Get the free In order to audit a course, a graduate student must have the approval of the instruc...

Show details

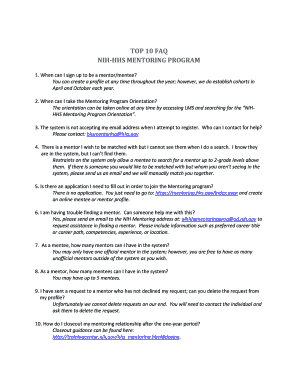

INSTRUCTORS PERMISSION TO AUDIT A COURSE

In order to audit a course, a graduate student must have the approval of the instructor of the

course. Complete this form and deliver it to the Registrars

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign in order to audit

Edit your in order to audit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in order to audit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing in order to audit online

To use the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit in order to audit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out in order to audit

How to Fill Out in Order to Audit:

01

Begin by gathering all necessary documentation related to the audit. This may include financial statements, tax records, invoices, receipts, and any other relevant paperwork.

02

Carefully review these documents to ensure they are accurate and complete. Make any necessary corrections or updates before proceeding with the audit.

03

Familiarize yourself with the audit objectives and scope. Understand what specific areas or aspects of the business or organization will be examined during the audit.

04

Use appropriate audit software or forms to record and document your findings. This could involve using electronic spreadsheets, specialized audit software, or manually filling out paper forms.

05

Follow the established audit procedures and guidelines. These will help ensure that the audit is conducted in a systematic and organized manner, minimizing the risk of errors or oversight.

Who Needs to Audit:

01

Businesses and organizations of all sizes may need to conduct audits. This includes both for-profit companies and non-profit organizations.

02

External stakeholders such as investors, creditors, and regulatory authorities often require audits to assess the financial health and reliability of a business.

03

Audits are also valuable for internal purposes. They help organizations identify areas of improvement, detect financial irregularities or fraud, and ensure compliance with legal and regulatory requirements.

04

Additionally, audits may be necessary for tax purposes. Many jurisdictions require businesses and individuals to undergo periodic audits to verify tax compliance and accuracy of financial reporting.

05

Ultimately, anyone seeking an objective and independent evaluation of financial records and processes may need to conduct or undergo an audit. This could be for legal, financial, or operational reasons.

Remember, the specific requirements and procedures for audits can vary depending on the jurisdiction, industry, and other factors. It is important to consult relevant professionals, such as auditors or accountants, for accurate and tailored guidance in your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute in order to audit online?

pdfFiller has made it easy to fill out and sign in order to audit. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit in order to audit on an Android device?

With the pdfFiller Android app, you can edit, sign, and share in order to audit on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I fill out in order to audit on an Android device?

On Android, use the pdfFiller mobile app to finish your in order to audit. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is in order to audit?

In order to audit, a thorough examination of financial records, transactions, and processes is conducted to ensure accuracy and compliance.

Who is required to file in order to audit?

Certain businesses and organizations are required by law to file for an audit, typically those that exceed a certain revenue threshold or are in regulated industries.

How to fill out in order to audit?

To fill out for an audit, financial documents and reports must be gathered and submitted to a certified public accountant or auditing firm.

What is the purpose of in order to audit?

The purpose of an audit is to provide assurance to stakeholders that financial statements are reliable and accurate.

What information must be reported on in order to audit?

Information such as income, expenses, assets, liabilities, and taxes must be reported on in an audit.

Fill out your in order to audit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

In Order To Audit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.