Get the free All DTC-Eligible Securities:

Show details

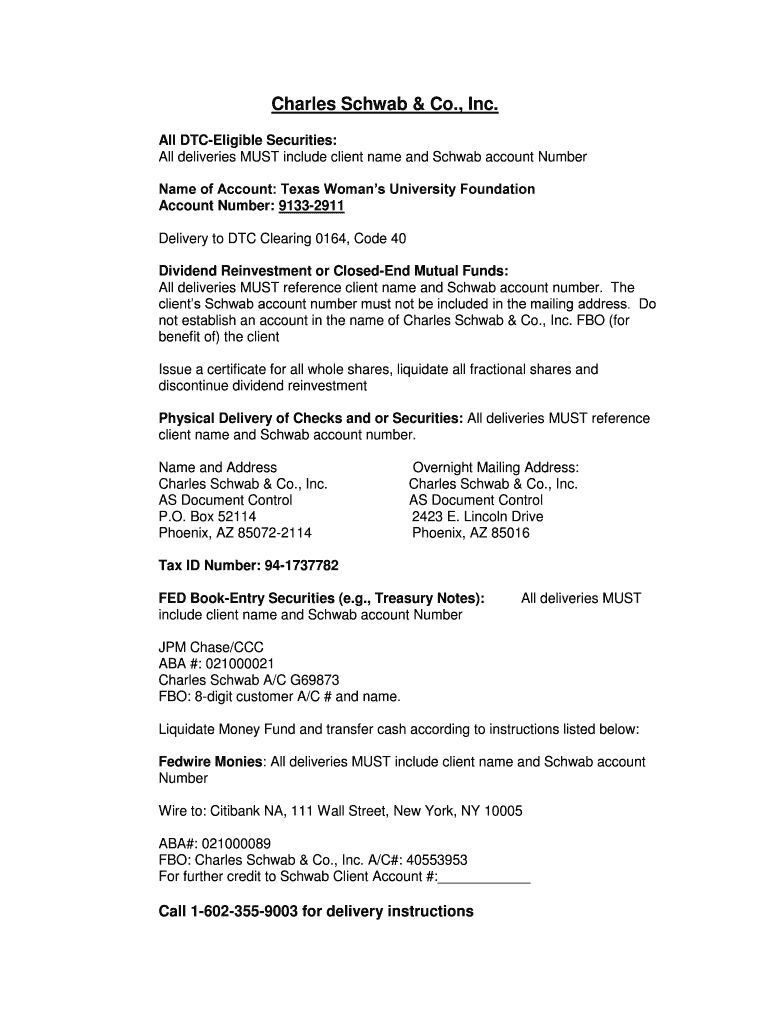

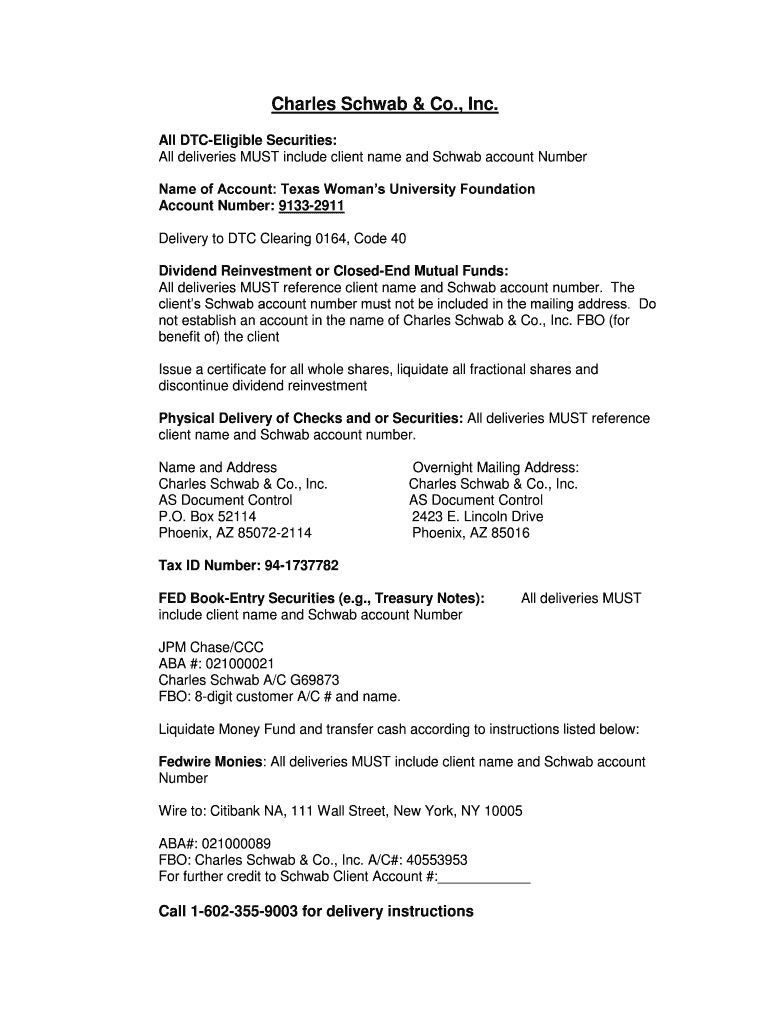

Charles Schwab & Co., Inc. All Eligible Securities: All deliveries MUST include client name and Schwab account Number Name of Account: Texas Women University Foundation Account Number: 91332911 Delivery

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign all dtc-eligible securities

Edit your all dtc-eligible securities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your all dtc-eligible securities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit all dtc-eligible securities online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit all dtc-eligible securities. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out all dtc-eligible securities

How to fill out all DTC-eligible securities:

01

Gather all relevant information: Before filling out the DTC-eligibility application, make sure you have all the necessary information, including the company's legal name, CUSIP number, trading symbol, and contact details for the transfer agent.

02

Complete the application form: Obtain the DTC-eligibility application form from the Depository Trust Company (DTC) and carefully fill it out. Provide accurate and up-to-date information for each section, including the issuer's identification, security details, and any supporting documentation required.

03

Submit the application: Once the application is complete, submit it to the DTC for review. Ensure that all necessary signatures are obtained, and any required fees are paid. You may need to coordinate with the transfer agent or broker-dealer to facilitate the submission process.

04

Wait for approval: After submitting the application, DTC will review the provided information and perform due diligence. The approval process may take several weeks or longer, depending on the complexity of the securities and any outstanding requirements.

05

Maintain compliance: Once the securities are approved and deemed DTC-eligible, it is crucial to maintain compliance with DTC's ongoing requirements. This includes ensuring timely submission of required documentation, keeping the transfer agent information up to date, and complying with any other applicable rules and regulations.

Who needs all DTC-eligible securities:

01

Publicly traded companies: Companies that are publicly traded on exchanges or over-the-counter markets often seek DTC-eligibility for their securities. This allows for efficient electronic clearing and settlement processes, making it easier for investors to trade their securities.

02

Broker-dealers: Broker-dealers play a crucial role in facilitating the trading of securities. To provide their clients with seamless trading experiences, broker-dealers prefer to work with DTC-eligible securities. It reduces administrative burdens and ensures quicker and more secure transactions.

03

Institutional investors: Institutional investors, such as mutual funds, pension funds, and hedge funds, commonly deal with large volumes of securities. By investing in DTC-eligible securities, they can benefit from faster settlement times, improved liquidity, and reduced operational risks.

04

Individual investors: Even individual investors can benefit from investing in DTC-eligible securities. It provides them with greater access to a broader range of investment options and allows for easier and more efficient trading through brokerage accounts.

05

Transfer agents: Transfer agents, responsible for maintaining accurate records of securities ownership, also prefer working with DTC-eligible securities. It streamlines their processes and ensures accurate and efficient transfer of securities between buyers and sellers.

In conclusion, the process of filling out all DTC-eligible securities involves gathering necessary information, completing the application form, submitting it to DTC, waiting for approval, and maintaining compliance. Various entities, including publicly traded companies, broker-dealers, institutional investors, individual investors, and transfer agents, can benefit from holding DTC-eligible securities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send all dtc-eligible securities for eSignature?

Once you are ready to share your all dtc-eligible securities, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete all dtc-eligible securities online?

Easy online all dtc-eligible securities completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make edits in all dtc-eligible securities without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing all dtc-eligible securities and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is all dtc-eligible securities?

All DTC-eligible securities are securities that meet the eligibility requirements set by the Depository Trust Company (DTC) for electronic transfer and trading.

Who is required to file all dtc-eligible securities?

All financial institutions and broker-dealers are required to file all DTC-eligible securities.

How to fill out all dtc-eligible securities?

To fill out all DTC-eligible securities, financial institutions and broker-dealers must provide information such as security details, issuer information, and transfer agent details to the DTC.

What is the purpose of all dtc-eligible securities?

The purpose of all DTC-eligible securities is to facilitate the electronic transfer and trading of securities, making the process more efficient and streamlined.

What information must be reported on all dtc-eligible securities?

Information such as security details, issuer information, and transfer agent details must be reported on all DTC-eligible securities.

Fill out your all dtc-eligible securities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

All Dtc-Eligible Securities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.