Get the free Bselfb-bemployedb income bstatementb - Application - faonline lau edu

Show details

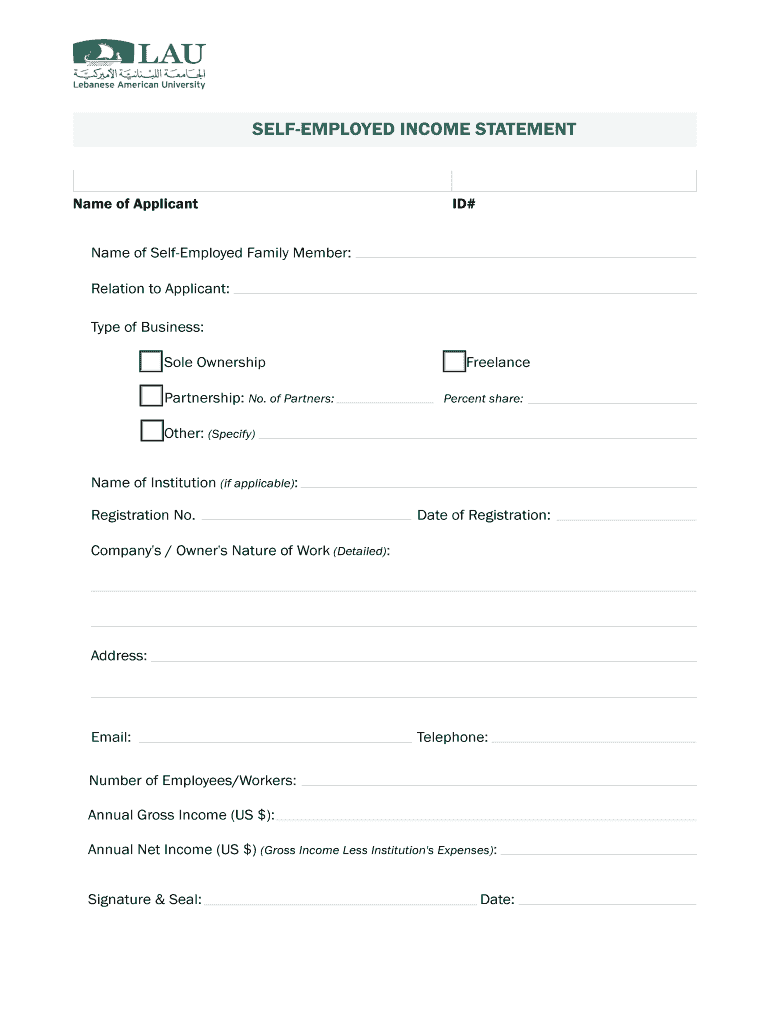

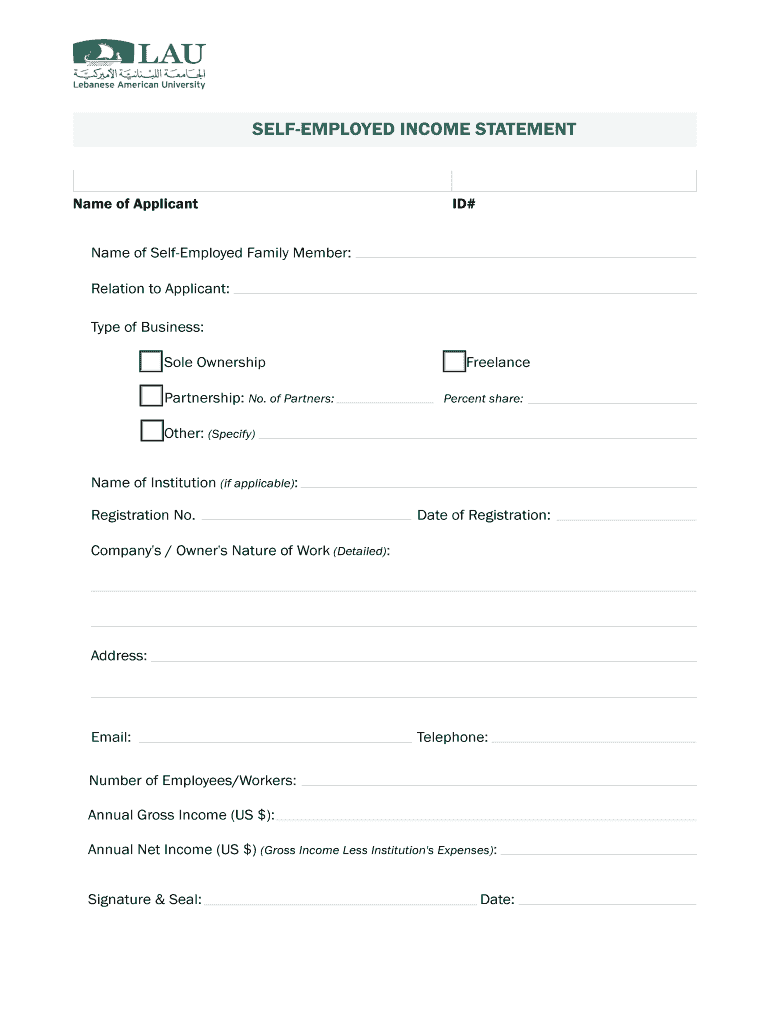

Name of self/employed/b Family Member: Relation to Applicant: Name of BR

Institution (if applicable): Registration No. Date of Registration: Email: Telephone:BR.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bselfb-bemployedb income bstatementb

Edit your bselfb-bemployedb income bstatementb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bselfb-bemployedb income bstatementb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bselfb-bemployedb income bstatementb online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit bselfb-bemployedb income bstatementb. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bselfb-bemployedb income bstatementb

How to fill out self-employed income statement?

01

Gather all necessary documents: Before you start filling out the self-employed income statement, make sure you have all the relevant documents ready. These may include invoices, receipts, bank statements, profit and loss statements, and any other financial records related to your self-employment.

02

Identify the required information: The self-employed income statement typically requires you to provide details such as your business name, address, and taxpayer identification number. You may also need to include information about your clients or customers, the type of services or products you offer, and the dates covered by the statement.

03

Calculate your total income: In this section, you will need to sum up all the income you received from your self-employment during the specified period. This may include money earned from sales, services rendered, or any other business-related activities. Ensure that you include all sources of income accurately to provide a comprehensive picture of your earnings.

04

Deduct your business expenses: As a self-employed individual, you are entitled to deduct certain business expenses. These could include costs related to supplies, equipment, advertising, travel, and rent. Subtract these expenses from your total income to determine your net profit.

05

Report your taxable income: After calculating your net profit, you will need to report it as your taxable income. Be aware of any specific tax regulations or requirements for self-employed individuals in your jurisdiction. It may be helpful to consult a tax professional or refer to tax guides provided by your local tax authority for guidance.

Who needs self-employed income statement?

01

Freelancers and independent contractors: If you work on a self-employed basis and receive income directly from clients or customers, you will likely need to provide a self-employed income statement at some point. This statement helps document your earnings and is often required when filing taxes or applying for loans or mortgages.

02

Small business owners: Entrepreneurs who operate their own businesses and generate income through self-employment should also maintain and provide self-employed income statements. This applies to sole proprietors, partners in partnerships, and individuals who own a single-member LLC.

03

Professionals with side gigs: Even if you have a regular job but also earn income from side gigs or freelance work, you may need to complete a self-employed income statement. It helps to keep track of the additional income you earn outside of your primary employment.

Remember, it is essential to consult with a financial advisor or tax professional to understand your specific obligations, legal requirements, and how to accurately complete your self-employed income statement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit bselfb-bemployedb income bstatementb from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including bselfb-bemployedb income bstatementb. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit bselfb-bemployedb income bstatementb on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign bselfb-bemployedb income bstatementb on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete bselfb-bemployedb income bstatementb on an Android device?

Use the pdfFiller Android app to finish your bselfb-bemployedb income bstatementb and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is self-employed income statement?

Self-employed income statement is a document that shows the income generated from self-employment activities.

Who is required to file self-employed income statement?

Individuals who are self-employed and earn income from their own business are required to file a self-employed income statement.

How to fill out self-employed income statement?

To fill out a self-employed income statement, one must gather information about their business income, expenses, and other financial details for the specific time period.

What is the purpose of self-employed income statement?

The purpose of a self-employed income statement is to report the income earned from self-employment activities and calculate the taxes owed.

What information must be reported on self-employed income statement?

The information that must be reported on a self-employed income statement includes gross income, business expenses, net income, and other financial details.

Fill out your bselfb-bemployedb income bstatementb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bselfb-Bemployedb Income Bstatementb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.