Get the free freddie mac vs fannie mae

Show details

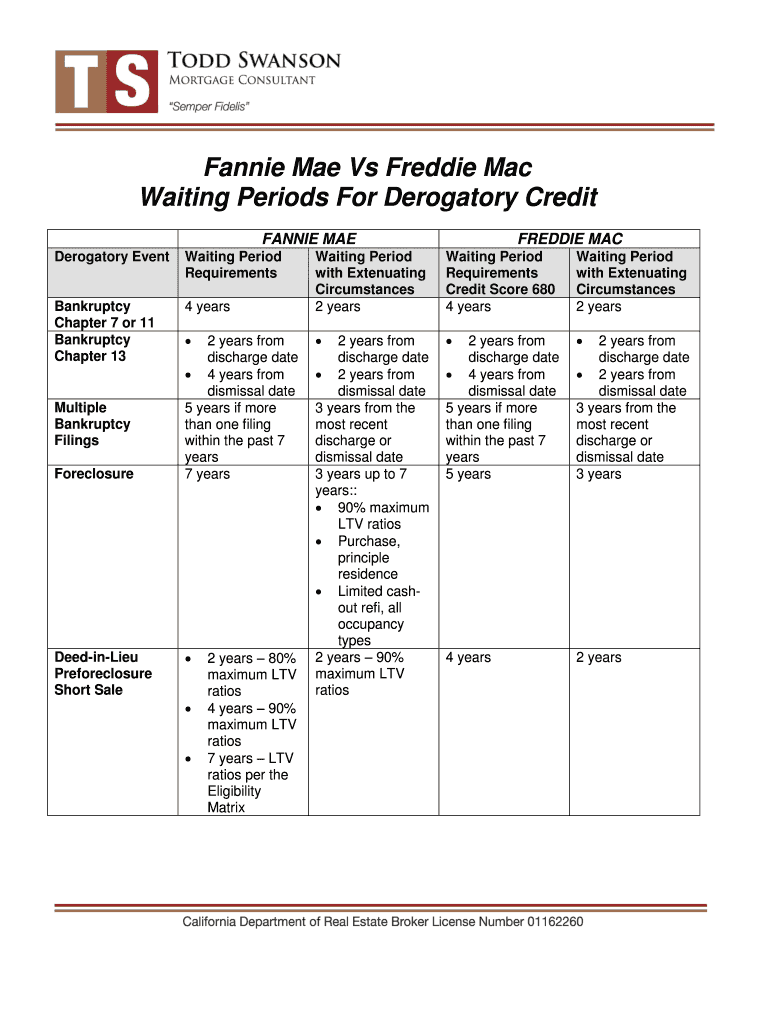

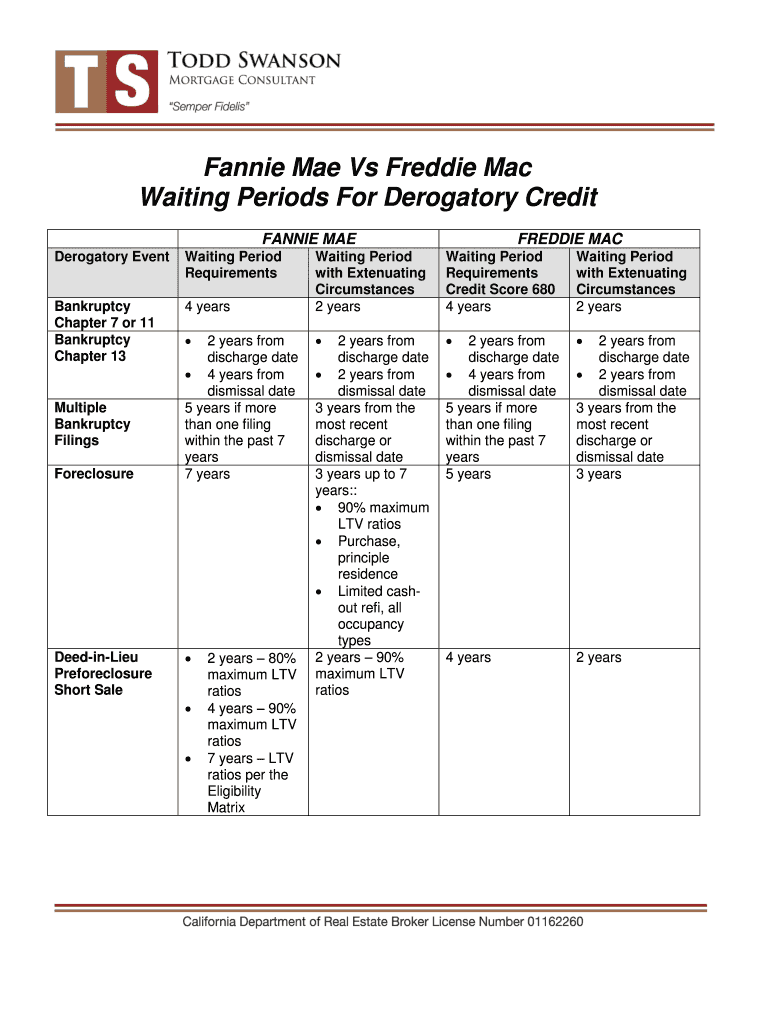

Fannie Mae Vs Freddie Mac Waiting Periods For Derogatory Credit FANNIE MAE Derogatory Eventuating Period RequirementsBankruptcy Chapter 7 or 11 Bankruptcy Chapter 13Multiple Bankruptcy Filings ForeclosureDeedinLieu

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign freddie mac vs fannie

Edit your freddie mac vs fannie form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your freddie mac vs fannie form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit freddie mac vs fannie online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit freddie mac vs fannie. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out freddie mac vs fannie

How to Fill out Fannie Mae vs. Freddie?

01

Gather all necessary documentation: Before filling out either Fannie Mae or Freddie Mac forms, it's important to gather all the required documentation. This may include personal identification documents, proof of income, tax returns, employment history, and other relevant financial information.

02

Familiarize yourself with the specific form: Both Fannie Mae and Freddie Mac have different forms that need to be filled out depending on the purpose. Take the time to understand the purpose of the form you need to fill out and read the instructions carefully.

03

Provide accurate information: Accuracy is crucial when filling out Fannie Mae or Freddie Mac forms. Double-check all the information you enter, ensuring that personal details, financial figures, and other pertinent data are accurate.

04

Take note of any deadlines: Pay attention to any deadlines associated with filling out Fannie Mae or Freddie Mac forms. Missing deadlines may result in delays or complications with the process.

05

Seek professional assistance if needed: Filling out Fannie Mae or Freddie Mac forms can be complex, especially for individuals who are unfamiliar with the process. If you are unsure or find it challenging to complete the forms, consider seeking assistance from professionals such as mortgage brokers or housing counselors who specialize in working with these entities.

Who needs Fannie Mae vs. Freddie?

01

Homebuyers: Both Fannie Mae and Freddie Mac play a critical role in the homeownership process. Homebuyers looking for mortgage options often engage with these entities for financing their homes.

02

Lenders: Fannie Mae and Freddie Mac provide liquidity to lenders by purchasing mortgages from them, allowing lenders to free up their capital and issue more loans to borrowers.

03

Investors: Investors, such as banks, financial institutions, and individual investors, can invest in securities tied to Fannie Mae or Freddie Mac to generate income and diversify their investment portfolios.

04

Housing counselors: Housing counselors play a crucial role in assisting individuals and families in navigating the mortgage process, including understanding the options available through Fannie Mae and Freddie Mac. They provide guidance and advice to ensure borrowers make informed decisions.

05

Government agencies: Fannie Mae and Freddie Mac are regulated by government agencies such as the Federal Housing Finance Agency (FHFA), which oversees their operations and ensures they comply with applicable regulations. Government agencies play a significant role in monitoring the activities of these entities to ensure the stability of the housing market.

Overall, Fannie Mae and Freddie Mac are essential players in the mortgage industry, benefiting various stakeholders such as homebuyers, lenders, investors, housing counselors, and government agencies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my freddie mac vs fannie directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign freddie mac vs fannie and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an electronic signature for signing my freddie mac vs fannie in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your freddie mac vs fannie and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit freddie mac vs fannie straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing freddie mac vs fannie.

What is fannie mae vs freddie?

Fannie Mae and Freddie Mac are government-sponsored enterprises that play a key role in the U.S. housing finance system by purchasing mortgages from lenders, packaging them as securities, and selling them to investors.

Who is required to file fannie mae vs freddie?

Lenders and institutions that originate or service mortgages are required to file reports to Fannie Mae and Freddie Mac.

How to fill out fannie mae vs freddie?

To fill out Fannie Mae and Freddie Mac reports, lenders and institutions must provide detailed information about the mortgages they originate or service.

What is the purpose of fannie mae vs freddie?

The purpose of Fannie Mae and Freddie Mac is to provide liquidity to the mortgage market, making it easier for lenders to provide home loans to borrowers.

What information must be reported on fannie mae vs freddie?

Information such as loan origination details, borrower information, loan terms, and performance data must be reported on Fannie Mae and Freddie Mac filings.

Fill out your freddie mac vs fannie online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Freddie Mac Vs Fannie is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.