Get the free INTERSPOUSAL TRANSFER GRANT DEED THE UNDERSIGNED GRANTOR(s) DECLARE(s): DOCUMENTARY ...

Show details

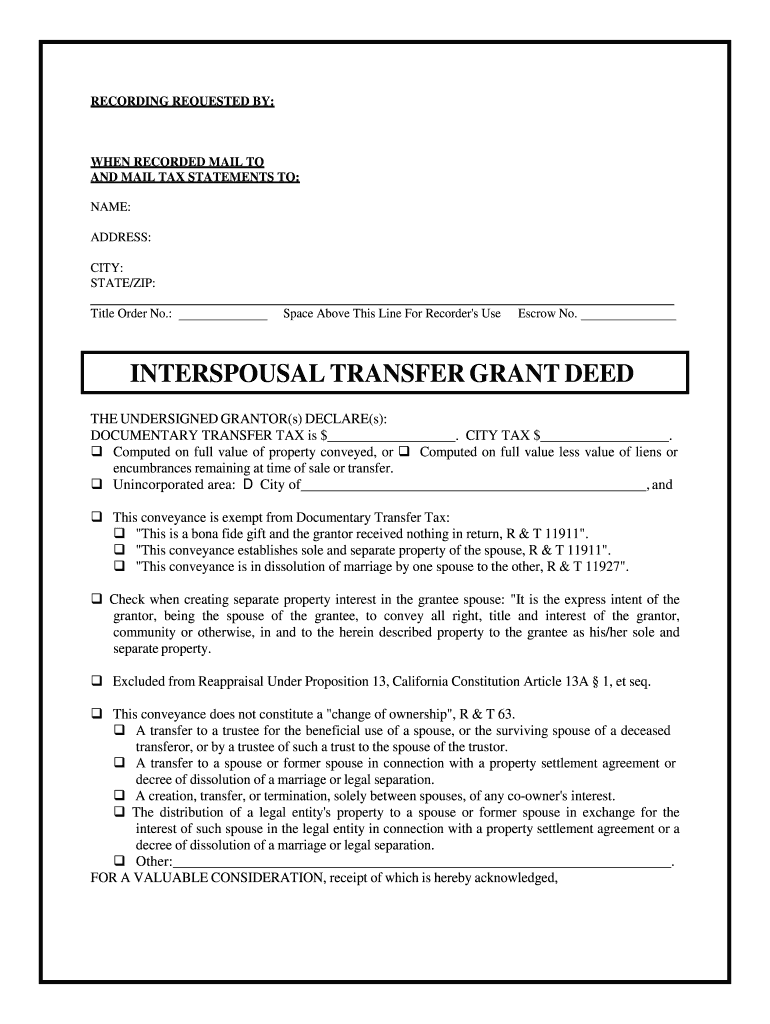

RECORDING REQUESTED BY: WHEN RECORDED MAIL TO AND MAIL TAX STATEMENTS TO: NAME: ADDRESS: CITY: STATE/ZIP: Title Order No.: Space Above This Line For Recorder's Use Escrow No. INTERSEXUAL TRANSFER

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign interspousal transfer grant deed

Edit your interspousal transfer grant deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your interspousal transfer grant deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing interspousal transfer grant deed online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit interspousal transfer grant deed. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out interspousal transfer grant deed

How to fill out interspousal transfer grant deed:

01

Gather the necessary information: Before filling out the interspousal transfer grant deed, you will need to gather relevant information such as the names of both spouses, their marital status, property details, and any outstanding mortgages or liens.

02

Obtain the appropriate form: Contact your local county recorder's office or visit their website to obtain the required interspousal transfer grant deed form. Ensure that you have the most recent and up-to-date version.

03

Identify the property: Clearly identify the property being transferred by providing the legal description, including the county, state, and any official registration numbers if applicable. This information can usually be found in the property's deed or on the county assessor's records.

04

Outline the transfer details: State that the grantor, the spouse transferring the property, is making the transfer to the grantee, the receiving spouse. Include their full names, addresses, and the date of the transfer.

05

Specify the consideration: Mention the consideration, which is typically stated as "love and affection" or for a specific dollar amount if money is involved. If there is a mortgage or lien to be assumed by the grantee, indicate so with the necessary details.

06

Sign and notarize the deed: Both spouses must sign the interspousal transfer grant deed in the presence of a notary public. Ensure that the signatures are clear and consistent with the names mentioned throughout the document.

07

Record the deed: Take the signed and notarized interspousal transfer grant deed to the county recorder's office for recording. Pay any required fees and follow their instructions to complete the recording process. Once recorded, the deed becomes a part of the public record.

Who needs interspousal transfer grant deed:

01

Married couples: The interspousal transfer grant deed is primarily used by married couples who wish to transfer property between themselves without triggering a reassessment of property taxes. It is commonly employed in situations such as divorce, asset settlement, or to adjust property ownership between spouses.

02

Couples owning community property: In community property states, the interspousal transfer grant deed can be used to transfer property that is part of the community property owned jointly by both spouses. This deed helps maintain the community property status of the transferred asset.

03

Spouses looking to add or remove someone from the title: If one spouse wishes to add the other spouse's name to the property title or remove their own name from it, an interspousal transfer grant deed can facilitate the transfer of ownership without incurring tax consequences associated with the transfer.

Note: It is always recommended to consult with a qualified attorney or real estate professional to ensure that you understand the specific requirements and implications of using an interspousal transfer grant deed in your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in interspousal transfer grant deed?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your interspousal transfer grant deed to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for signing my interspousal transfer grant deed in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your interspousal transfer grant deed and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out interspousal transfer grant deed on an Android device?

On Android, use the pdfFiller mobile app to finish your interspousal transfer grant deed. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is interspousal transfer grant deed?

An interspousal transfer grant deed is a legal document used to transfer real property between spouses.

Who is required to file interspousal transfer grant deed?

Spouses who want to transfer ownership of real property between themselves are required to file an interspousal transfer grant deed.

How to fill out interspousal transfer grant deed?

To fill out an interspousal transfer grant deed, you will need to provide information about the property being transferred, the names of the spouses involved, and follow the specific formatting requirements set forth by the state.

What is the purpose of interspousal transfer grant deed?

The purpose of an interspousal transfer grant deed is to facilitate the transfer of property ownership between spouses without the need for a formal sale.

What information must be reported on interspousal transfer grant deed?

The interspousal transfer grant deed must include information about the property being transferred, the names of the spouses involved, and any relevant legal descriptions or encumbrances.

Fill out your interspousal transfer grant deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Interspousal Transfer Grant Deed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.