Get the free Fund Balance Report - adots3amazonawscom

Show details

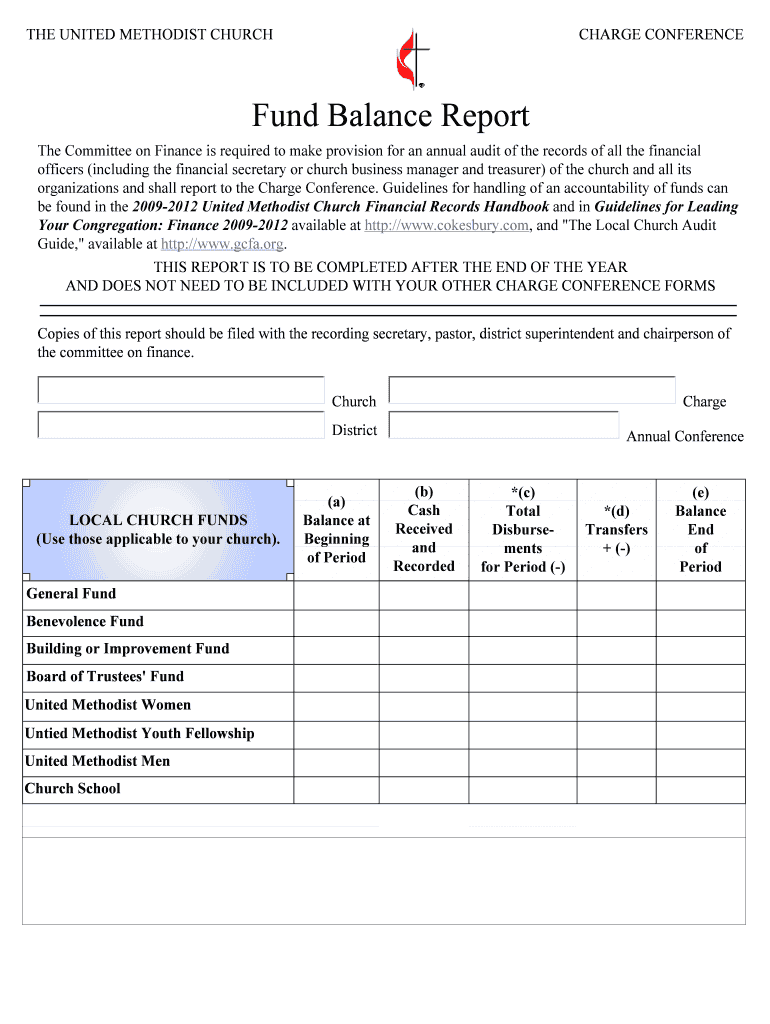

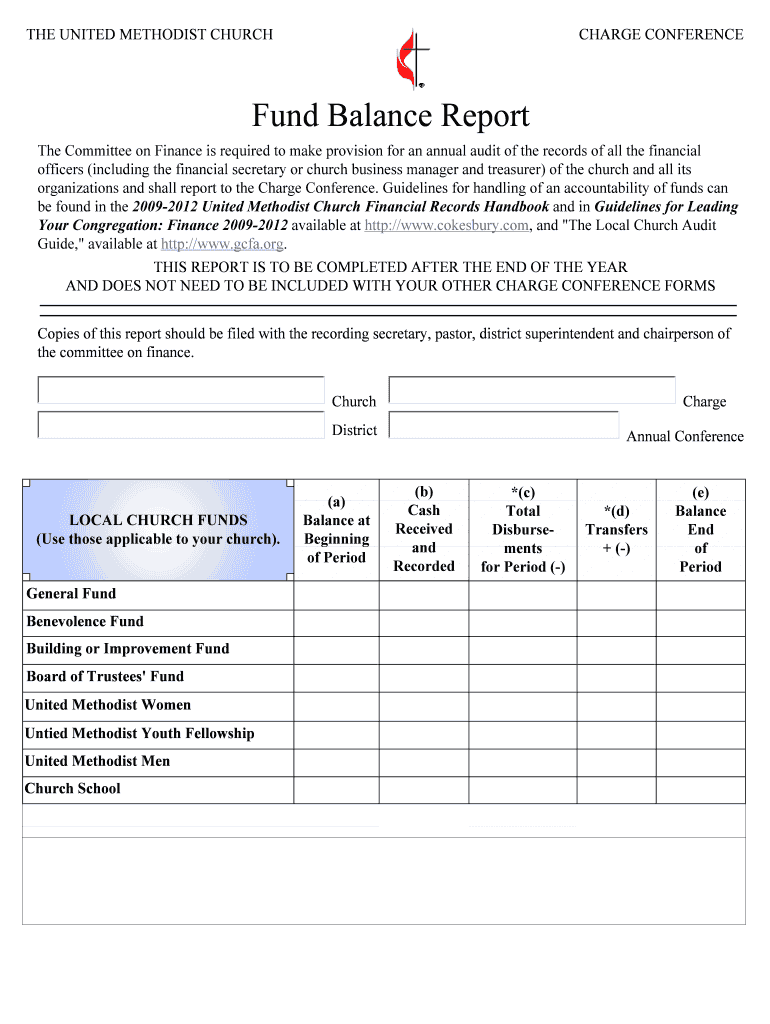

THE UNITED METHODIST CHURCH CHARGE CONFERENCE Fund Balance Report The Committee on Finance is required to make provision for an annual audit of the records of all the financial officers (including

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fund balance report

Edit your fund balance report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fund balance report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fund balance report online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fund balance report. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fund balance report

How to fill out a fund balance report:

01

Begin by gathering all the necessary financial documents and information, including bank statements, invoices, receipts, and any other relevant financial records.

02

Start by entering the opening balance of the fund in the designated section of the report. This should be the amount that was available in the fund at the beginning of the reporting period.

03

Proceed to record any incoming funds or revenues that have been received during the reporting period. This may include donations, grants, or any other sources of income. Make sure to include the dates and amounts for each transaction.

04

Next, document any outgoing funds or expenses that were incurred during the reporting period. This could include expenses for supplies, services, salaries, or any other expenditures related to the operation of the fund. Again, include the dates and amounts for each expense.

05

Calculate the net increase or decrease in the fund balance by subtracting the total expenses from the total revenues. This will provide an indication of whether the fund has grown or decreased in value during the reporting period.

06

Additionally, include any notes or explanations that may be necessary to provide a clear understanding of the financial transactions. For example, if there were any significant one-time expenses or unexpected revenue sources, it is important to provide a detailed explanation.

07

Review the completed fund balance report for accuracy and completeness. Make any necessary adjustments or corrections before finalizing the report.

Who needs a fund balance report:

01

Nonprofit organizations: Nonprofits often rely on fund balance reports to assess their financial health and make strategic decisions. These reports help them understand the resources available and plan for future expenses.

02

Government agencies: Government entities are responsible for managing various funds, and fund balance reports provide crucial information about each fund's financial status. This helps governments allocate resources effectively and make informed budgetary decisions.

03

Grant-making organizations: Fund balance reports assist grant-making organizations in evaluating the financial stability and accountability of potential grantees. These reports help determine if the organization or project is suitable for funding.

In conclusion, filling out a fund balance report requires careful attention to detail and accurate record-keeping. By following the step-by-step process outlined above, organizations can generate a comprehensive and reliable report to assess their financial position. Various entities such as nonprofit organizations, government agencies, and grant-making organizations rely on these reports to make informed decisions and ensure financial accountability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fund balance report in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your fund balance report along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I create an electronic signature for the fund balance report in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your fund balance report in minutes.

How do I edit fund balance report on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as fund balance report. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is fund balance report?

The fund balance report is a financial statement that shows the balances of all funds maintained by an organization.

Who is required to file fund balance report?

Non-profit organizations and government entities are typically required to file a fund balance report.

How to fill out fund balance report?

The fund balance report is typically filled out by the finance department of an organization using financial data and balances from their accounting records.

What is the purpose of fund balance report?

The purpose of the fund balance report is to provide transparency and accountability regarding the financial health of an organization.

What information must be reported on fund balance report?

The fund balance report typically includes the beginning balance, revenues, expenses, and ending balance for each fund.

Fill out your fund balance report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fund Balance Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.