Get the free SBAs 504 Loan - hightechmauicom

Show details

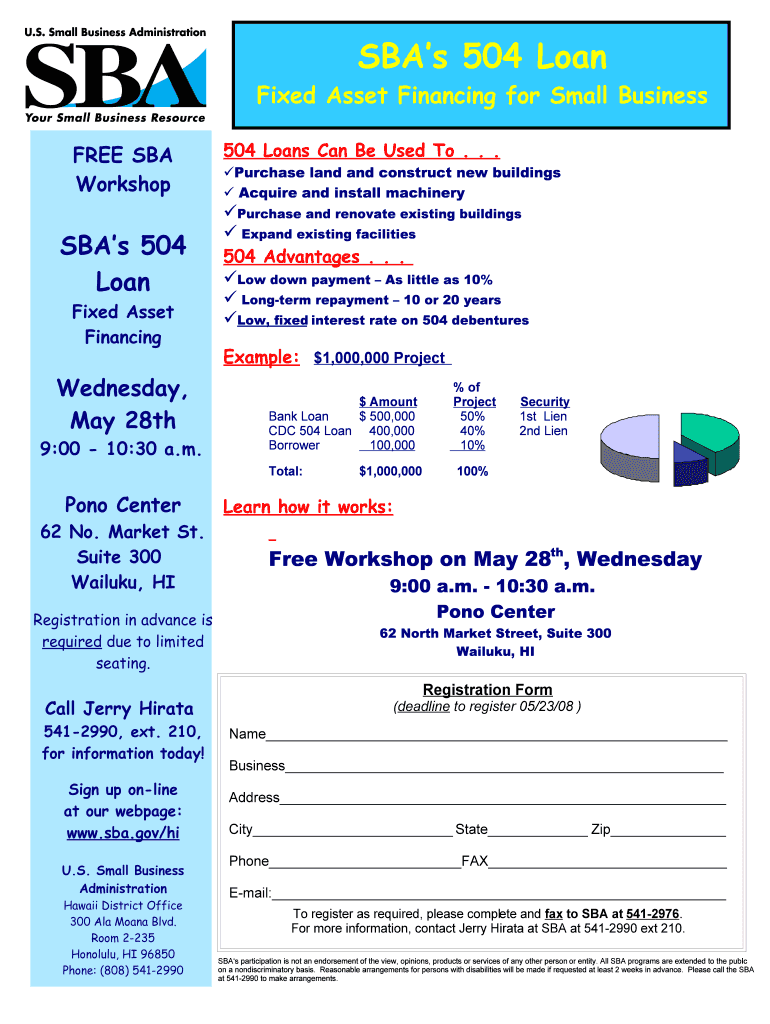

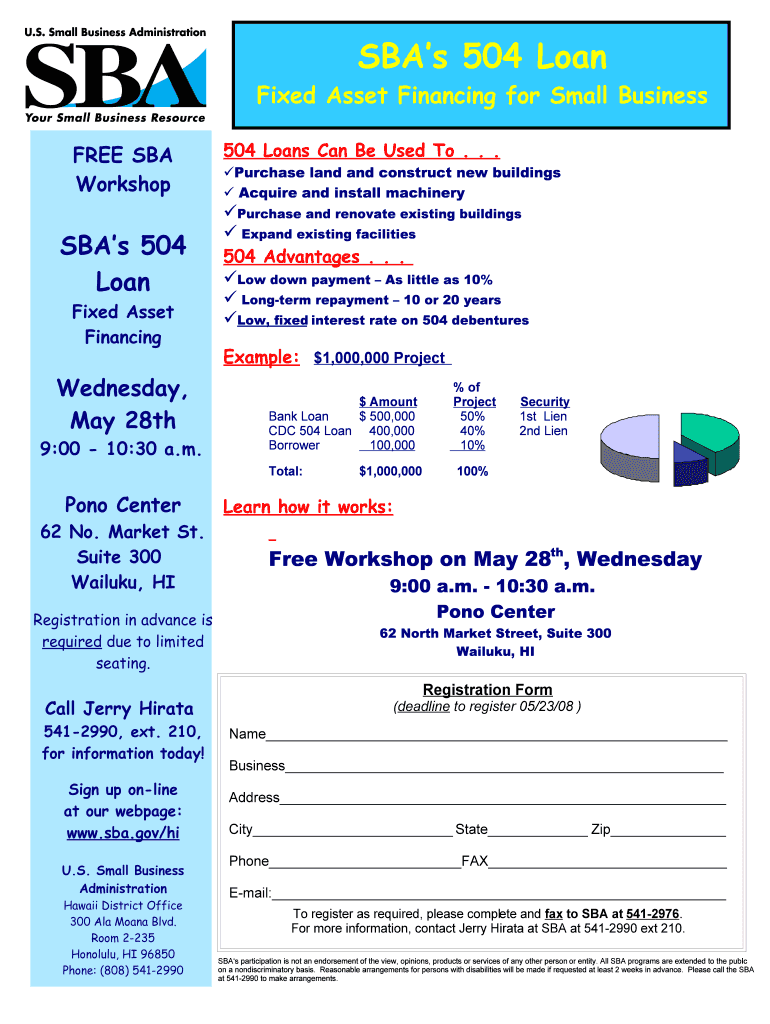

SBA's 504 Loan Fixed Asset Financing for Small Business FREE SBA Workshop SBA's 504 Loan Fixed Asset Financing Wednesday, May 28th 504 Loans Can Be Used To. . . Purchase land and construct new buildings

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sbas 504 loan

Edit your sbas 504 loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sbas 504 loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sbas 504 loan online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sbas 504 loan. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sbas 504 loan

How to fill out sbas 504 loan:

01

Gather all necessary documents: Start by collecting the required paperwork for the SBA's 504 loan application. This includes financial statements, tax returns, a business plan, and other relevant documents. Ensure that all information is accurate and up to date.

02

Find a certified lender: Locate a certified lender that participates in the SBA's 504 loan program. Contact multiple lenders to compare their terms, rates, and requirements. Choose the one that best aligns with your business needs.

03

Complete the loan application: Fill out the loan application form provided by the lender. The application will require information about your business, its financials, and your personal finances. Double-check all entries for accuracy before submitting the application.

04

Prepare a business plan: Develop a comprehensive business plan that outlines your company's goals, strategies, and financial projections. This plan will serve as a blueprint for your business and will be an essential component of the loan application.

05

Provide financial statements: Include your company's financial statements, such as balance sheets, income statements, and cash flow statements. These documents demonstrate your business's financial health and ability to repay the loan.

06

Submit personal tax returns: Prepare and submit your personal tax returns for the past few years. This helps the lender assess your personal financial situation and determine your ability to repay the loan.

07

Obtain an appraisal: As part of the SBA's 504 loan process, you'll need to get an appraisal of the property or assets that will serve as collateral for the loan. Engage a certified appraiser to evaluate the value of the property accurately.

08

Wait for loan approval: After submitting your application and all required documents, the lender will review your case and determine whether to approve or reject the loan. This process may take several weeks, so be patient and prepared for follow-up inquiries.

Who needs sbas 504 loan:

01

Small businesses seeking long-term fixed-rate financing: The SBA 504 loan is designed for small businesses in need of capital to purchase real estate, machinery, or equipment. It offers fixed-rate financing for up to 25 years, making it an attractive option for businesses looking for stability and predictable payments.

02

Businesses looking to expand or modernize: If your business has outgrown its current space, wishes to renovate an existing facility, or needs to invest in new equipment to increase productivity, the SBA's 504 loan can provide the necessary funds.

03

Start-ups and existing businesses: The SBA 504 loan is available to both start-up ventures and existing businesses. However, start-ups may need to provide additional documentation to prove their ability to repay the loan.

04

Businesses lacking sufficient collateral: It can be challenging for small businesses to meet traditional lenders' collateral requirements. The SBA 504 loan offers an alternative solution, allowing businesses to use the assets they are purchasing with the loan as collateral instead. This makes it an accessible option for businesses with limited assets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sbas 504 loan to be eSigned by others?

Once you are ready to share your sbas 504 loan, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I sign the sbas 504 loan electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your sbas 504 loan in minutes.

How can I edit sbas 504 loan on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing sbas 504 loan.

What is sbas 504 loan?

The SBA 504 loan program is a financing option designed to help small businesses purchase fixed assets such as real estate or equipment.

Who is required to file sbas 504 loan?

Small businesses looking to purchase fixed assets may be required to file for an SBA 504 loan.

How to fill out sbas 504 loan?

To fill out an SBA 504 loan application, businesses will need to provide detailed information about their financial history, the project they are seeking funding for, and other relevant details.

What is the purpose of sbas 504 loan?

The purpose of the SBA 504 loan program is to provide small businesses with long-term, fixed-rate financing for the acquisition of fixed assets.

What information must be reported on sbas 504 loan?

Information such as the business's financial history, the project details, the fixed assets being purchased, and other relevant information must be reported on an SBA 504 loan application.

Fill out your sbas 504 loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sbas 504 Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.