Get the free Response by Commissioner of Massachusetts Department of Revenue to Debtors’ Thirteen...

Show details

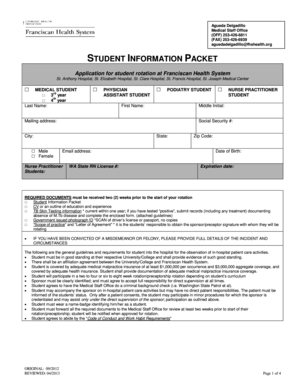

This document is a formal response by the Commissioner of Revenue for Massachusetts, Amy A. Pitter, opposing the Debtors’ Thirteenth Omnibus Objection to Claims related to an unpaid Massachusetts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign response by commissioner of

Edit your response by commissioner of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your response by commissioner of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing response by commissioner of online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit response by commissioner of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out response by commissioner of

How to fill out Response by Commissioner of Massachusetts Department of Revenue to Debtors’ Thirteenth Omnibus Objection to Claims

01

Start by gathering all necessary documentation related to the claims in question.

02

Review the Debtors’ Thirteenth Omnibus Objection to Claims to understand the specific objections raised.

03

Prepare a formal response format consistent with legal requirements.

04

Address each objection individually, providing evidence and rationale for each claim.

05

Include any relevant statutes or regulations that support the claims being defended.

06

Make sure to cite any past decisions or similar cases that may strengthen your position.

07

Review the response for clarity and conciseness before finalizing.

08

Submit the Response by the required deadline, ensuring all parties are notified.

Who needs Response by Commissioner of Massachusetts Department of Revenue to Debtors’ Thirteenth Omnibus Objection to Claims?

01

The Commissioner of the Massachusetts Department of Revenue.

02

Legal teams working on behalf of the state.

03

Creditors or claimants seeking clarifications on their claims.

04

Debtors needing to understand the state's position on eminent tax claims.

Fill

form

: Try Risk Free

People Also Ask about

What is an omnibus objection?

An omnibus objection is an objection that objects to claims filed by different claimants. This Local Rule governs omnibus objections to the extent inconsistent with Fed. R. Bankr.

What is an example of an omnibus claim?

According to the MPEP, an example of an omnibus claim is: “A device substantially as shown and described.” Such claims are rejected under 35 U.S.C. 112(b) or pre-AIA 35 U.S.C. 112, second paragraph, for being indefinite.

What is an omnibus agreement?

A: An Omnibus Agreement (also known as a Master Agreement) is a contract that sets out the general terms and conditions of a business relationship between two or more parties. It is usually a long-term contract that establishes the main principles governing all future agreements between the parties.

What is an offer in compromise Massachusetts?

Offer overview An Offer is an agreement between you and DOR to settle a tax liability for less than the full amount owed. The reasons why DOR might accept an Offer include: You're unable to pay the full liability owed. There is serious doubt as to whether the tax can be collected.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Response by Commissioner of Massachusetts Department of Revenue to Debtors’ Thirteenth Omnibus Objection to Claims?

The Response by the Commissioner of the Massachusetts Department of Revenue to Debtors’ Thirteenth Omnibus Objection to Claims is an official document filed to address and contest specific claims made by debtors in a bankruptcy proceeding. It outlines the Commissioner’s position on the objections raised regarding tax claims against the debtor.

Who is required to file Response by Commissioner of Massachusetts Department of Revenue to Debtors’ Thirteenth Omnibus Objection to Claims?

The Commissioner of the Massachusetts Department of Revenue is required to file the Response to respond to the objections raised by the debtors regarding tax claims. This response is part of the legal process in bankruptcy cases involving tax matters.

How to fill out Response by Commissioner of Massachusetts Department of Revenue to Debtors’ Thirteenth Omnibus Objection to Claims?

To fill out the Response, one must include case details, reference to specific objections made by the debtor, and the Commissioner’s position on each objection. It should be completed in accordance with the legal guidelines and format required by the bankruptcy court.

What is the purpose of Response by Commissioner of Massachusetts Department of Revenue to Debtors’ Thirteenth Omnibus Objection to Claims?

The purpose of this Response is to formally dispute or clarify the debtors' objections against tax claims filed by the Massachusetts Department of Revenue. It allows the state to assert its claims and provide necessary justifications related to tax amounts owed by the debtor.

What information must be reported on Response by Commissioner of Massachusetts Department of Revenue to Debtors’ Thirteenth Omnibus Objection to Claims?

The Response must include details such as the name of the debtor, the specific tax claims being addressed, the grounds for contesting the objections, relevant statutes or case law supporting the claims, and any supporting evidence or documentation that may aid the court in its decision.

Fill out your response by commissioner of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Response By Commissioner Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.