Get the free Roth IRA Transfer of Assets Form - GuideStone

Show details

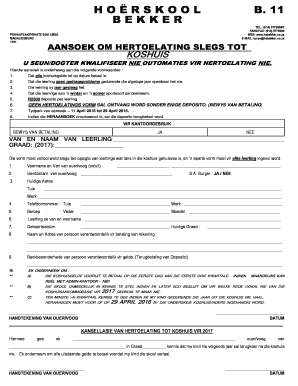

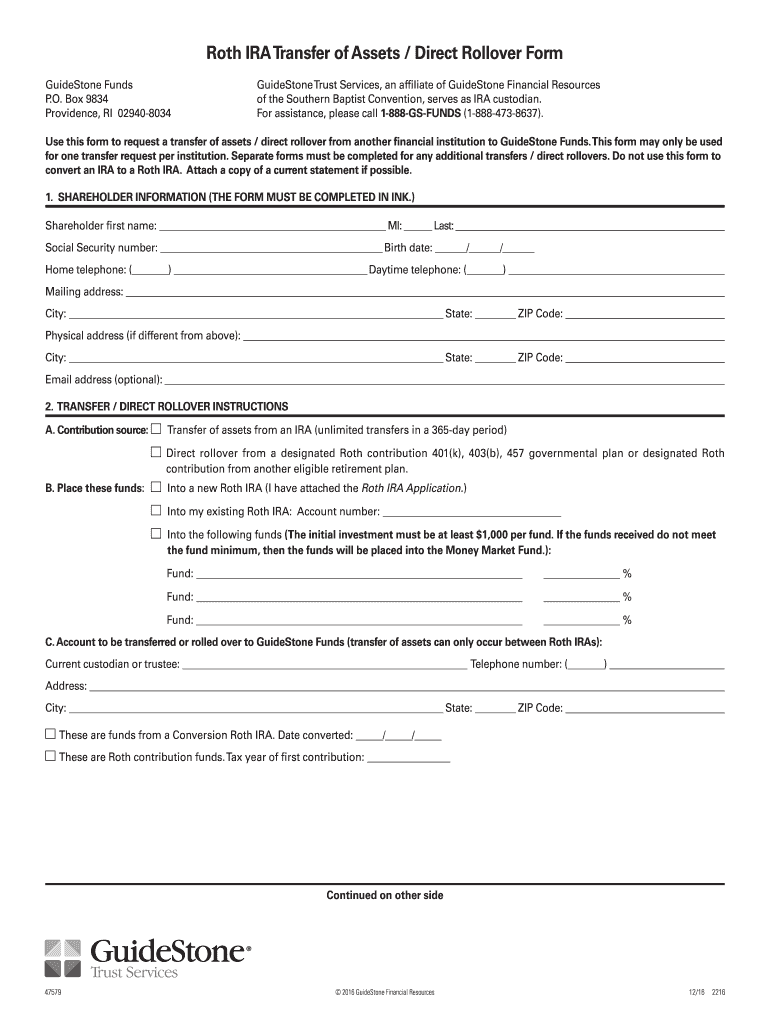

Roth IRA Transfer of Assets Form Guide Stone Funds P.O. Box 9834 Providence, RI 029408034 Guide Stone Trust Services, an affiliate of Guide Stone Financial Resources of the Southern Baptist Convention,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign roth ira transfer of

Edit your roth ira transfer of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your roth ira transfer of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing roth ira transfer of online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit roth ira transfer of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out roth ira transfer of

How to fill out roth ira transfer of:

Gather the required documents:

01

Roth IRA account information, including account number and current custodian's contact information.

02

Personal identification documents, such as a driver's license or passport.

Contact the new custodian:

01

Reach out to the new custodian where you want to transfer your Roth IRA funds.

02

Inquire about their specific process and any required forms.

Obtain the transfer form:

01

Request the transfer form from the new custodian.

02

They may provide it via email, mail, or have it available for download on their website.

Fill out the transfer form:

01

Provide your personal information, including name, address, and Social Security number.

02

Enter the current custodian's name, contact information, and account details.

03

Specify the amount or assets you wish to transfer and any specific instructions.

Review the form and ensure accuracy:

01

Double-check all the information you entered on the transfer form for accuracy.

02

Make sure the account numbers and personal details are correct.

Sign the form:

01

Once you have reviewed and verified all the information, sign the transfer form as required.

02

Some forms may require a notary or witness signature, so check the instructions carefully.

Submit the form:

01

Follow the instructions provided by the new custodian to submit the transfer form.

02

This might include mailing the form, faxing it, or submitting it online through their portal.

Monitor the transfer process:

01

Keep track of the transfer progress by contacting both the old and new custodians.

02

It may take a few weeks for the transfer to be completed.

Who needs roth ira transfer of:

01

Individuals who want to move their Roth IRA funds from one custodian to another.

02

Those who are dissatisfied with their current custodian's services or investment options.

03

People who have changed jobs and want to consolidate their retirement accounts.

04

Individuals who wish to take advantage of better investment opportunities offered by a different custodian.

Note: It's always advisable to consult with a financial advisor or tax professional before making any significant decisions regarding your retirement accounts.

Fill

form

: Try Risk Free

People Also Ask about

Does GuideStone offer Roth IRA?

An Individual Retirement Account (IRA) is a personal, tax-efficient way to invest for retirement. With a GuideStone IRA, you have full access to our wide range of faith-based investment options, including both Traditional and Roth IRAs.

How do I change my Roth IRA company?

Transferring an IRA from your current provider to another institution can be done through a direct trustee-to-trustee transfer. Alternatively, you can opt for an indirect rollover where your bank or broker sends you a check, which you must deposit to the new IRA institution within 60 days.

How do I transfer my IRA assets tax free?

If you deposit 100% of the amount distributed from your IRA within 60 days from the day you received the distribution, you will not owe any taxes on the distribution. If you had any amount withheld for taxes, you must make up this amount out of pocket to complete a 100% rollover.

Can you transfer a Roth IRA to a different company?

If you want to transfer your Roth IRA from one company to another, a direct transfer is likely the easiest path to take. With a direct transfer, you can move your assets straight to the new broker without having to sell them or deal with waiting on a check in the mail.

How do I fill out an IRA transfer form?

0:06 1:20 How to Fill Out a Transfer Form - YouTube YouTube Start of suggested clip End of suggested clip Form you'll first notice that your name and other personal. Information is pre-filled on the form.MoreForm you'll first notice that your name and other personal. Information is pre-filled on the form. The next section is where your current custodian. Information needs to be entered.

How do I transfer my Roth IRA to another company?

If you want to move your individual retirement account (IRA) balance from one provider to another, simply call the current provider and request a “trustee-to-trustee” transfer. This moves money directly from one financial institution to another, and it won't trigger taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit roth ira transfer of from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your roth ira transfer of into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for signing my roth ira transfer of in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your roth ira transfer of directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete roth ira transfer of on an Android device?

Complete your roth ira transfer of and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is roth ira transfer of?

Roth IRA transfer of is transferring funds from one Roth IRA account to another Roth IRA account.

Who is required to file roth ira transfer of?

Individuals who want to transfer funds from one Roth IRA account to another Roth IRA account are required to file Roth IRA transfer of.

How to fill out roth ira transfer of?

To fill out Roth IRA transfer of, you will need to contact your financial institution and request the necessary forms to transfer funds between Roth IRA accounts.

What is the purpose of roth ira transfer of?

The purpose of Roth IRA transfer of is to allow individuals to move funds from one Roth IRA account to another without incurring taxes or penalties.

What information must be reported on roth ira transfer of?

The transfer amount, account information for both the sending and receiving Roth IRA accounts, and any applicable fees must be reported on Roth IRA transfer of.

Fill out your roth ira transfer of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Roth Ira Transfer Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.