Get the free of your Checking Account #

Show details

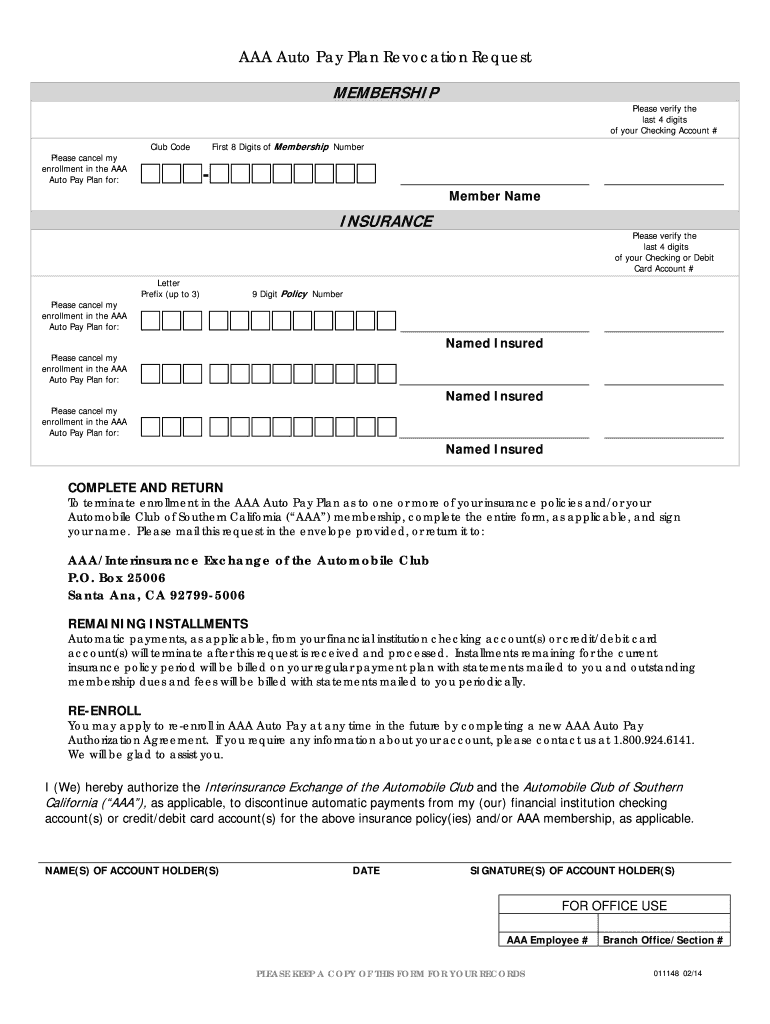

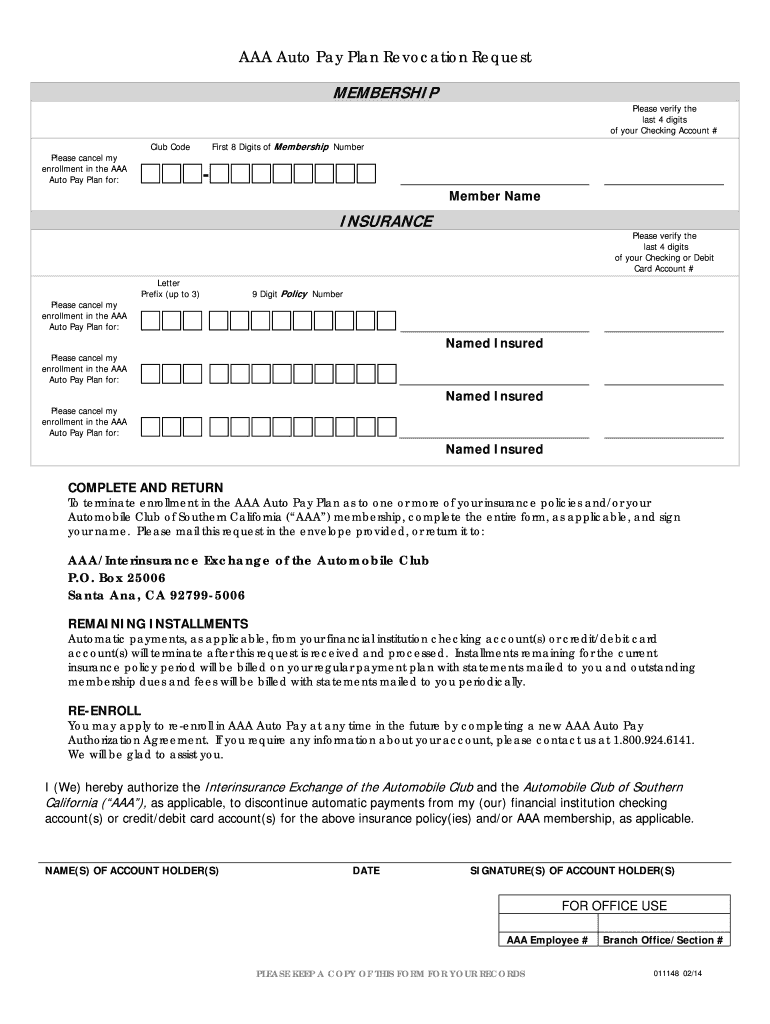

PRINT AAA Auto Pay Plan Revocation Request MEMBERSHIP Please verify the last 4 digits of your Checking Account # Please cancel my enrollment in the AAA Auto Pay Plan for: First 8 Digits of Membership

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign of your checking account

Edit your of your checking account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your of your checking account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit of your checking account online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit of your checking account. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out of your checking account

How to fill out your checking account:

01

Gather your personal identification: Before you can fill out your checking account, you'll need to have your personal identification documents ready. This typically includes your social security number, government-issued identification (such as a driver's license or passport), and proof of address (such as a utility bill or lease agreement).

02

Choose a bank or credit union: Decide on the financial institution where you want to open a checking account. Research different banks and credit unions to find one that suits your needs in terms of fees, services offered, and accessibility.

03

Visit the bank or credit union: Go to the branch location of your chosen institution. Request a meeting with a representative who can assist you in opening a checking account. Alternatively, some banks offer online account opening options that you can access through their website or mobile app.

04

Complete the application form: Fill out the application form provided by the bank or credit union. This form will ask for your personal information, including your name, address, contact details, and employment information. It may also include additional questions related to your financial history or preferences.

05

Provide the necessary documentation: Present your personal identification documents to the bank representative or follow the instructions given for online verification. These documents will be used to verify your identity and ensure you meet the requirements for opening a checking account.

06

Initial deposit: Some banks require an initial deposit to open a checking account. Make sure to check the minimum deposit amount required and be prepared to provide the necessary funds. You can usually make this deposit with cash, check, or a transfer from another account.

07

Review and sign the agreement: Carefully read through the terms and conditions of opening a checking account. This agreement outlines the rights and responsibilities of both the account holder and the financial institution. If you agree with the terms, sign the document to indicate your consent.

Who needs a checking account?

01

Individuals: A checking account is essential for individuals who want a safe and convenient place to manage their everyday finances. It allows for easy depositing of paychecks, writing checks, making electronic transfers, and accessing funds through debit cards.

02

Small Business Owners: Opening a checking account is crucial for small business owners as it provides a separate record-keeping system for business transactions. It allows business owners to separate personal and business finances and easily track expenses, pay bills, and accept customer payments.

03

Students: Checking accounts are often recommended for students as they provide a secure way to receive financial aid refunds, manage allowances or part-time job earnings, and learn responsible financial habits. They also come with the convenience of online banking and mobile apps for easy access to funds.

In summary, filling out a checking account involves gathering your personal identification, choosing a bank, visiting the branch or using an online platform, completing the application form, providing necessary documentation, making an initial deposit, and reviewing and signing the agreement. Checking accounts are needed by individuals, small business owners, and students for various banking and financial management purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my of your checking account in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your of your checking account and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I modify of your checking account without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including of your checking account. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit of your checking account on an iOS device?

Use the pdfFiller mobile app to create, edit, and share of your checking account from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is of your checking account?

A checking account is a bank account that allows deposits and withdrawals. It is typically used for everyday transactions such as paying bills and making purchases.

Who is required to file of your checking account?

Individuals who have a checking account are required to keep track of their transactions and report any income or expenses related to the account.

How to fill out of your checking account?

To fill out your checking account, you should keep a record of all deposits, withdrawals, and other transactions. You can use a check register or online banking system to track your activity.

What is the purpose of of your checking account?

The purpose of a checking account is to provide a convenient way to manage your money and make transactions. It allows you to access your funds easily and pay bills electronically.

What information must be reported on of your checking account?

All income and expenses related to your checking account must be reported, including deposits, withdrawals, and any interest earned.

Fill out your of your checking account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Of Your Checking Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.