Get the free MMC UK Pension Fund Expression of Wish

Show details

This document is for members of the MMC UK Pension Fund to express their wishes regarding the payment of death benefits to designated beneficiaries.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mmc uk pension fund

Edit your mmc uk pension fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mmc uk pension fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

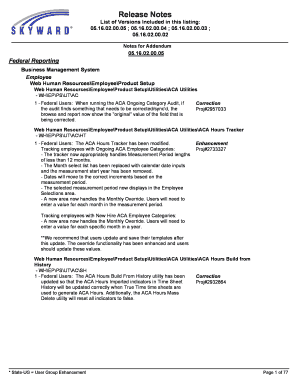

Editing mmc uk pension fund online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mmc uk pension fund. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mmc uk pension fund

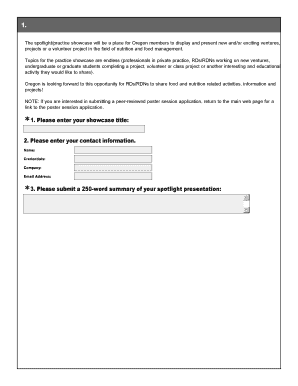

How to fill out MMC UK Pension Fund Expression of Wish

01

Begin by obtaining the MMC UK Pension Fund Expression of Wish form from the pension provider's website or directly from the HR department.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal details, including your name, address, and date of birth in the designated sections.

04

Clearly name the individuals or dependents you wish to nominate for the death benefits of your pension.

05

Specify the percentage of the benefit each nominated individual should receive, ensuring that the total equals 100%.

06

Sign and date the form at the bottom to validate your wishes.

07

Submit the completed form to the relevant HR contact or pension provider as instructed.

Who needs MMC UK Pension Fund Expression of Wish?

01

Anyone who is a member of the MMC UK Pension Fund and wishes to designate beneficiaries for their pension death benefits.

Fill

form

: Try Risk Free

People Also Ask about

What happens if there is no expression of wish?

While there is no requirement for you to complete an expression of wish form, there are two main reasons why doing so would be advantageous. If you do not complete an expression of wish form, any death grant that may become payable will be paid to your legal beneficiary.

What is the expression of wish for pension funds?

What is an expression of wishes? In most pensions, the scheme administrator has the final say over who receives the death benefits of your pension. This is part of the structure which allows your pension to stay outside of your estate for inheritance tax purposes and normally can't be changed.

What is the expression of wishes form for NHS pension?

The Expression of Wish form is in respect of lump sum death benefits, if due. In the case of the NHS, that's if death occurs either before starting to draw your pension benefits, or within 5 years of drawing your pension.

Is expression of wish better than nomination?

The recent link explains in great detail but in general it's preferable to make an expression of wishes. That allows the trustees flexibility in dealing with changed circumstances though if time allows you should update the wishes. Don't rely on likely. Be explicit that this is your preference in that situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MMC UK Pension Fund Expression of Wish?

The MMC UK Pension Fund Expression of Wish is a document that allows members of the pension scheme to specify who they would like their benefits to be paid to in the event of their death.

Who is required to file MMC UK Pension Fund Expression of Wish?

All members of the MMC UK Pension Fund are encouraged to file an Expression of Wish to ensure that their wishes regarding the distribution of their pension benefits are known and considered.

How to fill out MMC UK Pension Fund Expression of Wish?

To fill out the MMC UK Pension Fund Expression of Wish, a member should complete the designated form, clearly writing the names and relationships of the chosen beneficiaries, and then submit it to the pension fund administration.

What is the purpose of MMC UK Pension Fund Expression of Wish?

The purpose of the MMC UK Pension Fund Expression of Wish is to guide the pension trustees in making decisions on the distribution of the member's pension benefits after their death, aligning with the member's personal wishes.

What information must be reported on MMC UK Pension Fund Expression of Wish?

The information that must be reported includes the names of the beneficiaries, their relationship to the member, and any percentages of the benefit that should be allocated to each beneficiary.

Fill out your mmc uk pension fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mmc Uk Pension Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.