Get the free Tax Abatement Agreement

Show details

This document outlines the terms and conditions of a tax abatement agreement between Fort Bend County and Seatex, Ltd., including definitions, responsibilities, taxability, and administration aspects

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax abatement agreement

Edit your tax abatement agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax abatement agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax abatement agreement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax abatement agreement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax abatement agreement

How to fill out Tax Abatement Agreement

01

Obtain the Tax Abatement Agreement form from your local tax authority or online.

02

Read through the instructions carefully to understand the requirements and terms.

03

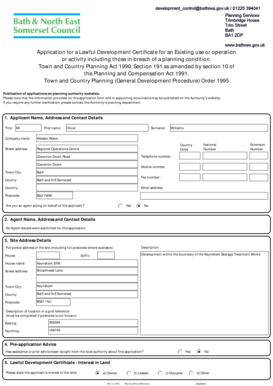

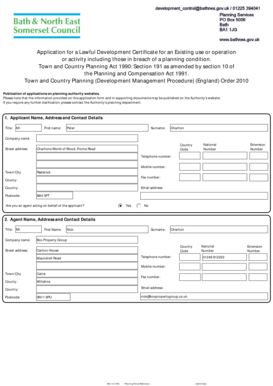

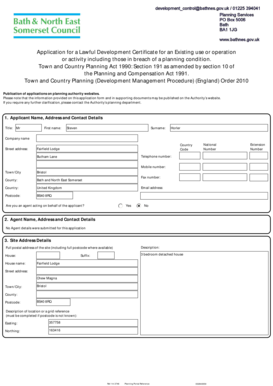

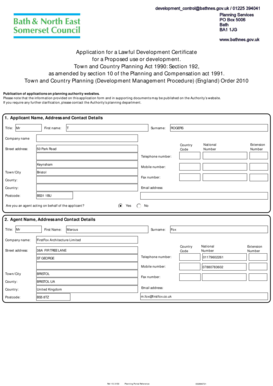

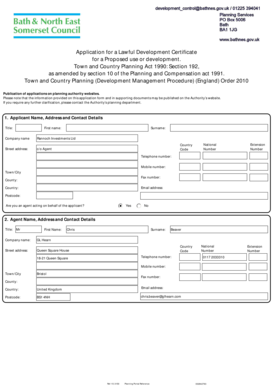

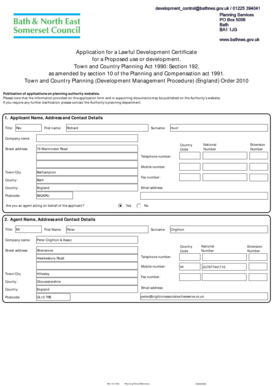

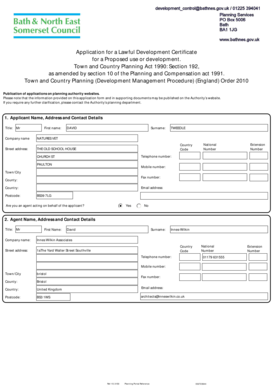

Fill in your personal information, including name, address, and contact details.

04

Provide details about the property eligible for tax abatement, including its address and description.

05

Include financial information, such as the anticipated investment or improvements to be made.

06

Attach any required documentation, such as proof of ownership or financial statements.

07

Review the completed form for accuracy and completeness.

08

Sign and date the agreement at the designated area.

09

Submit the form along with any required attachments to the appropriate tax authority.

Who needs Tax Abatement Agreement?

01

Property owners looking to reduce their tax liability on new development or improvements.

02

Businesses that are expanding and require financial incentives.

03

Investors planning to rehabilitate properties in designated areas.

04

Organizations engaged in affordable housing projects seeking tax relief.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of an abatement?

Abatements are specific types of receipts that are recorded as a reduction to an expenditure that has already been made. Examples of abatements include rebates from vendors for defective or returned merchandise, jury duty and witness fees, refunds from salary overpayments, and property damage or loss recoveries.

What is the tax abatement agreement in Texas?

The local taxing unit then enters into an abatement agreement with an individual or business, abating personal tangible and/or real property up to 100 percent for a period of up to 10 years. Over this 10-year period, the abated properties' values will adjust annually and should increase.

What is the meaning of abatement in a contract?

In contracts, the term is commonly used to describe the reduction of rent, fees, or other payments, often due to specific conditions such as a breach of contract or an unforeseen event that affects the business.

What is the meaning of abate in income tax?

a reduction in the amount of tax that a business would normally have to pay in a particular situation, for example to encourage investment: The development is eligible for a 10-year property tax abatement. Without tax abatement, I will never get the loans to finance the project.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Abatement Agreement?

A Tax Abatement Agreement is a legal contract between a government entity and a property owner or developer that provides for a reduction or elimination of property taxes for a specified period of time in exchange for commitments to invest in or develop property.

Who is required to file Tax Abatement Agreement?

Typically, property owners or developers who seek tax incentives or reductions in property tax assessments for new construction, renovation, or rehabilitation projects are required to file a Tax Abatement Agreement.

How to fill out Tax Abatement Agreement?

To fill out a Tax Abatement Agreement, the applicant must provide detailed information about the property, the proposed project, financial projections, and comply with any specific forms and guidelines set by the relevant government authority.

What is the purpose of Tax Abatement Agreement?

The purpose of a Tax Abatement Agreement is to stimulate economic development by encouraging investment in properties, supporting job creation, and revitalizing certain areas through temporary tax relief for property owners.

What information must be reported on Tax Abatement Agreement?

The information that must be reported typically includes the property owner's or developer's details, project scope, estimated costs, anticipated timelines, benefits expected from the project, and any compliance requirements set by the government.

Fill out your tax abatement agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Abatement Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.