Get the free Selective Invoice Finance - fnb co

Show details

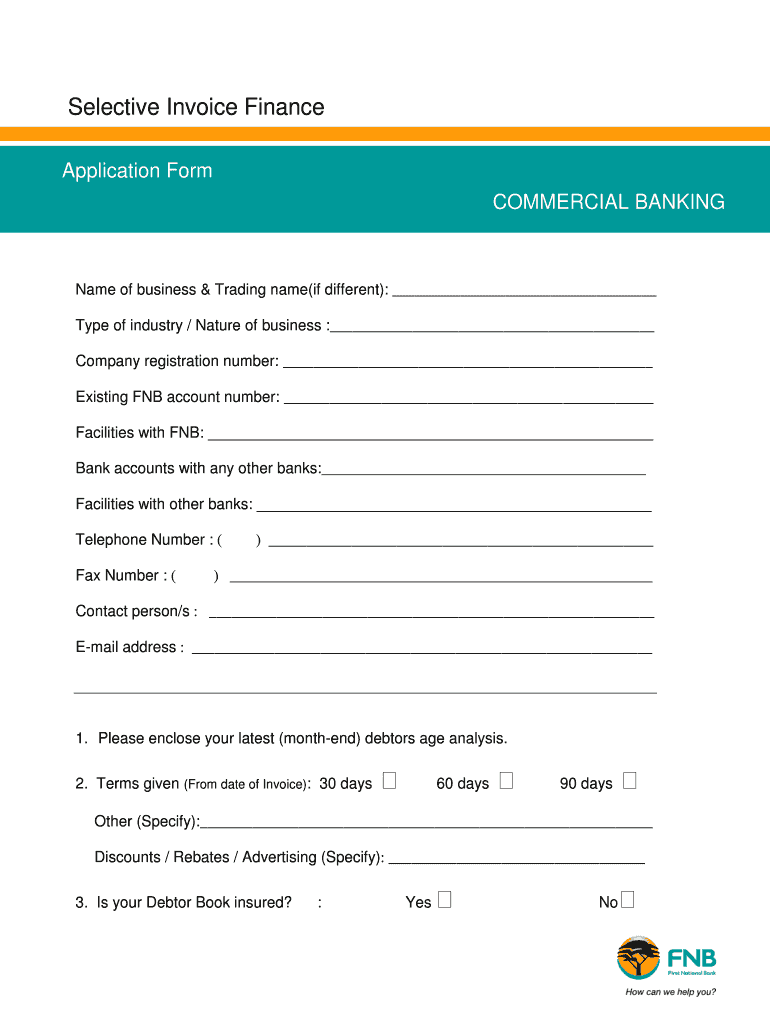

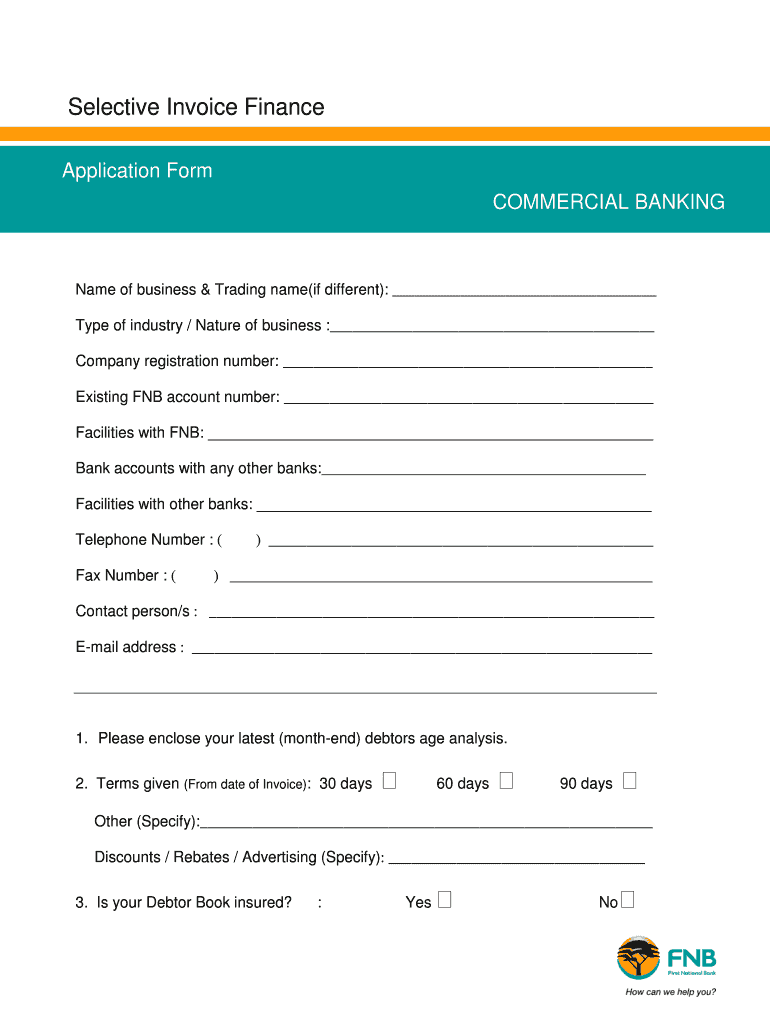

Selective Invoice Finance Application Form COMMERCIAL BANKING Name of business & Trading name(if different): Type of industry / Nature of business : Company registration number: Existing FNB account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign selective invoice finance

Edit your selective invoice finance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your selective invoice finance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing selective invoice finance online

To use the professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit selective invoice finance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out selective invoice finance

How to fill out selective invoice finance:

01

Start by gathering all the necessary information regarding the specific invoice you want to finance. This includes the client's details, invoice amount, payment terms, and due date.

02

Contact a selective invoice finance provider and submit your application. They will require you to provide details about your business, such as your company's financial history, turnover, and creditworthiness.

03

Once your application is approved, work with the finance provider to determine the percentage of the invoice you want to finance. This can range from 80% to 95% of the total invoice amount.

04

Provide the necessary documentation to the finance provider, which typically includes a copy of the invoice, proof of delivery or completion of services, and any relevant contracts or agreements.

05

The finance provider will evaluate the creditworthiness of the invoice debtor and may request additional supporting documents.

06

After the evaluation process, the finance provider will advance the agreed percentage of the invoice's value to your business account.

07

You should then inform your customer of the assignment of the invoice to the finance provider and provide them with the updated payment instructions.

08

When the customer pays the invoice, they will send the payment directly to the finance provider.

09

The finance provider will deduct their fees and any outstanding balance, and the remaining funds will be transferred to your business account.

10

Ensure timely repayment of the advanced amount to the finance provider as per the agreed terms.

Who needs selective invoice finance?

01

Small and medium-sized businesses that experience cash flow issues due to long payment terms from their clients can benefit from selective invoice finance.

02

Startups or businesses in their early stages that lack substantial assets or a strong credit history can access immediate funds by financing individual invoices.

03

Companies that have seasonal fluctuations in their cash flow can use selective invoice finance to bridge the gap between payment delays.

04

Businesses looking to avoid taking on additional debt or sacrificing equity in their company can utilize selective invoice finance as an alternative funding option.

05

Industries with long payment cycles, such as manufacturing or construction, can leverage selective invoice finance to access liquidity tied up in unpaid invoices while awaiting customer payments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my selective invoice finance directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your selective invoice finance and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make changes in selective invoice finance?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your selective invoice finance to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit selective invoice finance straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing selective invoice finance.

What is selective invoice finance?

Selective invoice finance is a type of financing where a business can sell single invoices or invoice batches to a third party to receive immediate funding.

Who is required to file selective invoice finance?

Businesses looking to improve their cash flow by selling their invoices to a third-party finance company.

How to fill out selective invoice finance?

To fill out selective invoice finance, businesses need to provide details of the invoice(s) they wish to sell and agree on the terms and conditions of the financing arrangement.

What is the purpose of selective invoice finance?

The purpose of selective invoice finance is to provide businesses with immediate funding by selling their invoices, helping them improve their cash flow.

What information must be reported on selective invoice finance?

Selective invoice finance requires details of the invoice(s) being sold, the amount to be funded, and the terms of the financing agreement.

Fill out your selective invoice finance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Selective Invoice Finance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.