Get the free Interest Reset Date - Rate of interest (ROI) will be reset at the - sanriya

Show details

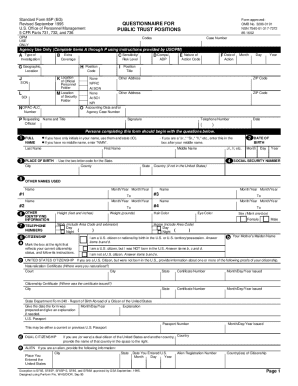

HDFC DEPOSITS INDIVIDUALS Fixed & Variable Rates Credit Rating 'A A A AAA & MAYA rating affirmed consecutively for over a decade by CRISIS & ICRA respectively. ELECTRONIC CLEARING SERVICE (ECS) VARIABLE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign interest reset date

Edit your interest reset date form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your interest reset date form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit interest reset date online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit interest reset date. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out interest reset date

How to fill out interest reset date:

01

Start by locating the section on the document or form where you are required to provide the interest reset date.

02

Check if there are any specific instructions or guidelines provided regarding how to fill out this date. If so, follow those instructions carefully.

03

The interest reset date refers to the date when the interest on a loan, investment, or financial instrument will be recalculated or adjusted. It is often used in adjustable-rate mortgages or bonds with variable interest rates.

04

Typically, you would need to enter the specific day, month, and year for the interest reset date. The format may vary depending on the document, so ensure you enter the date correctly.

05

Double-check your entries for accuracy before submitting the document to avoid any errors in the interest reset date.

Who needs interest reset date:

01

Borrowers: Individuals or businesses who have borrowed funds and have an adjustable-rate loan, such as an adjustable-rate mortgage, may need to be aware of the interest reset date. This date signifies when their interest rate could potentially change, affecting their future monthly payments.

02

Lenders: Financial institutions or lenders who provide adjustable-rate loans or other financial products tied to variable interest rates need to keep track of the interest reset dates for their customers. It helps them determine when it is necessary to adjust interest rates based on prevailing market conditions.

03

Investors: Investors who hold bonds or other fixed-income securities with adjustable interest rates should be familiar with the interest reset date. It indicates when the interest rate on their investment will be recalculated, potentially affecting the overall returns they receive.

Overall, understanding how to fill out the interest reset date and its significance is important for both borrowers and lenders to ensure accurate and timely adjustments to interest rates. Likewise, investors need to be aware of the interest reset date to effectively manage their portfolios and make informed investment decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete interest reset date online?

pdfFiller makes it easy to finish and sign interest reset date online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I sign the interest reset date electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your interest reset date.

Can I create an electronic signature for signing my interest reset date in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your interest reset date and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is interest reset date?

Interest reset date is the date on which the interest rate on a financial instrument is adjusted.

Who is required to file interest reset date?

The party responsible for managing the financial instrument, such as a borrower or issuer, is typically required to file the interest reset date.

How to fill out interest reset date?

To fill out the interest reset date, you need to provide information on the current interest rate, the date of the last reset, and any applicable benchmarks or indices.

What is the purpose of interest reset date?

The purpose of the interest reset date is to ensure that the interest rate on a financial instrument accurately reflects current market conditions.

What information must be reported on interest reset date?

The information that must be reported on the interest reset date includes the current interest rate, the date of the next reset, and any applicable reference rates.

Fill out your interest reset date online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Interest Reset Date is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.