Get the free VARIABLE RATE MORTGAGE ENDORSEMENT

Show details

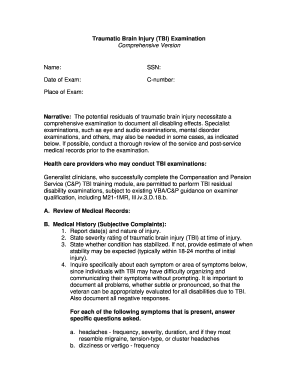

This document is an endorsement issued by First American Title Insurance Company for a variable rate mortgage, ensuring against certain losses related to changes in interest rates and the conversion

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign variable rate mortgage endorsement

Edit your variable rate mortgage endorsement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your variable rate mortgage endorsement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit variable rate mortgage endorsement online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit variable rate mortgage endorsement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out variable rate mortgage endorsement

How to fill out VARIABLE RATE MORTGAGE ENDORSEMENT

01

Review the mortgage agreement to understand the terms.

02

Locate the endorsement section in the document.

03

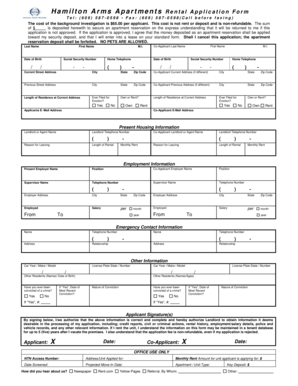

Fill in personal information, including name, address, and mortgage account number.

04

Specify the variable interest rate details, including how it will be adjusted.

05

Indicate any applicable index or benchmark for rate adjustments.

06

Include the date the endorsement will take effect.

07

Sign and date the endorsement to confirm acceptance.

08

Submit the completed endorsement to your lender for processing.

Who needs VARIABLE RATE MORTGAGE ENDORSEMENT?

01

Homeowners with a variable rate mortgage.

02

Individuals looking to adjust their mortgage terms to accommodate changing financial situations.

03

Borrowers interested in capturing lower interest rates as they fluctuate over time.

04

Anyone refinancing their mortgage to a variable rate.

Fill

form

: Try Risk Free

People Also Ask about

What happens when you are on a variable rate mortgage?

A standard variable rate, or SVR, is the interest rate that will be charged once an initial deal period on a fixed or tracker rate mortgage comes to an end. With an SVR mortgage, your mortgage payments could change each month, going up or down depending on the rate.

What is a variable lending rate?

A variable rate mortgage will fluctuate with the CIBC Prime rate throughout the mortgage term. While your regular payment will remain constant, your interest rate may change based on market conditions. This impacts the amount of principal you pay off each month.

Is it a good idea to get a variable rate mortgage?

Unlike fixed-rate mortgages, which often come with interest rate differential (IRD) penalties that can amount to tens of thousands of dollars, variable-rate mortgages typically carry a much smaller penalty — just three months' interest — making them a more flexible option for borrowers who may need to break their mortgage

What is the difference between a variable rate and a tracker rate?

With a tracker rate mortgage, you'll usually pay base rate plus an additional percentage in interest every month. This is for an initial fixed term of normally between 2 and 5 years. A Standard Variable Rate mortgage is what you revert to once any initial mortgage term ends.

What is a variable rate endorsement?

This endorsement insures against the invalidity, unenforceability, or loss of priority of the lien of the insured mortgage by reason of provisions for changes in the rate of interest.

What is meant by a variable rate?

What Is a Variable Interest Rate? A variable interest rate (sometimes called an “adjustable” or a “floating” rate) is an interest rate on a loan or security that fluctuates over time because it is based on an underlying benchmark interest rate or index that changes periodically.

What are the disclosures for variable rates?

For variable-rate loans, the creditor should disclose a reasonably current index and margin. In addition, the advertisement should include the period of time each rate will apply and the APR for the loan.

What is a variable rate mortgage?

A variable rate mortgage will fluctuate with the CIBC Prime rate throughout the mortgage term. While your regular payment will remain constant, your interest rate may change based on market conditions. This impacts the amount of principal you pay off each month.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is VARIABLE RATE MORTGAGE ENDORSEMENT?

A VARIABLE RATE MORTGAGE ENDORSEMENT is an addition to a mortgage agreement that permits the lender to adjust interest rates periodically based on changes in market conditions or specified indexes.

Who is required to file VARIABLE RATE MORTGAGE ENDORSEMENT?

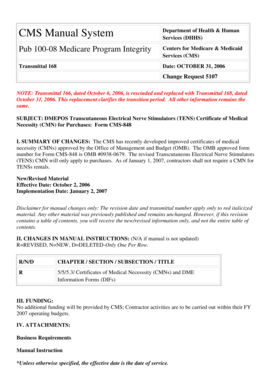

Lenders offering variable rate mortgage products are typically required to file a VARIABLE RATE MORTGAGE ENDORSEMENT with the appropriate regulatory body to ensure compliance with applicable laws and regulations.

How to fill out VARIABLE RATE MORTGAGE ENDORSEMENT?

To fill out a VARIABLE RATE MORTGAGE ENDORSEMENT, lenders must provide details such as the mortgage's loan amount, interest rate structure, adjustment intervals, and the indexes to be used for rate changes.

What is the purpose of VARIABLE RATE MORTGAGE ENDORSEMENT?

The purpose of the VARIABLE RATE MORTGAGE ENDORSEMENT is to provide transparency regarding how interest rates may change over the life of the loan and to protect the rights of both the lender and borrower.

What information must be reported on VARIABLE RATE MORTGAGE ENDORSEMENT?

The information that must be reported includes the initial interest rate, adjustment frequency, index used for rate changes, caps on interest rate increases, and other terms relevant to the variable rate structure.

Fill out your variable rate mortgage endorsement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Variable Rate Mortgage Endorsement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.