Get the free MMC UK Pension Savings Plan

Show details

This form allows members to choose how their contributions to the MMC UK Pension savings will be invested, detailing options for investments in specific funds or through a LifeStyle strategy.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mmc uk pension savings

Edit your mmc uk pension savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mmc uk pension savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mmc uk pension savings online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mmc uk pension savings. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

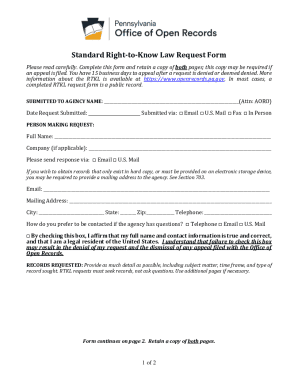

How to fill out mmc uk pension savings

How to fill out MMC UK Pension Savings Plan

01

Gather necessary personal information, including full name, address, and national insurance number.

02

Prepare your employment details, such as job title and start date at the company.

03

Access the MMC UK Pension Savings Plan form, either online or in hard copy.

04

Carefully read the instructions provided on the form.

05

Fill in your personal and employment information accurately in the designated fields.

06

Select your preferred contribution level and investment options as outlined in the plan.

07

Review your completed form for any errors or missing information.

08

Submit the form as per the guidelines: either online submission or mailing it to the designated office.

Who needs MMC UK Pension Savings Plan?

01

Employees of MMC who are looking to save for retirement.

02

Individuals seeking to benefit from employer contributions to their pension plan.

03

Those who want a structured savings plan to secure their financial future post-retirement.

Fill

form

: Try Risk Free

People Also Ask about

When can you take money out of an UK pension?

Personal and workplace pensions. When you can take money from your pension pot will depend on your pension scheme's rules, but it's usually after you're 55. You may be able to take money out before this age if either: you're retiring early because of ill health.

How to withdraw money from UK pension?

Taking your pension: your options take some or all of your pension pot as a cash lump sum, no matter what size it is. buy an annuity - you can take a cash lump sum too. take money directly from the pension fund, and leave the rest invested (income drawdown) - there won't be any restrictions for how much you can take.

How does the UK pension plan work?

The U.K. State Pension requires reaching pension age and making sufficient National Insurance (NI) contributions, while workplace pensions depend on employment status and earnings. Employers in the U.K. are generally required to enroll eligible employees into workplace pensions, with both parties contributing.

What is the overseas pension scheme UK?

A Qualifying Recognised Overseas Pension Scheme (QROPS) is a name used to categorise a non-UK pension scheme that can receive the transfer of UK pension benefits. To qualify as a QROPS, the overseas pension scheme must meet certain conditions as prescribed by HM Revenue & Customs (HMRC), the UK tax authority.

Can I withdraw 25% of my pension before 55?

While it's not against the law to access a pension before the age of 55, doing so isn't recommended for two main reasons. You'll be charged up to 55% tax on the amount you request to withdraw. This will significantly impact how much of your pension you'll end up receiving.

Can I pull money out of a pension?

Cashing out a pension after leaving a job is an option in some cases, but the process can vary depending on plan rules, vesting status and tax implications. Some pensions allow a lump-sum cash-out, offering immediate access to funds – but at the cost of potential taxes and penalties.

How to withdraw money from pension account in the UK?

Invest the money in a drawdown fund You may be able to ask your pension provider to invest your pension pot in a flexi-access drawdown fund. From a flexi-access drawdown fund you can: make withdrawals. buy a short-term annuity - this will give you regular payments for up to 5 years.

What are the fees for Mercer pension?

Between 1.17% and 1.20% depending on your circumstances. The fee is applied to the value of your investments and is made up of: Ongoing advice fee of 0.60% based on the value of the assets advised on.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MMC UK Pension Savings Plan?

The MMC UK Pension Savings Plan is a retirement savings scheme offered to employees of Marsh & McLennan Companies in the UK, designed to help them save for retirement through a combination of employer and employee contributions.

Who is required to file MMC UK Pension Savings Plan?

Employees who are eligible for the pension plan and wish to contribute to it are required to file the MMC UK Pension Savings Plan forms. This typically includes all qualifying staff members at Marsh & McLennan Companies.

How to fill out MMC UK Pension Savings Plan?

To fill out the MMC UK Pension Savings Plan, employees need to provide personal information, choose their contribution level, and select investment options as detailed in the plan documents. It is advisable to read the guidelines carefully before submitting the forms.

What is the purpose of MMC UK Pension Savings Plan?

The purpose of the MMC UK Pension Savings Plan is to provide employees with a structured way to save for retirement, ensuring they have adequate financial resources upon retirement through regular contributions and investment growth.

What information must be reported on MMC UK Pension Savings Plan?

Information that must be reported on the MMC UK Pension Savings Plan includes personal details of the employee, contribution amounts, selected investment options, and any other necessary details as outlined in the plan documentation.

Fill out your mmc uk pension savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mmc Uk Pension Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.