Get the free Municipal Transfer Stamp Requirements 07.21.15.docx

Show details

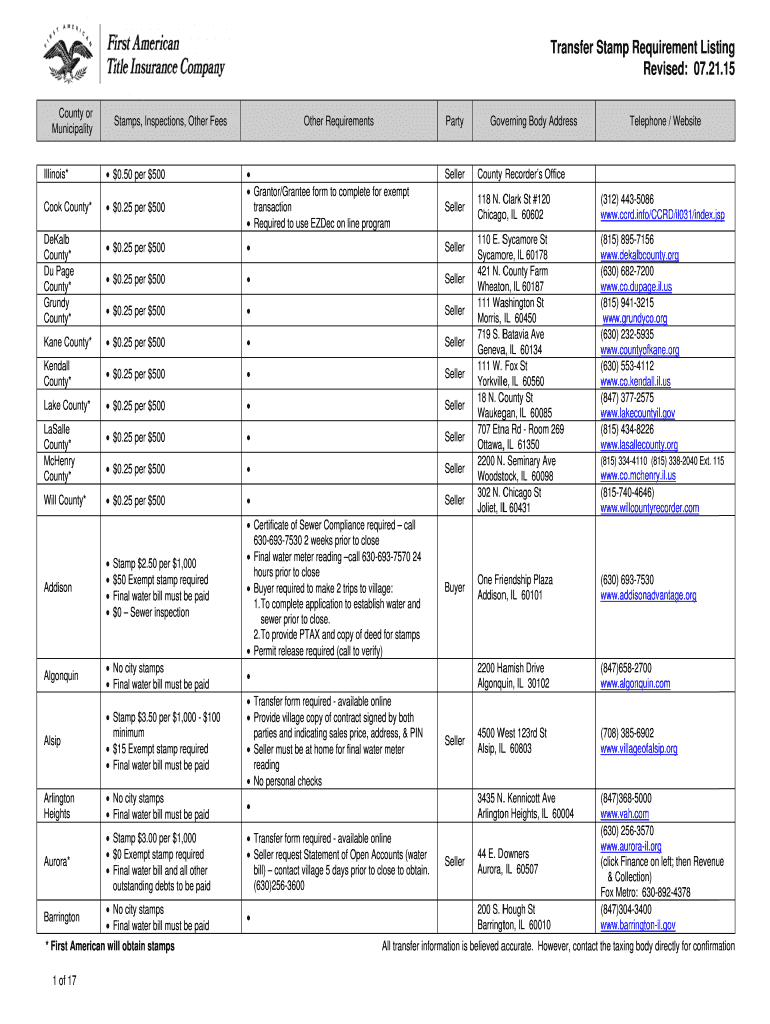

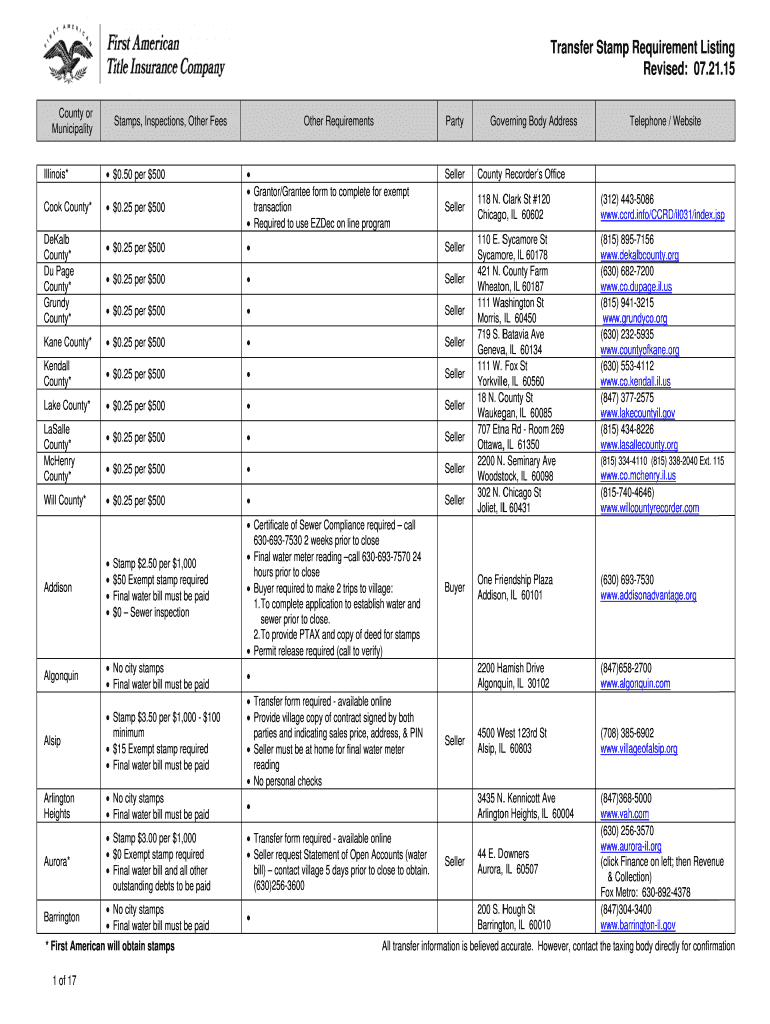

Trans sphere Stamp Req requirement Listing R Revised: 07.21.15 COU unity or Music capacity Stamps, Inspections, Other Fe yes Illinois* $0.50 per $500 r Cook Co county* r $0.25 per $500 DeKalb County*

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign municipal transfer stamp requirements

Edit your municipal transfer stamp requirements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your municipal transfer stamp requirements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing municipal transfer stamp requirements online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit municipal transfer stamp requirements. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out municipal transfer stamp requirements

How to Fill Out Municipal Transfer Stamp Requirements:

01

Begin by gathering all the necessary documents and information required for the transfer of ownership. This typically includes the property deed, identification documents of the buyer and seller, and any supporting documents related to the transaction.

02

Visit the municipal office or relevant authority responsible for stamping the transfer documents. Ensure you have the correct address and operating hours of the office.

03

Obtain the necessary transfer stamp application form from the office. Fill out the form accurately and provide all requested information. This may include details such as the property address, purchase price, and the names and contact information of the buyer and seller.

04

Attach all the required supporting documents to the application form. These may include the property deed, proof of identification for both parties, and any other documents specific to the transfer process. Ensure that all photocopies are clear and legible.

05

Review the completed application form and attached documents to ensure all information is accurate, complete, and in compliance with the municipal transfer stamp requirements.

06

Submit the application form and documents to the designated office. Pay any required fees associated with the stamping process, if applicable. It is advisable to retain a copy of the submitted application form and supporting documents for your own records.

Who Needs Municipal Transfer Stamp Requirements:

01

Property buyers and sellers who are involved in the transfer of ownership of a property within a municipality may need to fulfill municipal transfer stamp requirements. These requirements vary based on the jurisdiction and may be specific to the municipality in question.

02

Individuals who are selling or purchasing residential, commercial, or industrial properties may need to comply with municipal transfer stamp requirements. These requirements help ensure the legality and proper documentation of property transfers within the municipality's jurisdiction.

03

Real estate professionals, such as real estate agents, brokers, or lawyers, involved in property transactions are also required to understand and adhere to municipal transfer stamp requirements. It is their responsibility to guide their clients through the necessary steps and paperwork to complete the transfer successfully.

Overall, municipal transfer stamp requirements are necessary to ensure transparency, legality, and proper documentation during the process of transferring property ownership within a municipality. Compliance with these requirements is crucial to avoid any legal complications or disputes in the future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send municipal transfer stamp requirements for eSignature?

Once your municipal transfer stamp requirements is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit municipal transfer stamp requirements online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your municipal transfer stamp requirements to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit municipal transfer stamp requirements straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing municipal transfer stamp requirements.

What is municipal transfer stamp requirements?

Municipal transfer stamp requirements are a tax levied by local municipalities on property transactions.

Who is required to file municipal transfer stamp requirements?

The buyer or seller of the property is typically required to file municipal transfer stamp requirements.

How to fill out municipal transfer stamp requirements?

You can fill out municipal transfer stamp requirements by providing the necessary information about the property transaction, such as the sale price and location.

What is the purpose of municipal transfer stamp requirements?

The purpose of municipal transfer stamp requirements is to generate revenue for the local municipality and ensure that property transactions are properly recorded.

What information must be reported on municipal transfer stamp requirements?

Information such as the sale price, property location, and buyer/seller details must be reported on municipal transfer stamp requirements.

Fill out your municipal transfer stamp requirements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Municipal Transfer Stamp Requirements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.