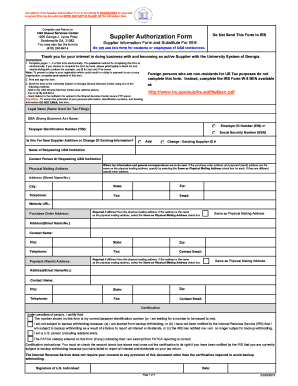

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Get the free Annual Accounting

Show details

This document is for the Seller to provide an annual accounting to the Buyer regarding the payment status of a Contract for Deed. It includes details about the payments made, remaining amounts owed,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual accounting

Edit your annual accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual accounting online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit annual accounting. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual accounting

How to fill out Annual Accounting

01

Gather all financial documents for the year, including income statements, expense reports, and bank statements.

02

Organize your financial data into categories such as revenue, expenses, assets, and liabilities.

03

Ensure that all receipts and invoices are collected and properly documented.

04

Choose the accounting method (cash or accrual) that you will use for the annual accounting.

05

Fill out the relevant forms required for Annual Accounting as per your jurisdiction's regulations.

06

Calculate your total income and total expenses to determine your net income or loss.

07

Review all entries for accuracy and completeness before finalizing.

08

Submit your completed Annual Accounting to the appropriate tax authority or regulatory body before the deadline.

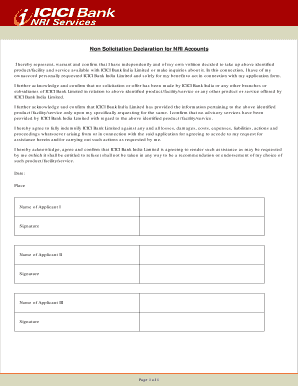

Who needs Annual Accounting?

01

Individuals and businesses required to report their financial performance and tax obligations.

02

Self-employed individuals who need to keep track of their income and expenses.

03

Corporations and partnerships that must comply with legal accounting requirements.

04

Non-profit organizations that need to provide transparency and accountability to stakeholders.

Fill

form

: Try Risk Free

People Also Ask about

Why is the English language important in accounting?

Developing strong English literacy skills in reading, writing, listening, and speaking enhances students' ability to understand and analyze complex accounting concepts, international financial standards, and regulations.

What is the basic of accounting in English?

What are the basics of accounting? Basic accounting concepts used in the business world encompass revenues, expenses, assets, and liabilities. Accountants track and record these elements in documents like balance sheets, income statements, and cash flow statements.

What is annual accounting?

Annual accounts are financial reports that provide a comprehensive overview of a company's financial activity over a specific financial year. These accounts include a profit and loss statement, balance sheet, and other information about the company's financial position.

What English do you need for accounting?

Accepted evidence Minimum test scoresListeningWriting IELTS Academic 7 7 TOEFL iBT 24 27 PTE Academic 65 65 Cambridge 185 185

What language should an accountant learn?

Learning coding languages such as Python, R, or SQL can help the accountant improve the process and workflow. Rather than hiring out to a programmer and trying to communicate what function you would like them to code for you, you code write the code yourself.

What subjects are needed for accounting?

Accountancy Degree Programme through UTME should possess the Senior Secondary School Certificate (SSCE) or the General Certificate of Education (GCE) Ordinary level or an equivalent qualification with credit level passes in at least five subjects which must include English Language, Mathematics, Economics and any one

What requirements do I need for accounting?

You could do a degree in any subject then apply for a place on a graduate training scheme to work towards a professional accountancy qualification. If you want to take a more focused route onto a graduate scheme, you could study for an accountancy related degree, like: accountancy. accounting and finance.

What is the difference between bookkeeping and accounting in English?

The purpose of bookkeeping is to maintain a systematic record of financial activities and transactions chronologically. The purpose of accounting is to report the financial strength and obtain the results of the operating activity of a business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Annual Accounting?

Annual Accounting is a process whereby a business or individual summarizes and reports its financial activities over a year, including income, expenses, and tax obligations.

Who is required to file Annual Accounting?

Individuals and businesses that meet specific income thresholds or types of business activity mandated by tax authorities are required to file Annual Accounting.

How to fill out Annual Accounting?

To fill out Annual Accounting, one must gather all relevant financial records, complete the required forms provided by tax authorities, and ensure all figures are accurate and reflect the total financial activity for the year.

What is the purpose of Annual Accounting?

The purpose of Annual Accounting is to provide a clear and comprehensive financial summary for the year, ensuring compliance with tax regulations and helping businesses and individuals assess their financial performance.

What information must be reported on Annual Accounting?

Information that must be reported includes total income, allowable expenses, net profit or loss, assets and liabilities, and any relevant tax credits or deductions.

Fill out your annual accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.