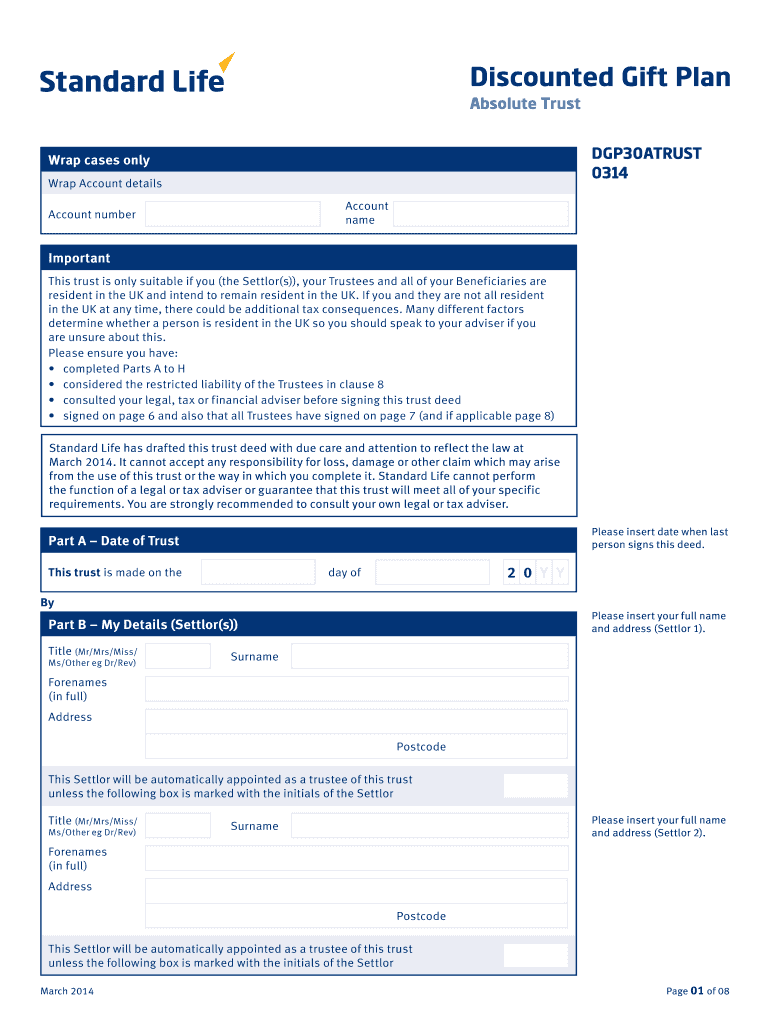

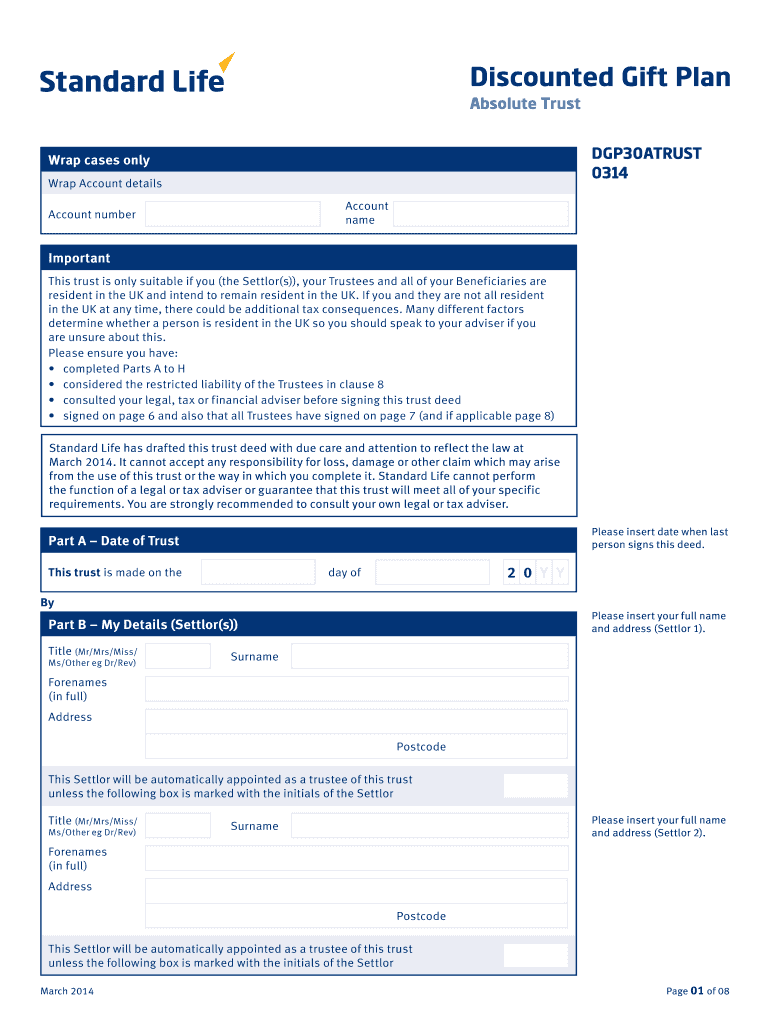

Get the free Discounted Gift Plan Absolute Trust DGP30ATRUST 0314 Wrap cases only Wrap Account de...

Show details

Discounted Gift Plan Absolute Trust DGP30ATRUST 0314 Wrap cases only Wrap Account details Account name Account number Important This trust is only suitable if you (the Settler(s)), your Trustees and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign discounted gift plan absolute

Edit your discounted gift plan absolute form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your discounted gift plan absolute form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit discounted gift plan absolute online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit discounted gift plan absolute. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out discounted gift plan absolute

How to fill out discounted gift plan absolute:

01

Gather all necessary information: Start by collecting all the relevant documents and information required to fill out the discounted gift plan absolute. This may include personal details, financial statements, and any other relevant paperwork.

02

Understand the guidelines: Familiarize yourself with the guidelines and regulations surrounding the discounted gift plan absolute. Make sure you understand the eligibility criteria and any specific requirements for filling out the form.

03

Provide accurate information: Ensure that all the information you enter on the discounted gift plan absolute form is accurate and up to date. Double-check all the personal details, financial figures, and any other necessary information to avoid any mistakes or discrepancies.

04

Seek professional assistance, if needed: If you find the discounted gift plan absolute form complex or if you have any doubts, consider consulting with a financial advisor or estate planning professional. They can provide guidance and assist you in correctly filling out the form.

05

Review and sign the form: After completing the discounted gift plan absolute form, carefully review all the entered information for any errors. Once you are satisfied, sign the form and date it as required.

Who needs discounted gift plan absolute:

01

Individuals interested in estate planning: The discounted gift plan absolute is commonly used in estate planning to help individuals pass on their assets to their beneficiaries while minimizing potential inheritance tax liabilities. Therefore, anyone interested in estate planning or looking to optimize their wealth transfer strategy may consider utilizing this plan.

02

High net worth individuals: The discounted gift plan absolute can be particularly beneficial for high net worth individuals who have sizable assets that may be subject to significant inheritance taxes. By making use of this plan, they can potentially reduce the tax burden on their estates and maximize the amount passed on to their beneficiaries.

03

Individuals aiming for long-term asset protection: Implementing a discounted gift plan absolute can also provide long-term asset protection. By transferring assets into a trust, individuals can safeguard their wealth from potential creditors or other financial risks that may arise in the future.

It is always advisable to consult with a professional advisor or attorney to understand the suitability and implications of a discounted gift plan absolute based on your specific financial situation and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my discounted gift plan absolute directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your discounted gift plan absolute as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I execute discounted gift plan absolute online?

pdfFiller has made it easy to fill out and sign discounted gift plan absolute. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit discounted gift plan absolute straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing discounted gift plan absolute.

What is discounted gift plan absolute?

Discounted gift plan absolute is a tax planning strategy used to transfer assets to future generations at a reduced value for gift tax purposes.

Who is required to file discounted gift plan absolute?

Individuals who are transferring assets using the discounted gift plan absolute are required to file the necessary paperwork with the IRS.

How to fill out discounted gift plan absolute?

To fill out discounted gift plan absolute, individuals need to gather all relevant information about the assets being transferred and accurately report them on the appropriate tax forms.

What is the purpose of discounted gift plan absolute?

The purpose of discounted gift plan absolute is to minimize the gift tax liability for transferring assets to beneficiaries.

What information must be reported on discounted gift plan absolute?

The discounted value of the assets being transferred, the relationship between the donor and the beneficiary, and any other relevant financial information must be reported on discounted gift plan absolute.

Fill out your discounted gift plan absolute online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Discounted Gift Plan Absolute is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.