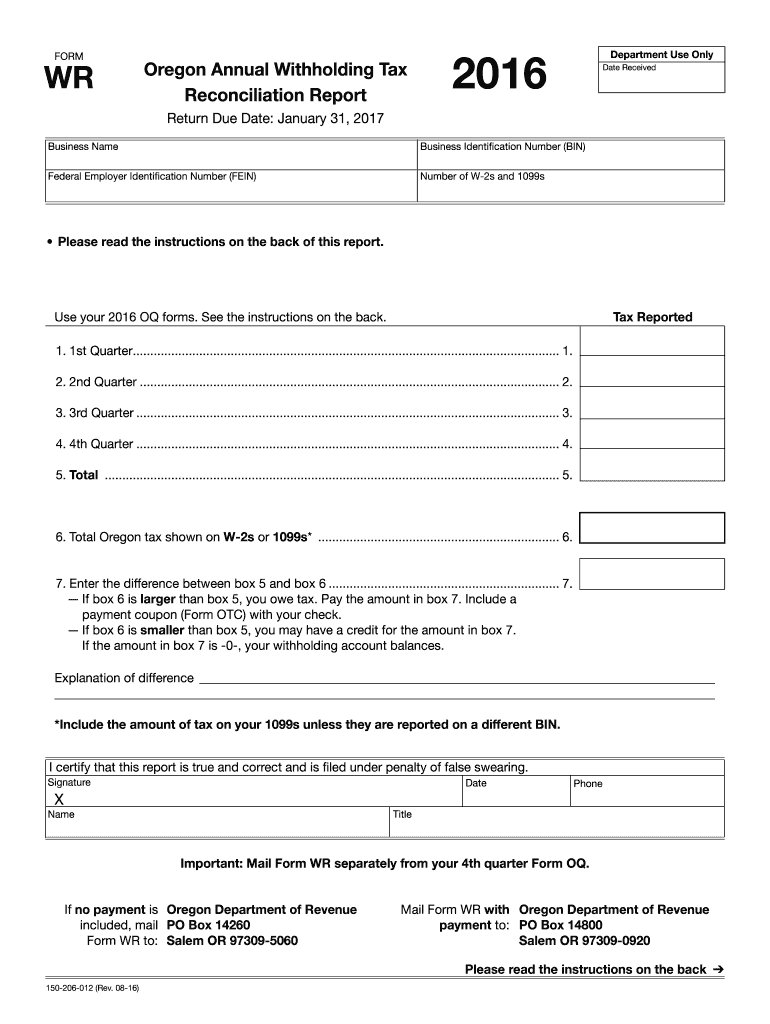

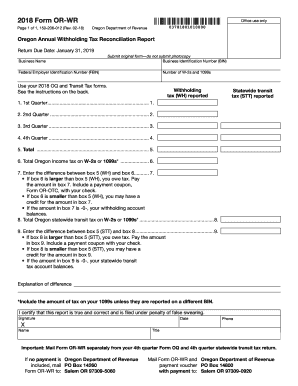

What is Form WR?

Form WR is called the Oregon Annual Withholding Tax Reconciliation Report. This report must be filed by all Oregon employers who pay income taxes. There is a penalty for all employers who failed to submit this form. It is $100.

What is Form WR for?

This form is designed for reporting the annual withholding tax. If you have troubles with filling it out, you may check the instructions on the back of the form. The form itself is stored on our site.

When is Form WR Due?

Generally, the form must be filed on the annual basis. However, you may complete and submit it during the next 45 days after the final payroll was made.

Is Form WR Accompanied by Other Forms?

First you must attach Form 1099 or just include the information provided there to your WR. The same is with your OF forms. The information about taxes on each quarter must be provided.

What Information do I Include in Form WR?

First it is necessary to indicate the business name, business identification number and federal employer identification number. Then provide the information about each tax quarter and indicate the total amount. Provide the tax data from W-2 and 1099 forms and check is it coincides, If not, explain the difference. The form includes the certification where you prove the validity of all information.

Where do I Send Form WR?

Use the following address for filing your Oregon tax report:

Oregon Department of Revenue

PO Box 14260

Salem OR 97309-5060