Get the free Irrevocable standby letter of credit This letter of credit can replace all or part o...

Show details

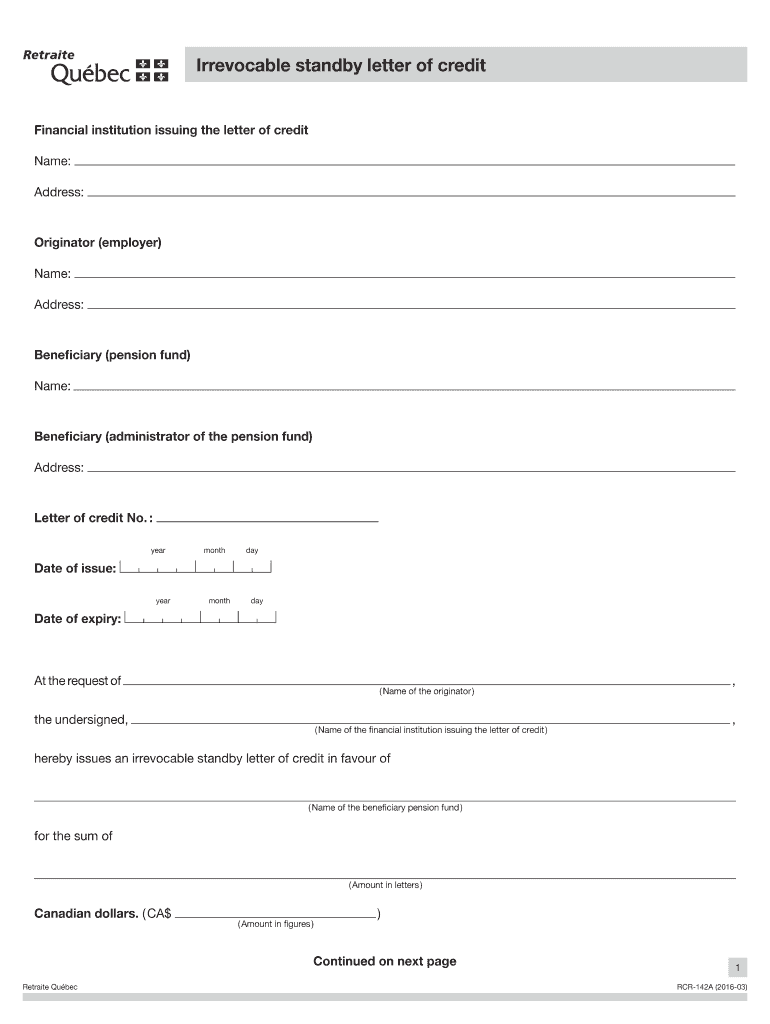

Irrevocable standby letter of credit Financial institution issuing the letter of credit Name: Address: Originator (employer) Name: Address: Beneficiary (pension fund) Name: Beneficiary (administrator

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irrevocable standby letter of

Edit your irrevocable standby letter of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irrevocable standby letter of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irrevocable standby letter of online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit irrevocable standby letter of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irrevocable standby letter of

How to fill out an irrevocable standby letter of credit (ISL)?

01

Start by gathering the necessary information and documentation. This may include details about the beneficiary (the party who will receive payment), the applicant (the party requesting the letter of credit), and any specific instructions or terms that need to be included.

02

Write the opening paragraph, which typically includes the applicant's request for the issuance of an ISL, the desired amount, the expiration date, and any specific conditions or requirements.

03

Specify the beneficiary and their contact information in the next section. Include their name, address, and any additional details needed for identification.

04

Clearly state the purpose of the ISL. This can vary depending on the specific situation, such as guaranteeing payment for goods or services, acting as a performance bond, or securing a loan or credit facility.

05

Outline the terms and conditions of the ISL. This includes defining any performance requirements, declaration of the documents necessary for the drawing or payment, and the confirmation that the ISL will only be automatically drawn upon the beneficiary's written demand.

06

Specify the expiry date of the ISL. This is the date until which the letter of credit will remain valid and can be drawn upon.

07

Indicate the rules governing the ISL, such as the applicable laws, jurisdiction, and any arbitration clauses.

08

Include any additional instructions or remarks that are relevant to the specific transaction or agreement.

09

Finally, review the completed letter of credit thoroughly for accuracy, ensuring all necessary information is provided and any special instructions are clearly stated.

Who needs an irrevocable standby letter of credit?

01

Importers or exporters involved in international trade may require an ISL to mitigate risks during the process of shipping and receiving goods. It can provide assurance to the exporter that they will receive payment, even if the importer fails to pay.

02

Suppliers and contractors who want to ensure they will be compensated for their work may request an ISL as a form of guarantee or security for fulfilling their contractual obligations.

03

Banks or lenders may require an ISL as collateral for extending credit or providing financing to individuals or businesses.

04

Government institutions or agencies may utilize ISLs to guarantee payment for public infrastructure projects or procurements.

05

Any party involved in a transaction where a level of financial security or assurance is needed may consider using an ISL as a means of protecting their interests.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete irrevocable standby letter of online?

With pdfFiller, you may easily complete and sign irrevocable standby letter of online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make edits in irrevocable standby letter of without leaving Chrome?

irrevocable standby letter of can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I complete irrevocable standby letter of on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your irrevocable standby letter of from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is irrevocable standby letter of?

An irrevocable standby letter of credit is a guarantee issued by a bank on behalf of a client, ensuring payment will be made under specified conditions.

Who is required to file irrevocable standby letter of?

The party requesting the letter of credit is required to file an irrevocable standby letter of credit.

How to fill out irrevocable standby letter of?

To fill out an irrevocable standby letter of credit, the issuer must include specific terms and conditions, beneficiary details, and any necessary supporting documentation.

What is the purpose of irrevocable standby letter of?

The purpose of an irrevocable standby letter of credit is to provide assurance of payment to the beneficiary in the event that the applicant fails to fulfill their obligations.

What information must be reported on irrevocable standby letter of?

The irrevocable standby letter of credit must include details about the parties involved, the terms and conditions of the credit, expiry dates, and beneficiary information.

Fill out your irrevocable standby letter of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irrevocable Standby Letter Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.