PH FILSCAP Extra Judicial Settlement of Estate 2014 free printable template

Show details

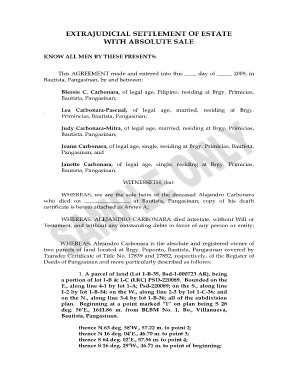

Form No. Sample Deed of Extrajudicial Settlement of Estate DEED OF EXTRAJUDICIAL SETTLEMENT OF ESTATE KNOW ALL MEN BY THESE PRESENTS This DEED made and entered into by and among W I T N E S S E T H THAT WHEREAS died intestate and without will on at WHEREAS at the time of his death he has no personal properties of considerable value except his conjugal share over a real property consisting of a parcel of land located at meters more or less covered by Transfer Certificate of Title No. issued by...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign PH FILSCAP Extra Judicial Settlement of Estate

Edit your PH FILSCAP Extra Judicial Settlement of Estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PH FILSCAP Extra Judicial Settlement of Estate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PH FILSCAP Extra Judicial Settlement of Estate online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PH FILSCAP Extra Judicial Settlement of Estate. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH FILSCAP Extra Judicial Settlement of Estate Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PH FILSCAP Extra Judicial Settlement of Estate

How to fill out PH FILSCAP Extra Judicial Settlement of Estate

01

Title the document as 'Extra Judicial Settlement of Estate'.

02

Provide the names and details of the deceased person, including the date of death.

03

List the names and details of the heirs or beneficiaries.

04

Describe the properties or assets of the deceased clearly, including their location and value.

05

State the manner in which the properties will be divided among the heirs.

06

Include any debts or liabilities that the estate may have.

07

Ensure all heirs sign the document, indicating their agreement.

08

Have the document notarized for legal validation.

Who needs PH FILSCAP Extra Judicial Settlement of Estate?

01

Individuals who are legal heirs to the estate of a deceased person.

02

Heirs who wish to settle the estate without going through a formal probate process.

03

Trustees or administrators managing the estate on behalf of the heirs.

Fill

form

: Try Risk Free

People Also Ask about

What is the prescriptive period of Sec 4 Rule 74?

Section 4, Rule 74 provides for a two year prescriptive period (1) to persons who have participated or taken part or had notice of the extrajudicial partition, and in addition (2) when the provisions of Section 1 of Rule 74 have been strictly complied with, i.e., that all the persons or heirs of the decedent have taken

How to transfer land title if owner is deceased in the Philippines?

The first step is to obtain a copy of the death certificate and the will if there is one. Then, you'll need to go to the local assessor's office to get a tax declaration for the property. Once you have these documents, you can then go to the registry of deeds and register the property in your name.

What is Rule 74 Arizona Rules of the Supreme Court?

Rule 74, Arizona Rules of the Supreme Court, sets forth the requirements for the issuance of certificates of good standing. A certificate of good standing will include any prior discipline imposed, including any transfer to from disability inactive status, in the preceding ten (10) years.

How do I transfer a title with an extra judicial settlement?

Deed of Extrajudicial Settlement of Estate. Deed of Sale (if the property has been sold to a third party)Supporting Documents: BIR CAR/tax clearance certificate. Owner's Duplicate Copy of Title. Realty Tax Clearance. Tax Declaration (Certified Copy) Transfer Tax Receipt/Clearance. Affidavit of Publication of Settlement.

What is required for extra judicial settlement?

Extrajudicial Settlement of the estate can be done if: i) the decedent did not leave a will; (ii) there are no debts (or the debts have been fully paid); and (iii) all of the heirs agree on the manner of the division and distribution of the estate.

What are the requirements for extrajudicial settlement?

For extrajudicial settlement of estate, the following documents must be submitted with the BIR: Notice of Death. Certified true copy of the Death Certificate. Deed of Extra-Judicial Settlement of the Estate. Certified true copy of the land titles involved.

What is Rule 74.01 Missouri?

74.01. (a) Included Matters. "Judgment" as used in these rules includes a decree and any order from which an appeal lies. A judgment is rendered when entered. A judgment is entered when a writing signed by the judge and denominated "judgment" or "decree" is filed.

When can I execute extrajudicial settlement in the Philippines?

Extrajudicial Settlement of the estate can be done if: i) the decedent did not leave a will; (ii) there are no debts (or the debts have been fully paid); and (iii) all of the heirs agree on the manner of the division and distribution of the estate.

What is mo supreme court rule 74?

Rule 74.05 - Entry of Default Judgment (a) Entry of Default Judgment. When a party against whom a judgment for affirmative relief is sought has failed to plead or otherwise defend as provided by these rules, upon proof of damages or entitlement to other relief, a judgment may be entered against the defaulting party.

What are the requirement for extrajudicial settlement of estate?

What are the Requirements for an Extrajudicial Settlement of Estate? Decedent left no will and no debts. The heirs are all of age, or the minors are represented by their judicial or legal representatives duly authorized for the purpose. The Extrajudicial Settlement of Estate is made in a public instrument (notarized).

What is the process of extra judicial settlement in the Philippines?

An Extrajudicial Settlement of Estate is a legal process involving surviving heirs of a deceased person to distribute the deceased person's property. The surviving heirs of the deceased will sign a document called “Deed of Extrajudicial Settlement of Estate”.

How do I get rid of Section 4 Rule 74?

You need to file a petition for Cancellation of Encumbrance under Section 4, Rule 74 of the Rules of Court with the Register of Deeds where the property is located. Note that it is important that the two years have lapsed before the petition must be filed, or else it will be denied.

How does extrajudicial settlement of estate work?

Extrajudicial partition occurs when a deceased estate owner has not named any heirs to the property or if they passed away without a valid will. This is a common procedure in the Philippines and is usually settled outside the court. Since the heirs don't need to go to trial, the estate can be divided among themselves.

How do I execute an extrajudicial settlement in the Philippines?

Register the Deed of Extrajudicial Settlement of Estate with the Register of Deeds where the land is located, simultaneously filing the bond. Publish the Deed of Extrajudicial Settlement of Estate in a newspaper of general circulation once a week for three (3) consecutive weeks.

What is Rule 74.05 Missouri?

“Good cause” and a “meritorious defense” Missouri Supreme Court Rule 74.05(d): (d) When Set Aside. Upon motion stating facts constituting a meritorious defense and for good cause shown, an interlocutory order of default or a default judgment may be set aside.

How long is the validity of extrajudicial settlement?

This bond should be filed simultaneously with the extrajudicial settlement instrument(document). Such bond will answer for the payment of any just claim at any time within two (2) years after the settlement and distribution of an estate.

What is Sec 4 Rule 74 of the Rules of court in the Philippines?

The provision of Section 4, Rule 74 prescribes the procedure to be followed if within two years after an extrajudicial partition or summary distribution is made, an heir or other person appears to have been deprived of his lawful participation in the estate, or some outstanding debts which have not been paid are

How do you remove an annotation from a title?

You need to file a petition for Cancellation of Encumbrance under Section 4, Rule 74 of the Rules of Court with the Register of Deeds where the property is located. Note that it is important that the two years have lapsed before the petition must be filed, or else it will be denied.

What is Rule 74 of the Rules of Court?

Rule 74, Section 1 of the Rules of Court allows the extrajudicial settlement of estate by agreement among the heirs.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit PH FILSCAP Extra Judicial Settlement of Estate from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including PH FILSCAP Extra Judicial Settlement of Estate. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I get PH FILSCAP Extra Judicial Settlement of Estate?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific PH FILSCAP Extra Judicial Settlement of Estate and other forms. Find the template you need and change it using powerful tools.

How can I edit PH FILSCAP Extra Judicial Settlement of Estate on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing PH FILSCAP Extra Judicial Settlement of Estate.

What is PH FILSCAP Extra Judicial Settlement of Estate?

PH FILSCAP Extra Judicial Settlement of Estate is a legal document used in the Philippines to settle the estate of a deceased individual without going through probate court. It allows the heirs to divide the deceased's assets among themselves directly.

Who is required to file PH FILSCAP Extra Judicial Settlement of Estate?

The heirs of the deceased individual are required to file the PH FILSCAP Extra Judicial Settlement of Estate. This typically includes all individuals who are legally recognized as beneficiaries or heirs under Philippine law.

How to fill out PH FILSCAP Extra Judicial Settlement of Estate?

To fill out the PH FILSCAP Extra Judicial Settlement of Estate, heirs must provide details such as the decedent's name, date of death, list of assets, and information about the heirs. Each heir must also sign the document, and it may need to be notarized.

What is the purpose of PH FILSCAP Extra Judicial Settlement of Estate?

The purpose of PH FILSCAP Extra Judicial Settlement of Estate is to provide a straightforward and efficient means for heirs to distribute the deceased's estate without lengthy court proceedings, allowing for a smoother transfer of ownership of assets.

What information must be reported on PH FILSCAP Extra Judicial Settlement of Estate?

The PH FILSCAP Extra Judicial Settlement of Estate must report information including the decedent's full name, date of death, a description of the estate assets, the names and relationships of the heirs, and each heir's consent to the settlement.

Fill out your PH FILSCAP Extra Judicial Settlement of Estate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PH FILSCAP Extra Judicial Settlement Of Estate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.