Get the free Short Sale Agreement

Show details

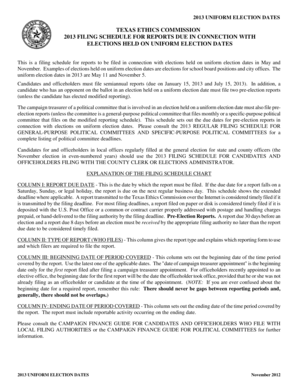

This document outlines the terms and conditions of a short sale agreement between a borrower and a servicer to facilitate the sale of a property in order to avoid foreclosure.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign short sale agreement

Edit your short sale agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your short sale agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing short sale agreement online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit short sale agreement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out short sale agreement

How to fill out Short Sale Agreement

01

Gather necessary documents like mortgage statements and property information.

02

Identify and assess the outstanding mortgage balance on the property.

03

Fill out the Short Sale Agreement form with property details and the seller's information.

04

Clearly state the purchase price and the terms of the sale.

05

Include any required disclosures and addenda as necessary.

06

Ensure all parties involved review and sign the agreement.

07

Submit the agreement to the bank or lender for approval.

Who needs Short Sale Agreement?

01

Homeowners who are facing financial difficulties and cannot keep up with mortgage payments.

02

Real estate investors looking to purchase properties at a discounted price.

03

Lenders or banks managing distressed properties seeking to minimize losses.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a short sale?

For example, let's say a stock is trading at $50 a share. You borrow 100 shares and sell them for $5,000. The price subsequently declines to $25 a share, at which point you purchase 100 shares to replace those you borrowed, netting $2,500.

What is a spa short form PLC?

A simplified, short form agreement (SPA) for the sale and purchase of the entire issued share capital of a private company limited by shares, involving a single target company and a simultaneous exchange and completion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

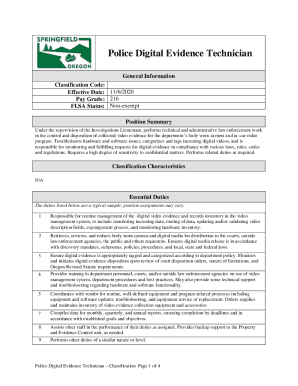

What is Short Sale Agreement?

A Short Sale Agreement is a legal document between a homeowner and their mortgage lender that allows the homeowner to sell their property for less than the outstanding balance on their mortgage, with the lender's permission.

Who is required to file Short Sale Agreement?

The homeowner who intends to sell their property in a short sale is required to file the Short Sale Agreement, along with receiving approval from their mortgage lender.

How to fill out Short Sale Agreement?

To fill out a Short Sale Agreement, the homeowner should provide accurate details about the property, loan information, current financial situation, and reason for the short sale, and must ensure the lender reviews and approves the document.

What is the purpose of Short Sale Agreement?

The purpose of a Short Sale Agreement is to allow a homeowner facing financial hardship to avoid foreclosure by selling their property for less than what is owed on the mortgage, thus minimizing losses for both the homeowner and the lender.

What information must be reported on Short Sale Agreement?

The Short Sale Agreement must include information such as property details, loan account numbers, the seller's financial condition, terms of the sale, and necessary disclosures required by the lender.

Fill out your short sale agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Short Sale Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.