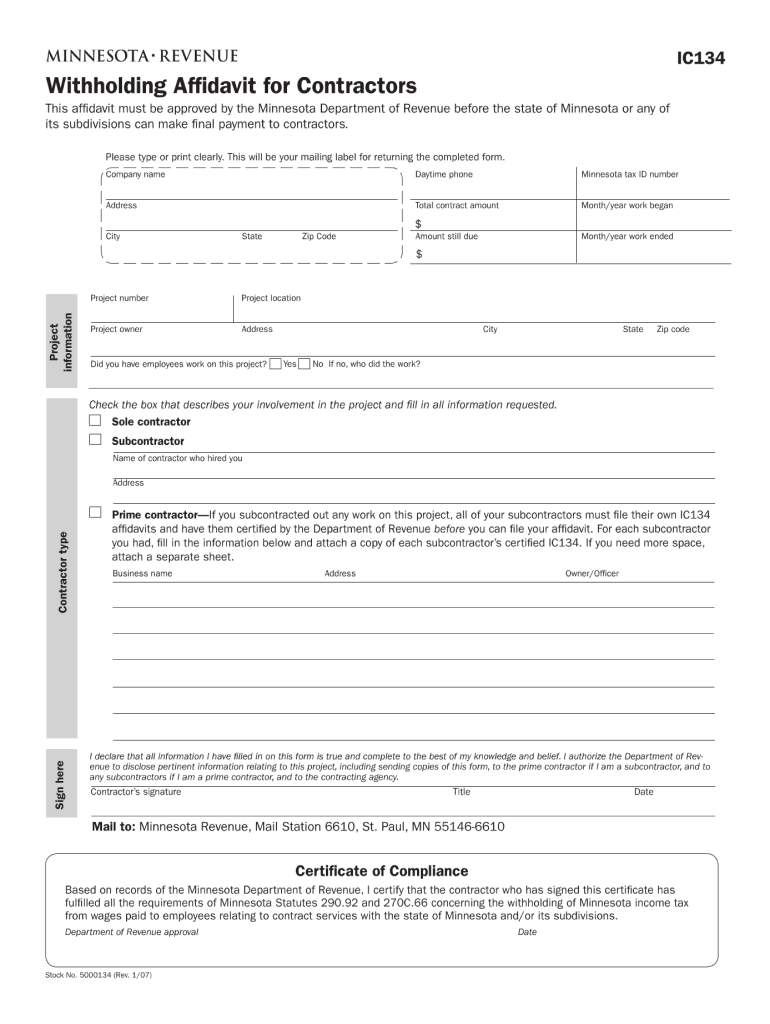

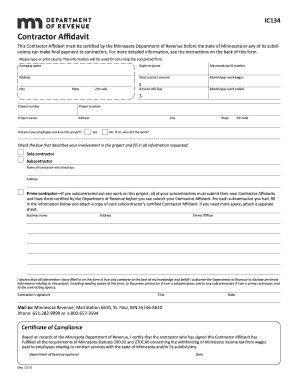

Who needs Form IC134?

A contractor working on a project can get a final payment only after they submit Contractor’s Affidavit. It varies from state to state. Form IC134 is Minnesota Contractor Affidavit designed for contractors working on the project in state of Minnesota or any of its cities, school districts or counties. Form IC134 is issued by the Minnesota Department of Revenue.

What is Form IC134 for?

Contractor’s affidavit aims to show that a contractor has provided necessary supplies to complete the project. It also serves to list the amount of money owed by either of the parties. It means that contractor’s affidavit is a means to get unpaid debt. A contractor receives their final payment only after Minnesota tax withholding requirements are met.

Is Form IC134 accompanied by other forms?

Form IC134 isn’t accompanied by other documents.

When is Form IC134 due?

Form IC134 must be filled out only after the work on the project is finished. If a contractor submits affidavit before the work is completed it will be denied. All subcontractors submit the form when they finish their part of the project. Prime contractors must wait until the entire project is complete and all subcontractors provide their affidavits.

How do I fill out Form IC134?

Form IC134 is a brief document. It contains information about company including its ID, address and name. Contractor is required to provide project details such as its number, owner and location. Additionally, an individual must define which contractor type they belong to. Form IC134 is signed and dated by the contractor.

Where do I send Form IC134?

If you’d like to get immediate response fill out Form IC134 electronically. It can be also mailed to Minnesota Department of Revenue. To get the final payment, send the affidavit to the government.