Get the free WAGES AND BENEFITS SCHEDULE - miamidade

Show details

MIA MIDADE COUNTY, FLORIDA RESPONSIBLE WAGES AND BENEFITS SECTION 211.16 OF THE CODE OF MIA MIDADE COUNTY SUPPLEMENTAL GENERAL CONDITIONS WAGES AND BENEFITS SCHEDULE (Construction Type: Highway) Highway

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wages and benefits schedule

Edit your wages and benefits schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wages and benefits schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wages and benefits schedule online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit wages and benefits schedule. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wages and benefits schedule

How to fill out wages and benefits schedule:

01

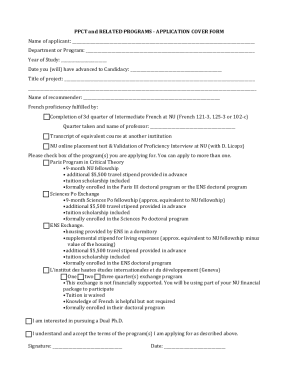

Begin by gathering all relevant information regarding employee wages and benefits. This may include the employee's name, position, hours worked, salary, overtime hours, bonuses, and any additional benefits such as healthcare or retirement plans.

02

Organize the information into appropriate categories or columns within the schedule. For example, you may have separate sections for regular wages, overtime wages, bonuses, and benefits.

03

Fill in the schedule with the specific details for each employee. Ensure accuracy by double-checking all figures and calculations. If you are using a spreadsheet or software, make sure the formulas are correctly set up to automatically calculate totals.

04

Include any necessary notes or explanations for specific entries. For instance, if an employee received a bonus for exceptional performance, you might want to indicate the reason for the bonus in a separate column or note section.

05

Review the completed wages and benefits schedule for any errors or inconsistencies. Cross-reference the information with other relevant documents such as timesheets, pay stubs, or employment contracts to ensure accuracy.

Who needs wages and benefits schedule:

01

Employers: Employers utilize wages and benefits schedules to track and document employee compensation. It helps in ensuring compliance with labor laws and regulations, managing payroll processes accurately, and providing necessary data for financial reporting.

02

Human Resources Departments: HR departments use wages and benefits schedules to maintain records of employee compensation and benefits. This information helps in effectively managing employee contracts, resolving any discrepancies, and ensuring fair and equitable treatment for all employees.

03

Accountants and Bookkeepers: These professionals rely on wages and benefits schedules to accurately record and track payroll expenses, while also ensuring the proper allocation of employee costs to different departments or projects within an organization.

04

Auditors and Regulatory Authorities: Auditors and regulatory bodies may require companies to provide a wages and benefits schedule during audits or inspections. This information helps in verifying compliance with labor laws, tax regulations, and reporting requirements.

In summary, filling out a wages and benefits schedule involves gathering and organizing accurate employee compensation information. This schedule is crucial for employers, HR departments, accountants, auditors, and regulatory authorities to effectively manage payroll, ensure compliance, and maintain accurate financial records.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send wages and benefits schedule for eSignature?

To distribute your wages and benefits schedule, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I sign the wages and benefits schedule electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your wages and benefits schedule in seconds.

How do I edit wages and benefits schedule straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit wages and benefits schedule.

What is wages and benefits schedule?

Wages and benefits schedule is a document that outlines the compensation and benefits given to employees by an organization.

Who is required to file wages and benefits schedule?

Employers are required to file wages and benefits schedule with the relevant authorities.

How to fill out wages and benefits schedule?

Wages and benefits schedule can be filled out by providing detailed information about the wages, bonuses, benefits, and other compensation given to employees.

What is the purpose of wages and benefits schedule?

The purpose of wages and benefits schedule is to report the compensation and benefits provided to employees for tax and regulatory compliance purposes.

What information must be reported on wages and benefits schedule?

Information such as salaries, bonuses, benefits, overtime pay, and other compensation given to employees must be reported on the wages and benefits schedule.

Fill out your wages and benefits schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wages And Benefits Schedule is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.