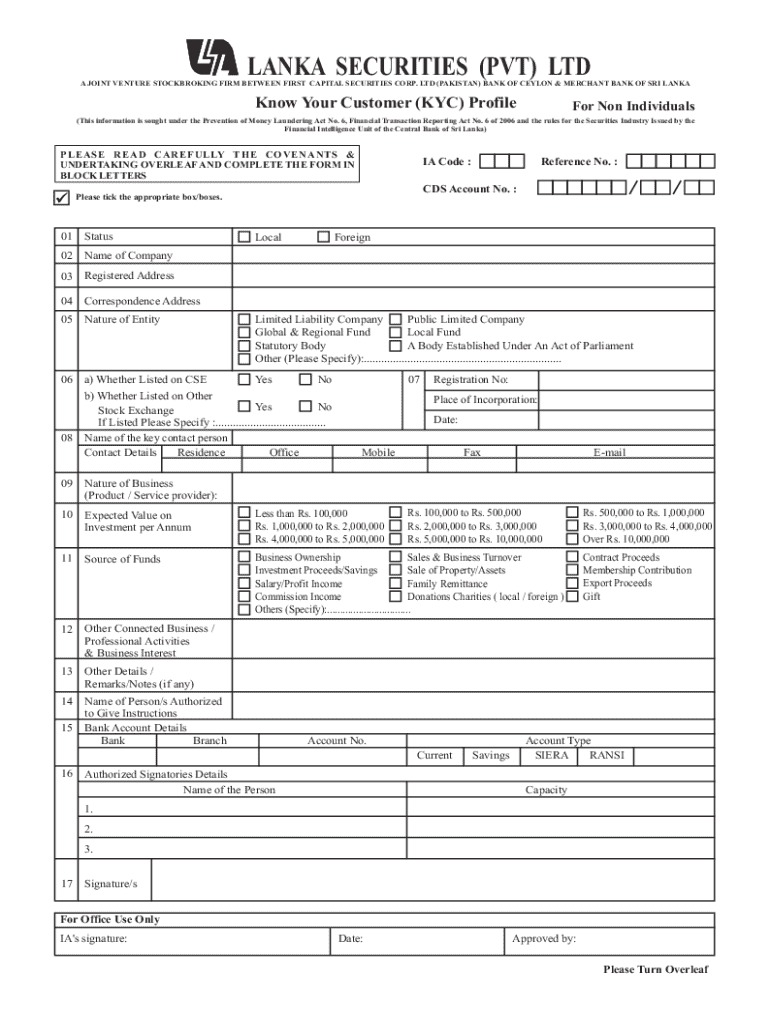

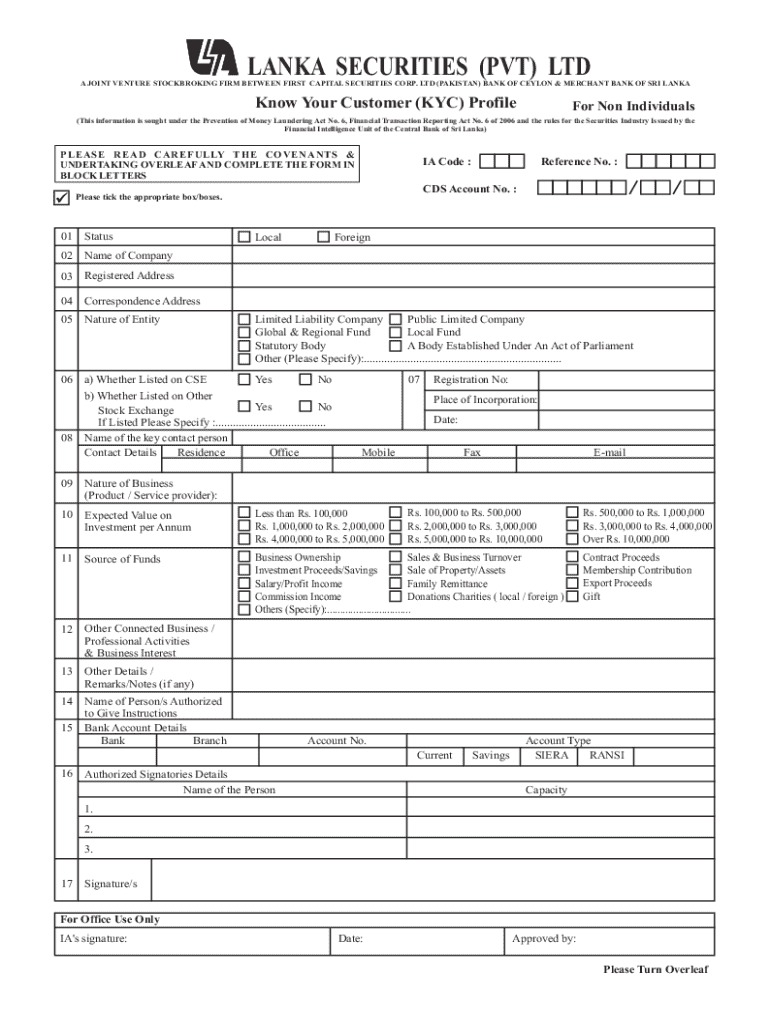

Get the free Know Your Customer (kyc) Profile for Non Individuals

Get, Create, Make and Sign know your customer kyc

Editing know your customer kyc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out know your customer kyc

How to fill out know your customer kyc

Who needs know your customer kyc?

Know Your Customer (KYC) Form: A Comprehensive Guide

Understanding know your customer (KYC)

Know Your Customer (KYC) refers to the process by which organizations, typically in the finance sector, verify the identities of their clients. This practice is crucial in preventing potential fraud and ensuring compliance with legal regulations.

Historically, KYC regulations emerged in response to increasing instances of financial crime, including money laundering and terrorist financing. Over the years, global financial authorities have implemented stricter guidelines to safeguard financial institutions and their clientele.

In today's regulatory landscape, effective KYC practices are not just advisable but mandatory, playing a pivotal role in bolstering an organization's integrity and reputation. As governments enforce stricter regulations, the implementation of KYC processes becomes essential for maintaining compliance and generating trust.

Why KYC is essential for organizations

KYC is integral to organizations for several compelling reasons. First and foremost, regulatory compliance is critical in avoiding legal penalties. Organizations must adhere to local and international laws governing identity verification.

Moreover, effective KYC procedures can significantly reduce the likelihood of fraud, thereby protecting the financial and reputational standing of an organization.

Key components of the KYC process

The KYC process comprises several essential components aimed at thoroughly verifying customer identities and assessing potential risks. The primary elements include:

Types of KYC documents

When completing a know your customer (KYC) form, customers are typically required to provide specific types of documentation for verification purposes. These documents can generally be categorized into three main groups:

By ensuring the correct documentation is provided, organizations can bolster their KYC processes, ensuring compliance while reducing the risk of financial misconduct.

The role of eKYC in digital transformation

Electronic Know Your Customer (eKYC) is an innovative adaptation of traditional KYC processes, leveraging technology to streamline identity verification. eKYC systems allow organizations to verify customer identities online without the need for physical document submissions.

The primary benefits of digital KYC processes include enhanced efficiency, improved customer experience, and reduced operational costs. As organizations increasingly integrate digital transformation strategies, eKYC fits seamlessly into these developments, providing quick and secure customer onboarding.

Legal frameworks supporting eKYC implementation are evolving rapidly. Countries are tailoring their regulations to accommodate electronic processes, enabling organizations to comply effortlessly while adopting emerging technologies.

Innovative approaches to KYC verification

As financial fraud evolves, innovative approaches to KYC verification are essential. Organizations are adopting advanced techniques to enhance the security and reliability of their verification processes. Notable methods include:

These innovative approaches not only boost security but also enhance the overall customer experience by expediting the KYC process.

Common challenges in the KYC process

Despite its importance, the KYC process is not without challenges. Organizations frequently encounter obstacles that can hinder efficiency and effectiveness. Common challenges include:

Addressing these challenges requires organizations to adopt a proactive approach, employing technology and best practices to enhance their KYC procedures.

Best practices for filling out the KYC form

Successfully completing a know your customer (KYC) form entails attention to detail and thoroughness. To ensure accuracy and compliance, individuals should follow these best practices when filling out KYC forms:

By adhering to these practices, individuals can facilitate a smoother KYC process and avoid unnecessary complications.

Using pdfFiller for your KYC form needs

pdfFiller offers a robust solution for efficiently managing the know your customer (KYC) form process. With pdfFiller, users can utilize advanced features like editing, eSigning, and collaboration capabilities.

The platform facilitates user collaboration on KYC forms through team features, allowing teams to seamlessly edit and review documents together.

Moreover, pdfFiller's cloud-based solution provides access to KYC forms anytime, anywhere, ensuring a smooth and efficient KYC process.

The future of KYC: Trends to watch

The landscape of KYC is continuously evolving, with various trends signaling significant changes. Key trends to monitor include:

Staying informed on these trends will help organizations remain competitive and maintain compliance in the evolving KYC landscape.

Interactive tools for effective KYC management

Utilizing interactive tools significantly enhances KYC management, and platforms like pdfFiller offer a suite of features designed for efficient form management. Interactive tools allow for:

By leveraging these interactive tools, organizations can ensure compliance while improving the efficiency of their KYC processes.

Ensuring compliance and security in your KYC procedures

Ensuring compliance and security in KYC procedures is paramount for any organization aiming to maintain its integrity and reputation. Organizations must stay updated with Anti-Money Laundering (AML) and KYC regulations, following guidelines rigorously.

Implementing internal compliance training is necessary for all employees to familiarize them with KYC processes and the importance of adherence to regulations. pdfFiller offers robust security features that protect sensitive KYC data, ensuring organizations can confidently manage their documentation.

Maintaining high security standards in KYC procedures not only protects the organization but also builds trust with clients, assuring them their data is secure.

Overcoming KYC hurdles with a single vendor approach

Implementing a unified vendor approach for KYC processes offers numerous advantages. This method streamlines operations, reduces costs, and enhances resource management significantly.

This comprehensive approach not only enhances organizational efficiency but also ensures higher compliance rates, making it essential for modern organizations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit know your customer kyc online?

Can I create an electronic signature for the know your customer kyc in Chrome?

How do I edit know your customer kyc straight from my smartphone?

What is know your customer kyc?

Who is required to file know your customer kyc?

How to fill out know your customer kyc?

What is the purpose of know your customer kyc?

What information must be reported on know your customer kyc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.