Get the free Advisory Retirement

Show details

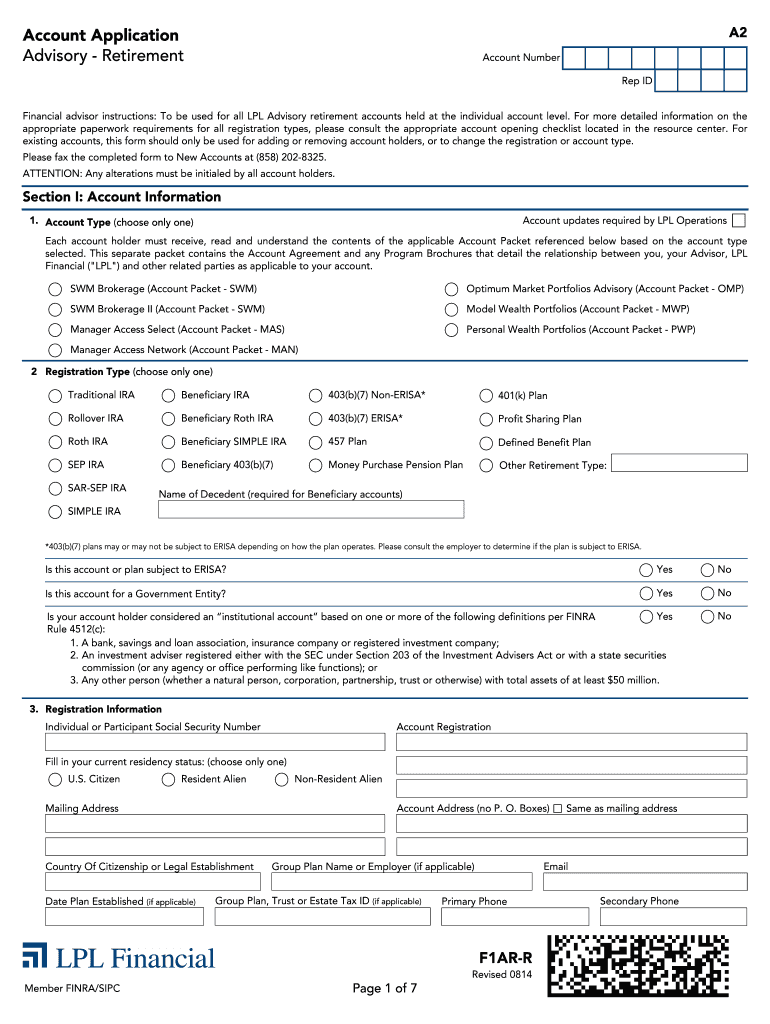

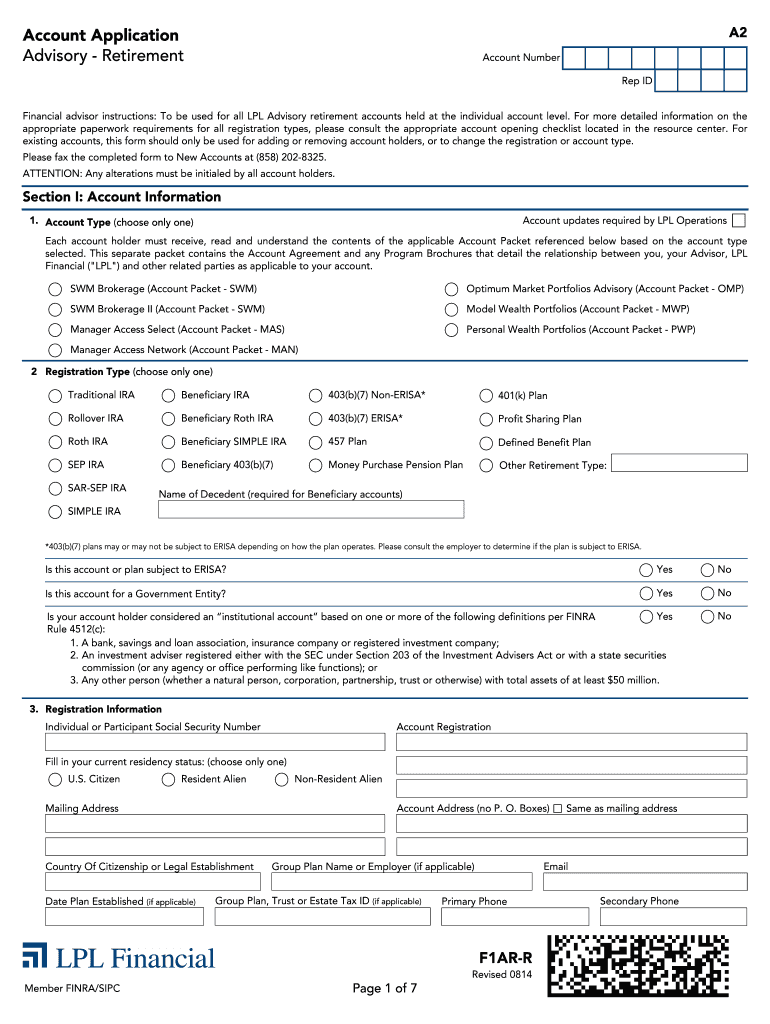

A2 Account Application Advisory Retirement Account Number Rep ID Financial advisor instructions: To be used for all LPL Advisory retirement accounts held at the individual account level. For more

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign advisory retirement

Edit your advisory retirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your advisory retirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing advisory retirement online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit advisory retirement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out advisory retirement

How to fill out advisory retirement:

01

Start by gathering all the necessary documents such as identification, financial statements, and retirement account information.

02

Review the advisory retirement application form carefully, ensuring that you understand all the questions and requirements.

03

Begin by providing your personal information, including your full name, date of birth, address, and contact details.

04

Proceed to the section where you need to disclose your current employment status and any relevant employment history.

05

Provide details about your financial situation, including your income, assets, liabilities, and any other relevant financial information.

06

If applicable, disclose any retirement accounts or pensions you currently have and provide the necessary details for each account.

07

Review any investment options offered by the advisory retirement program and make choices based on your financial goals and risk tolerance.

08

Carefully read through the terms and conditions of the advisory retirement program and provide any additional information or signatures required.

09

Double-check all the information provided in the application form to ensure accuracy and completeness.

10

Submit the completed advisory retirement application form to the designated authority or institution.

Who needs advisory retirement:

01

Individuals who are planning for retirement and are seeking professional guidance and advice in managing their finances.

02

Those who want to have a comprehensive strategy in place to maximize their retirement savings and achieve their financial goals.

03

Individuals who feel overwhelmed or unsure about making investment decisions and would benefit from the expertise of financial advisors.

04

People who would like to stay informed and updated about the latest retirement planning strategies and investment opportunities.

05

Individuals who value professional support in monitoring and adjusting their retirement portfolio to adapt to changing market conditions.

06

Those who want to ensure a secure and comfortable retirement by making educated decisions about their savings and investments.

07

Individuals who may have complex financial situations, such as multiple income sources, assets, or dependents, that require specialized retirement planning.

08

People who want to take advantage of tax-efficient investment strategies and optimize their retirement income.

09

Those who want peace of mind knowing that they have a dedicated advisor to help them navigate through the complexities of retirement planning.

10

Individuals who want to ensure the long-term financial stability and prosperity of themselves and their loved ones during retirement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send advisory retirement to be eSigned by others?

To distribute your advisory retirement, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get advisory retirement?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the advisory retirement in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I sign the advisory retirement electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your advisory retirement in seconds.

What is advisory retirement?

Advisory retirement is a formal process where an individual provides notice of their intention to retire from a certain position or role.

Who is required to file advisory retirement?

Individuals who are planning to retire from a specific position or role are required to file advisory retirement.

How to fill out advisory retirement?

Advisory retirement forms can typically be filled out online or submitted in person to the appropriate department or organization.

What is the purpose of advisory retirement?

The purpose of advisory retirement is to formally notify the relevant parties of an individual's intention to retire from their position.

What information must be reported on advisory retirement?

Advisory retirement forms typically require information such as the individual's name, position, retirement date, and any additional comments or details.

Fill out your advisory retirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Advisory Retirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.