Get the free DEFA14A

Show details

Additional proxy soliciting materials filed to amend previous disclosures due to an inadvertent error.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign defa14a

Edit your defa14a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your defa14a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit defa14a online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit defa14a. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out defa14a

How to fill out DEFA14A

01

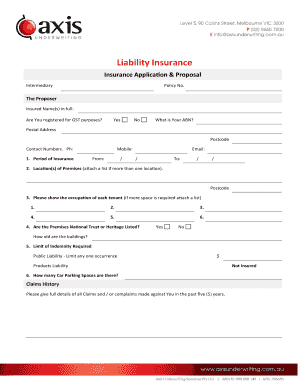

Gather all necessary information including the company's details, shareholder information, and the purpose of the proxy statement.

02

Begin by completing the heading section with the company's name, address, and the date of the meeting.

03

Provide a detailed description of the matters to be voted on, including any proposals and background information.

04

Fill out the sections related to the board of directors, including their names and any relevant qualifications.

05

Include any financial information as required, along with the independent auditor's report.

06

Disclose any interests in the proposals being voted on, particularly from directors and executive officers.

07

Review the document for compliance with SEC guidelines and accuracy of information.

08

File the completed DEFA14A with the SEC and provide copies to shareholders as required.

Who needs DEFA14A?

01

Publicly traded companies that are seeking shareholder approval on certain matters.

02

Companies that are required to disclose additional information during the proxy solicitation process.

03

Investors and shareholders who need transparent information regarding the proposals being voted on.

Fill

form

: Try Risk Free

People Also Ask about

What is a DEFA14A?

SEC Form DEFA14A is also referred to as 'additional proxy soliciting materials - definitive'. This means that SEC Form DEFA14A is a filing submitted by or on behalf of a registrant who wishes to give additional materials that are associated to an upcoming shareholder vote under the Securities and Exchange Commission.

What information is on the Schedule 14A?

Schedule 14A sets out the information required to be in the proxy statement. For more information, see Practice Note, Proxy Statements. Regulation 14A sets out the requirements applicable to any communication by a public company that would cause a stockholder to grant, withhold or revoke a proxy.

What is a proxy statement pursuant to Section 14 A of the Securities Exchange Act of 1934?

SEC Form DEF 14A, which is also known as a "definitive proxy statement," is required under Section 14(a) of the Securities Exchange Act of 1934. This form is filed with the SEC when a definitive proxy statement is given to shareholders and helps the SEC ensure that shareholders' rights are upheld.

What is the rule 14A 12 under the Securities Exchange Act of 1934?

Prior to filing the preliminary proxy statement, Rule 14a-12 under the Securities Exchange Act of 1934 allows for soliciting materials to be published or sent to shareholders if certain conditions are met. In particular, the materials must include a “participants in the solicitation” legend.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DEFA14A?

DEFA14A is a form filed with the U.S. Securities and Exchange Commission (SEC) that contains information related to proxy solicitations for matters that require shareholder approval.

Who is required to file DEFA14A?

Companies that are publicly traded and are soliciting shareholder votes on certain corporate actions or proposals are required to file DEFA14A.

How to fill out DEFA14A?

To fill out DEFA14A, companies must provide detailed information about the proposals, including dates, voting instructions, and details about the board of directors and their recommendations.

What is the purpose of DEFA14A?

The purpose of DEFA14A is to ensure that shareholders are adequately informed about matters that will be brought to a vote, allowing them to make informed decisions.

What information must be reported on DEFA14A?

DEFA14A must report information such as the nature of the proposal, background information, reasons for the board's position, and any agreements or plans related to the proposals.

Fill out your defa14a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

defa14a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.