Get the free Fannie Mae Loan Performance Data License and Subscription Agreement

Show details

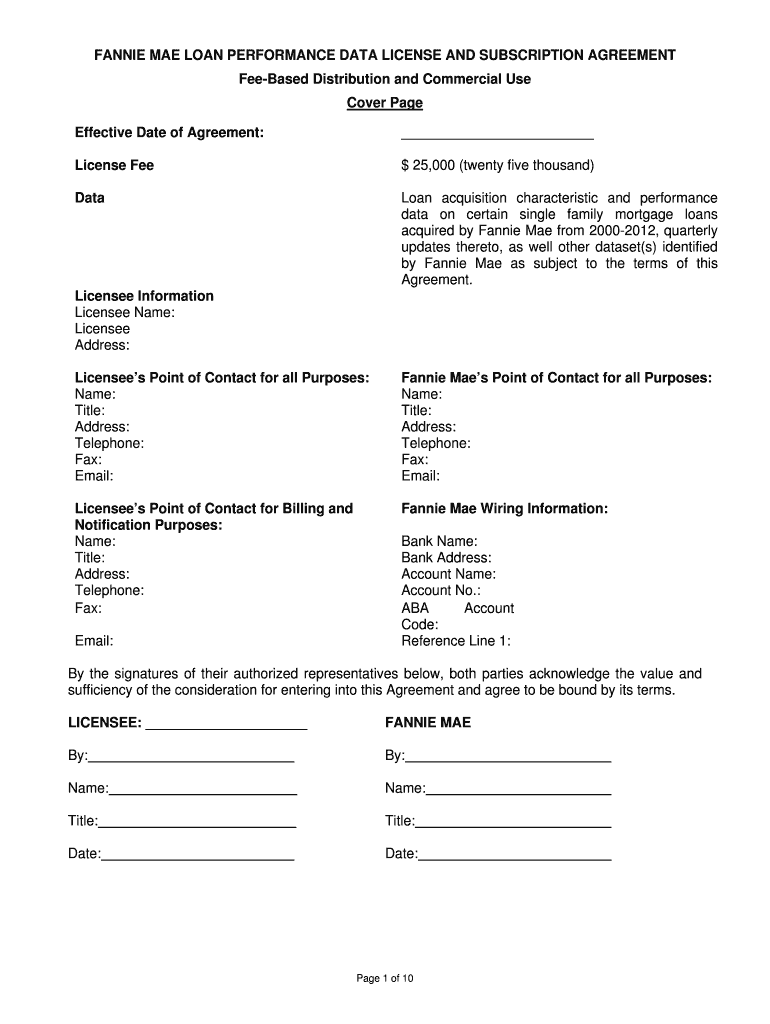

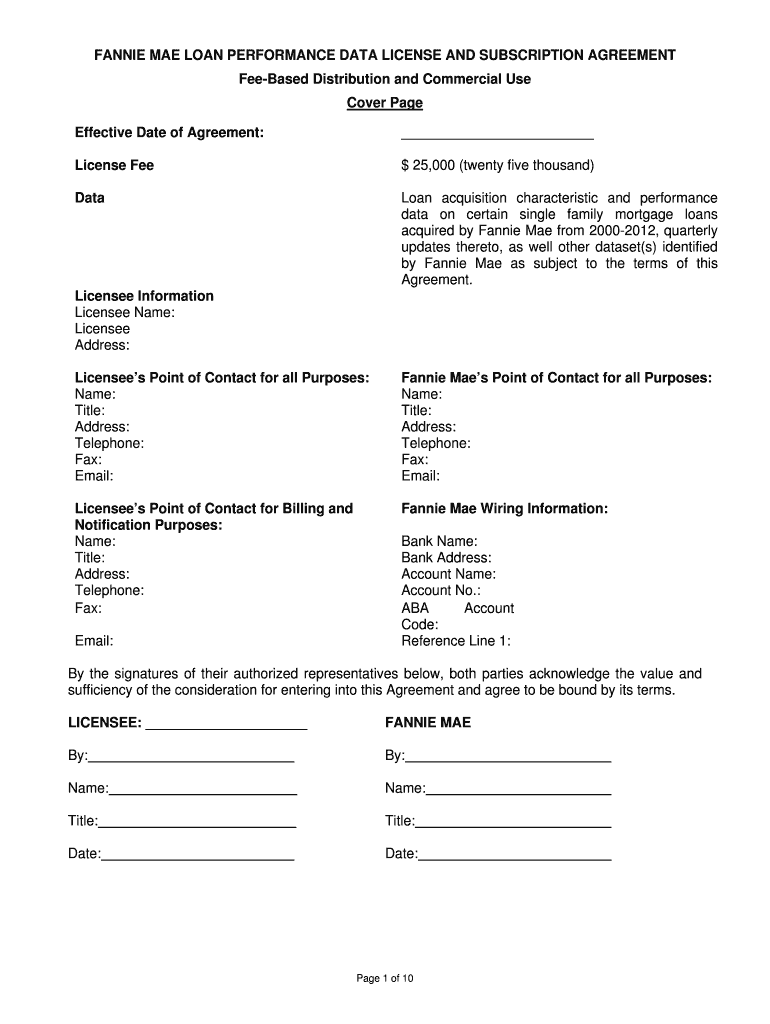

FANNIE MAE LOAN PERFORMANCE DATA LICENSE AND SUBSCRIPTION AGREEMENT Freebased Distribution and Commercial Use Cover Page Effective Date of Agreement: License Fee $25,000 (twenty-five thousand) Data

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fannie mae loan performance

Edit your fannie mae loan performance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fannie mae loan performance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fannie mae loan performance online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fannie mae loan performance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fannie mae loan performance

How to fill out Fannie Mae loan performance:

01

Gather all necessary documents: Before starting the process of filling out Fannie Mae loan performance, ensure you have all the required documents such as loan application, financial statements, credit reports, and any other relevant information.

02

Understand the requirements: Familiarize yourself with the guidelines and requirements set by Fannie Mae for loan performance reporting. This may include specific timeframes, data collection methods, and formatting guidelines.

03

Input loan data: Begin by inputting all relevant loan data into the designated fields. This may include borrower information, loan terms, payment history, delinquency status, etc. Make sure to accurately enter all the information and double-check for any errors.

04

Provide supporting documentation: Attach any supporting documentation required as per Fannie Mae's guidelines. This may include payment receipts, loan modification agreements, foreclosure notices, or any other documents that demonstrate the loan's performance.

05

Include explanations if necessary: In cases where there are unusual circumstances or significant changes in loan performance, provide clear and concise explanations. This helps provide context and clarity to the loan performance report.

06

Review and validate the information: Before finalizing the loan performance report, thoroughly review all the entered information. Look for any inconsistencies, missing data, or errors. Validate the accuracy of the report against the loan's documentation.

07

Submit the report: Once you are confident that the loan performance report is accurately filled out, submit it to Fannie Mae as per their specified method. This may involve uploading the report online, mailing it, or following any other designated submission process.

Who needs Fannie Mae loan performance:

01

Mortgage lenders and servicers: Fannie Mae loan performance is essential for mortgage lenders and servicers as it allows them to assess the performance and repayment history of the loans they have originated or are servicing. It provides insights into the creditworthiness and risk level associated with the loans.

02

Investors and stakeholders: Investors and stakeholders, such as shareholders or bondholders, also require Fannie Mae loan performance information. They use this data to evaluate the financial health and stability of mortgage-backed securities or other financial instruments linked to the loans.

03

Regulators and government agencies: Regulators and government agencies utilize Fannie Mae loan performance data to monitor the overall health and stability of the housing market. It helps them identify trends, assess risk, and make informed policy decisions related to housing finance.

04

Researchers and analysts: Researchers and analysts in the real estate and housing finance industry utilize Fannie Mae loan performance data for various research purposes. They may analyze loan trends, default rates, foreclosure rates, and other performance metrics to gain insights into the industry and make informed forecasts.

05

Borrowers and homeowners: While not a direct need, borrowers and homeowners indirectly benefit from Fannie Mae loan performance reporting. The availability of comprehensive loan performance data contributes to the transparency and stability of the mortgage market, which can influence interest rates, lending practices, and overall affordability for borrowers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find fannie mae loan performance?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific fannie mae loan performance and other forms. Find the template you need and change it using powerful tools.

How do I make changes in fannie mae loan performance?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your fannie mae loan performance to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit fannie mae loan performance in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing fannie mae loan performance and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is fannie mae loan performance?

Fannie Mae loan performance refers to the measurement of how well loans owned or guaranteed by Fannie Mae are performing in terms of repayment and overall financial health.

Who is required to file fannie mae loan performance?

Lenders and servicers who have loans owned or guaranteed by Fannie Mae are required to file loan performance data with Fannie Mae.

How to fill out fannie mae loan performance?

Filling out Fannie Mae loan performance involves submitting accurate data on loan repayment status, delinquencies, defaults, modifications, and other relevant information.

What is the purpose of fannie mae loan performance?

The purpose of Fannie Mae loan performance data is to track and analyze the repayment trends of loans in order to assess risk, make informed decisions, and improve overall loan performance.

What information must be reported on fannie mae loan performance?

Information such as loan status, delinquency rates, default rates, modifications, forbearance, and other relevant loan performance metrics must be reported on Fannie Mae loan performance.

Fill out your fannie mae loan performance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fannie Mae Loan Performance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.