Get the free Record Breaking Bankruptcy Filings Reported

Show details

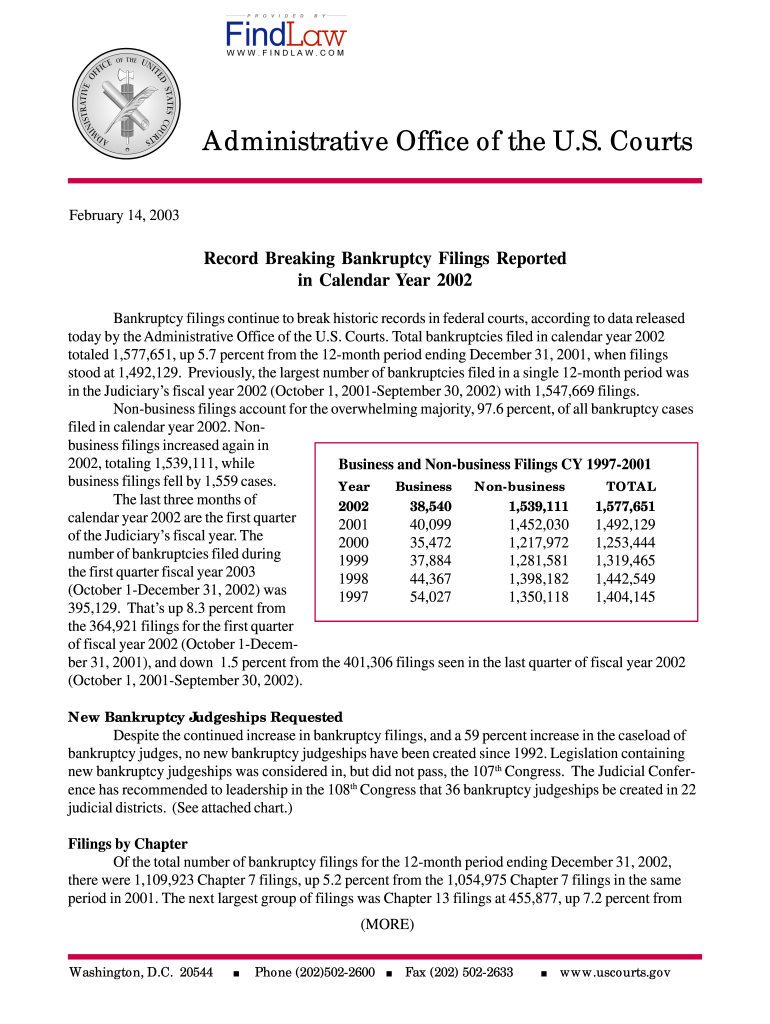

Administrative Office of the U.S. Courts February 14, 2003, Record Breaking Bankruptcy Filings Reported in Calendar Year 2002 Bankruptcy filings continue to break historic records in federal courts,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign record breaking bankruptcy filings

Edit your record breaking bankruptcy filings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your record breaking bankruptcy filings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit record breaking bankruptcy filings online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit record breaking bankruptcy filings. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out record breaking bankruptcy filings

How to fill out record breaking bankruptcy filings:

01

Gather all necessary financial documents, including income statements, bank statements, tax returns, and any other relevant paperwork.

02

Compile a comprehensive list of all debts owed, including outstanding loans, credit card debt, and any other financial obligations.

03

Research the specific bankruptcy laws and regulations in your jurisdiction to ensure compliance and accuracy in your filing.

04

Consult with a bankruptcy attorney or financial advisor to receive professional guidance throughout the process.

05

Complete all required bankruptcy forms accurately and honestly, ensuring that all information provided is thorough and up-to-date.

06

Submit your bankruptcy filing to the appropriate court and pay any necessary fees.

07

Attend any required meetings or hearings related to your bankruptcy case.

08

Follow any additional instructions or requests from the bankruptcy trustee assigned to your case.

09

Provide all requested documentation and cooperate fully with the bankruptcy court to ensure a smooth and successful filing.

10

Continuously monitor your bankruptcy case and stay informed about any updates or changes from the court.

Who needs record breaking bankruptcy filings:

01

Large corporations or businesses facing insurmountable debt and financial crises may opt for record-breaking bankruptcy filings to restructure or liquidate their assets in a structured manner.

02

Individuals with exceedingly high levels of debt that cannot be repaid within a reasonable timeframe may also consider record-breaking bankruptcy filings as a last resort for financial relief.

03

Industries or sectors that have suffered significant setbacks or economic downturns, such as the automotive industry or real estate market, might experience a surge in record-breaking bankruptcy filings as companies struggle to cope with financial challenges.

Fill

form

: Try Risk Free

People Also Ask about

Are bankruptcies increasing 2023?

In the first four months of the year, a total of eight companies listing liabilities over $1 billion filed for bankruptcy. Larger bankruptcy cases are rising in 2023 alongside the broader increase in filings.

What percent of bankruptcies are Chapter 7?

Chapter 7 bankruptcy statistics Just over 288,000 Americans filed Chapter 7 personal bankruptcy in 2021, which accounts for roughly 70% of all personal bankruptcies filed.

What profession files bankruptcy the most?

In 2021, 6,691 US businesses went bankrupt. This marks a significant decrease from the 11,375 filings in 2020 and the 10,056 filings in 2019. The real estate sector had more bankruptcy filings than any other sector of the economy, more than 1,100.

What chapter are 70% of all bankruptcies filed under?

Chapter 7 and Chapter 13 were the most commonly filed bankruptcy petitions, making up roughly 70% of all cases.

What is one of the biggest bankruptcy filings in the history?

As of March 2023, the largest all-time bankruptcy in the United States remained Lehman Brothers. The New York-based investment bank had assets worth 691 billion U.S. dollars when filing for bankruptcy on September 15, 2008.

What is under Chapter 7 and Chapter 11?

The main difference between Chapter 7 and Chapter 11 bankruptcy is that under a Chapter 7 bankruptcy filing, the debtor's assets are sold off to pay the lenders (creditors) whereas in Chapter 11, the debtor negotiates with creditors to alter the terms of the loan without having to liquidate (sell off) assets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send record breaking bankruptcy filings to be eSigned by others?

record breaking bankruptcy filings is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Where do I find record breaking bankruptcy filings?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific record breaking bankruptcy filings and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my record breaking bankruptcy filings in Gmail?

Create your eSignature using pdfFiller and then eSign your record breaking bankruptcy filings immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is record breaking bankruptcy filings?

Record breaking bankruptcy filings refer to the highest number or value of bankruptcies filed within a specific time period.

Who is required to file record breaking bankruptcy filings?

Any individual or business entity that is unable to pay off their debts and seeks protection from creditors through bankruptcy proceedings may be required to file record breaking bankruptcy filings.

How to fill out record breaking bankruptcy filings?

Record breaking bankruptcy filings can be filled out by providing accurate financial information, details of creditors, assets, income, and debts to the bankruptcy court.

What is the purpose of record breaking bankruptcy filings?

The purpose of record breaking bankruptcy filings is to allow individuals or businesses to reorganize their finances, discharge debts, and obtain a fresh start financially.

What information must be reported on record breaking bankruptcy filings?

Information such as total debts, assets, income, expenses, creditors, and any previous bankruptcy filings must be reported on record breaking bankruptcy filings.

Fill out your record breaking bankruptcy filings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Record Breaking Bankruptcy Filings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.