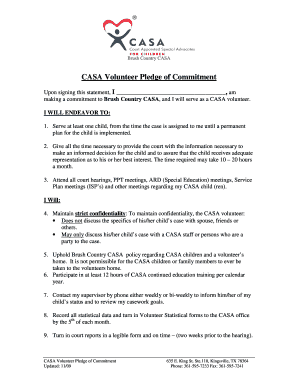

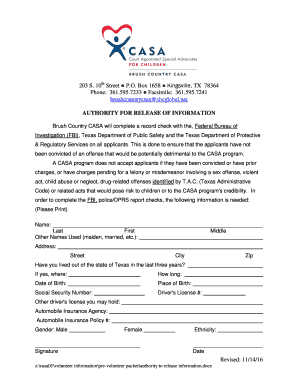

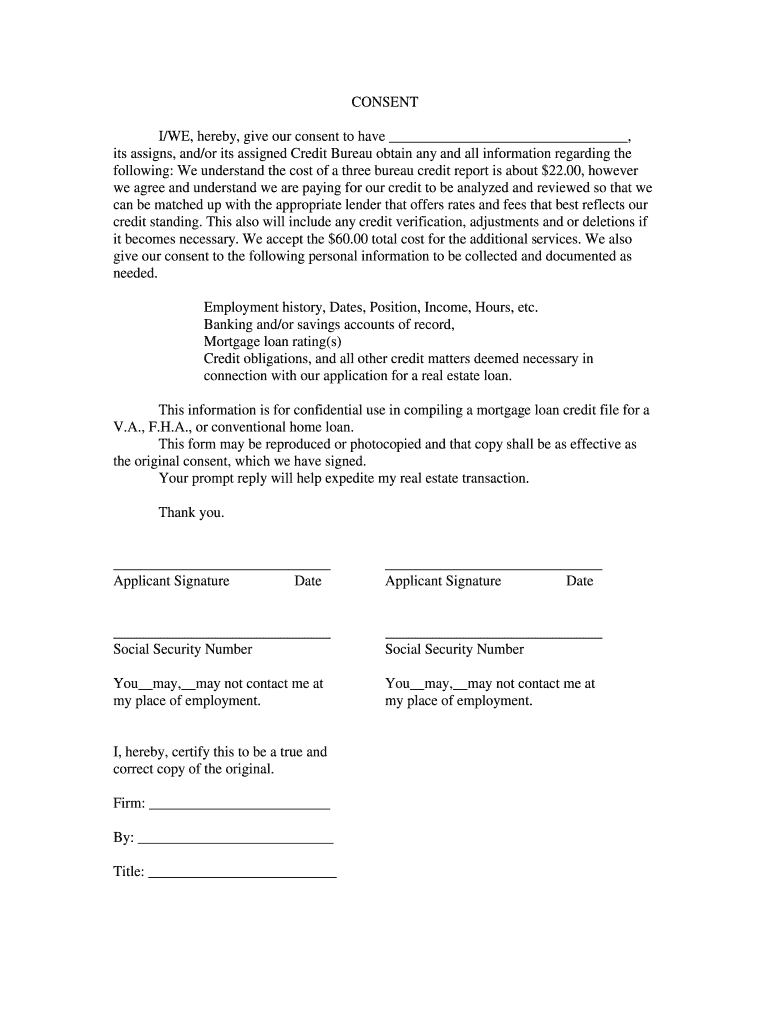

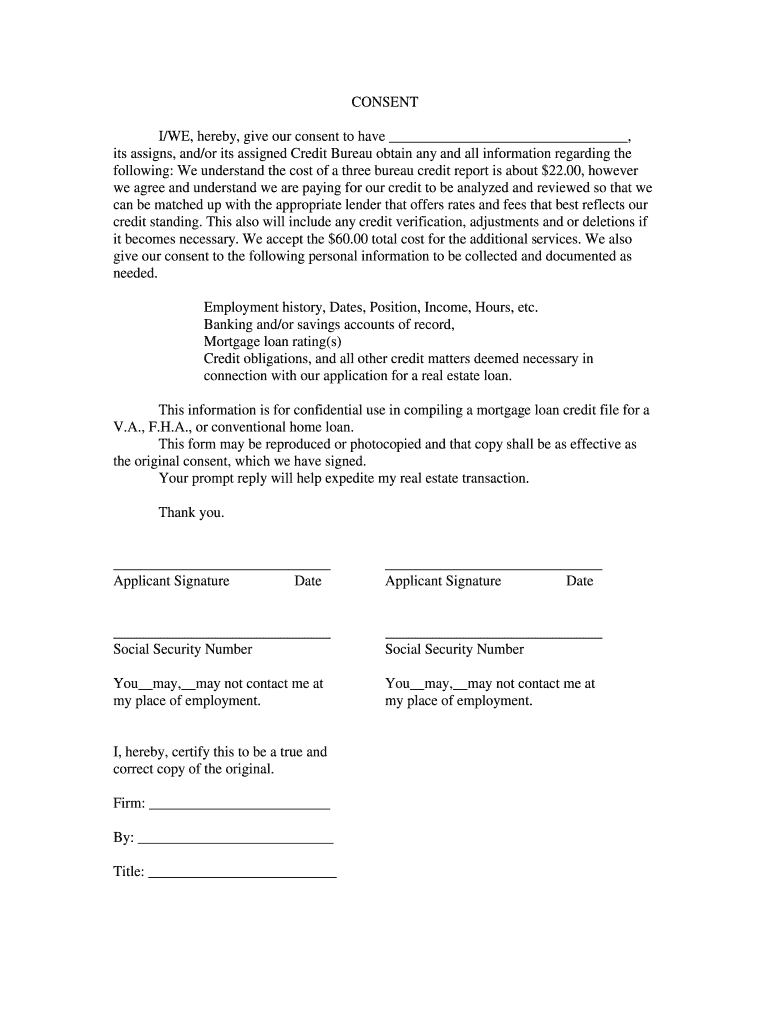

Get the free Consent and Mortgage Broker Fee Disclosure

Show details

This document serves to obtain consent for credit information collection and outlines the nature of the relationship with the mortgage broker, including their compensation and responsibilities. It

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consent and mortgage broker

Edit your consent and mortgage broker form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consent and mortgage broker form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consent and mortgage broker online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit consent and mortgage broker. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consent and mortgage broker

How to fill out Consent and Mortgage Broker Fee Disclosure

01

Begin by entering your name and contact information at the top of the document.

02

Provide the date of the disclosure.

03

Clearly state the purpose of the consent, detailing the services you will receive from the mortgage broker.

04

Outline the fees associated with the services provided, ensuring transparency about any costs involved.

05

Include a section for the borrower's acknowledgment and agreement to the terms by providing space for signatures and dates.

06

Review the completed document for accuracy before submission.

Who needs Consent and Mortgage Broker Fee Disclosure?

01

Anyone applying for a mortgage loan through a broker.

02

Borrowers who require clear understanding of mortgage broker fees and consent.

03

Real estate agents involved in transactions requiring disclosures.

Fill

form

: Try Risk Free

People Also Ask about

What does RESPA require lenders to disclose?

The Act requires lenders, mortgage brokers, or servicers of home loans to provide borrowers with pertinent and timely disclosures regarding the nature and costs of the real estate settlement process. The Act also prohibits specific practices, such as kickbacks, and places limitations upon the use of escrow accounts.

What disclosures are specifically required within 3 days of application?

Disclosure of good faith estimate of costs must be made no later than 3 days after application. This means that a creditor must deliver or mail the early disclosures for all mortgage loans subject to RESPA no later than 3 business days (general definition) after the creditor receives a consumer's application.

Do mortgage brokers have to disclose commissions?

If a borrower asks, the broker must inform the borrower of the amount of the commission or, if not ascertainable, the method of calculation. This does have an impact on the creditor.

What are the four main disclosures required under TILA?

TILA disclosures include the number of payments, the monthly payment, late fees, whether a borrower can prepay the loan without penalty and other important terms. TILA disclosures is often provided as part of the loan contract, so the borrower may be given the entire contract for review when the TILA is requested.

Can a mortgage broker charge a fee?

Sometimes, a broker will charge you a fee directly — instead of, or as well as, the lender's commission. If you're not sure whether you're getting a good deal, ask around or look online to see what other brokers charge.

What does the Home Mortgage Disclosure Act require?

The Home Mortgage Disclosure Act (HMDA) requires certain financial institutions to collect, report, and disclose information about their mortgage lending activity. HMDA was originally enacted by Congress in 1975 and is implemented by Regulation C (12 CFR Part 1003)).

Why is the mortgage broker asking for too much documents?

The more proof a lender has for a homebuyer's reliability, the more protection they have. And that proof comes in the form of lots of documents and questions. The more paperwork lenders have on you, the better they can protect themselves.

What disclosures are mandatory when disclosing a mortgage loan file?

A RE 882 Mortgage Loan Disclosure Statement (MLDS) is required by California law and must also be provided. ❖ The information provided below reflects estimates of the charges you are likely to incur at the settlement of your loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Consent and Mortgage Broker Fee Disclosure?

Consent and Mortgage Broker Fee Disclosure is a document that outlines the fees and consents associated with mortgage brokerage services. It ensures that consumers are informed about the costs they may incur while obtaining a mortgage through a broker.

Who is required to file Consent and Mortgage Broker Fee Disclosure?

Mortgage brokers who operate within certain jurisdictions are required to file Consent and Mortgage Broker Fee Disclosure. This typically includes licensed brokers who serve clients seeking mortgage financing.

How to fill out Consent and Mortgage Broker Fee Disclosure?

To fill out the Consent and Mortgage Broker Fee Disclosure, the broker must provide details about their services, list any fees associated with the mortgage transactions, obtain the client's signature for consent, and ensure all required information is clearly presented.

What is the purpose of Consent and Mortgage Broker Fee Disclosure?

The purpose of Consent and Mortgage Broker Fee Disclosure is to provide transparency to consumers regarding the fees they will be charged and to obtain their consent for any associated services, fostering trust between the broker and the client.

What information must be reported on Consent and Mortgage Broker Fee Disclosure?

The information that must be reported includes the broker's name and contact details, the types of fees charged, the services provided, estimated costs for services, and any conflicts of interest that may arise.

Fill out your consent and mortgage broker online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consent And Mortgage Broker is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.