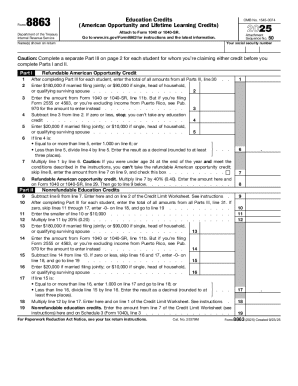

IRS 8863 2011 free printable template

Instructions and Help about IRS 8863

How to edit IRS 8863

How to fill out IRS 8863

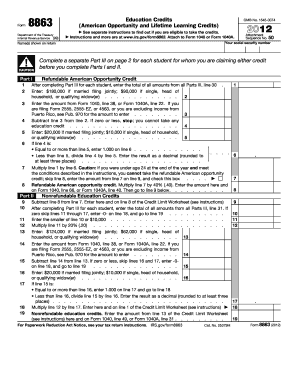

About IRS 8 previous version

What is IRS 8863?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

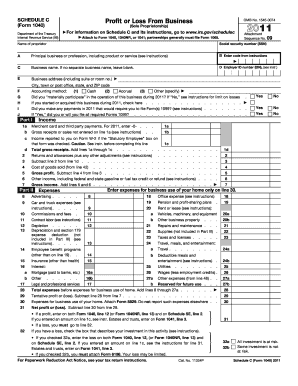

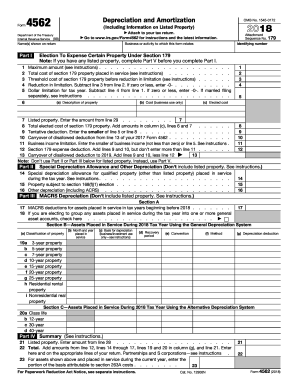

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8863

What should I do if I need to correct an error on my 2011 8863 form?

If you identify a mistake on your 2011 8863 form after submission, you should file an amended version of the form as soon as possible. It’s essential to follow the guidelines for submitting corrections to avoid any delays in processing or potential issues with your tax return.

How can I track the status of my submitted 2011 8863 form?

To track the status of your submitted 2011 8863 form, you can use the IRS online tools or contact the IRS directly. Keep a record of your submission details, as you may encounter common e-file rejection codes that indicate specific issues with your filing.

What if I receive a notice from the IRS regarding my 2011 8863 form?

If you receive a notice from the IRS about your 2011 8863 form, carefully read the instructions provided in the notice. Depending on the nature of the notice, you may need to respond promptly with documentation or clarifications to address any concerns they have raised.

Are there any service fees associated with e-filing my 2011 8863 form?

Yes, some tax preparation software or e-filing services may charge fees for submitting your 2011 8863 form electronically. Be sure to check the pricing details provided by the service you choose, as these can vary significantly.

What technical requirements should I be aware of for e-filing the 2011 8863 form?

When e-filing your 2011 8863 form, ensure that your software is compatible with the required IRS standards and that you are using an updated browser or device. Review any specific technical requirements specified by the e-filing service you select to ensure a smooth filing experience.

See what our users say