all entries for accuracy and completeness.

07

Submit the application package by the specified deadline, either by mail or online as instructed.

Who needs Linked Deposit Program Application Package?

01

Individuals or businesses seeking to lower their interest rates on loans or mortgages.

02

Eligible participants looking for financial assistance through state-sponsored economic programs.

03

Organizations that need funding for development projects, particularly in economically distressed areas.

Fill

form

: Try Risk Free

People Also Ask about

What is the Kansas Economic Recovery Loan deposit Program?

The Kansas Economic Recovery Loan Deposit Program became law in April 2021. This program provides $60 million in state idle funds for the purpose of providing low-interest loans to small commercial or agricultural businesses.

What is a linked deposit program?

A program that links the deposit of state funds to loans made by participating financial institutions to certified businesses.

What is the linked deposit program in NY State?

New York State places a deposit for the same amount as the loan at the bank and earns less interest on the deposit, allowing the lender to transfer the interest rate savings on to the borrower. At the end of the four year term of Linked Deposit assistance, the bank returns the deposit to New York State.

What are linked deposits?

additional facilities (which may be a current account, a savings account, or both) that are linked to a regulated mortgage contract but which may be the subject of a separate contract.

What is the recovery loan scheme UK?

The Recovery Loan Scheme (RLS) is a government-backed loan scheme designed to support access to finance for UK businesses as they look to invest and grow. It can support facility sizes of up to £2 million for borrowers outside the scope of the Northern Ireland Protocol Read footnote text 1 .

What is the state loan repayment program Kansas?

Eligible health care professionals have the opportunity to receive assistance with the repayment of qualifying educational loans in exchange for a minimum two-year service commitment at an eligible practice site. The SLRP funds are to be used as an annual one-time lump sum payment toward eligible student loans.

Is a linked fixed deposit better than a fixed deposit?

Higher Interest Earnings These deposits typically provide better interest rates compared to regular savings accounts. By linking your savings account with a fixed deposit, you can earn higher returns on surplus funds, ensuring more effective growth of your money while keeping it accessible for day-to-day needs.

What is the linked deposit program in Ohio?

When a linked deposit is approved, the Board directs the State Treasurer to place certificates of deposit from moneys contained in the Fund with the eligible lending institution at an interest rate lower than the current market rates determined and calculated by the State Treasurer.

What are the disadvantages of deposit insurance?

By promoting increased asset risk, deposit insurance leads to the increased likelihood and severity of banking crises. Banks are more likely to make riskier investments that would not be feasible without the safety net protections that deposit insurance provides.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Linked Deposit Program Application Package?

The Linked Deposit Program Application Package is a collection of forms and documents required for participants to apply for benefits through the Linked Deposit Program, which typically assists borrowers in obtaining loans at reduced interest rates.

Who is required to file Linked Deposit Program Application Package?

Eligible individuals or businesses seeking financial assistance under the Linked Deposit Program are required to file the application package.

How to fill out Linked Deposit Program Application Package?

To fill out the Linked Deposit Program Application Package, applicants should carefully complete each form, providing accurate information about their financial status and loan needs, and ensure all necessary documents are included before submission.

What is the purpose of Linked Deposit Program Application Package?

The purpose of the Linked Deposit Program Application Package is to facilitate the application process for individuals or businesses seeking low-interest loans, thereby promoting economic growth and accessibility to credit.

What information must be reported on Linked Deposit Program Application Package?

The application package must report information such as the applicant's contact details, financial status, loan purpose, and any collateral offered, along with supporting documentation as required by the program.

Fill out your linked deposit program application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Linked Deposit Program Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.