Get the free LOAN CONDITION SUBMISSION CHECKLIST

Show details

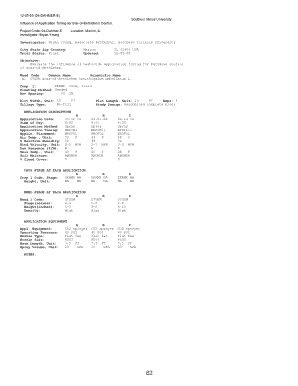

This document serves as a checklist for brokers to submit loan conditions necessary for expediting the loan process, requiring detailed information about the loan status and conditions needed for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan condition submission checklist

Edit your loan condition submission checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan condition submission checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan condition submission checklist online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit loan condition submission checklist. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan condition submission checklist

How to fill out LOAN CONDITION SUBMISSION CHECKLIST

01

Begin by gathering all necessary documents required for the loan submission.

02

Review the checklist provided by your lender to understand specific requirements.

03

Fill out personal details such as name, address, and loan information at the top of the checklist.

04

Affiliate each required document with its corresponding checkbox to confirm its inclusion.

05

Double-check that each document is complete, signed, and dated where necessary.

06

Include any additional information that may be requested by the lender.

07

Make copies of completed checklist and submitted documents for your records.

08

Submit the completed checklist along with the documents to your lender.

Who needs LOAN CONDITION SUBMISSION CHECKLIST?

01

Individuals applying for a loan.

02

Loan officers managing the application process.

03

Financial institutions reviewing loan applications.

Fill

form

: Try Risk Free

People Also Ask about

What are the things needed for personal loan?

o Identity proof (PAN card, Voters ID, Passport, Aadhaar, etc.) o Address proof (Driving license, Passport, Aadhaar, etc.) For salaried individuals, provide income proof of the last 2 years' ITR/Form 16 and the latest 3 months' salary slip. Additionally, submit bank statements of the last 12 months.

What checks are done for a personal loan?

Lenders also check Details you provide. As part of a credit application you'll be asked for some personal and financial information, which could include your address, employment status, income and regular expenditure. Affordability. Your account history.

What are the 5 elements of a loan?

The Underwriting Process of a Loan Application One of the first things all lenders learn and use to make loan decisions are the “Five C's of Credit": Character, Conditions, Capital, Capacity, and Collateral.

What are the conditions of a loan?

Conditions are essentially requirements set by the lender that the borrower must meet to secure the mortgage approval. These could be related to your credit score, income, employment status, or down payment. They're non-negotiable and must be fulfilled for the loan to be approved.

What is a standard loan condition?

These conditions typically address the borrower's obligations, the loan's repayment structure, interest rates, collateral, covenants, and any other factors that govern the relationship between the borrower and the lender.

What are the basic requirements for a personal loan?

Key personal loan requirements Credit Score. Lenders consider your credit score whenever they decide to approve you for a personal loan. Debt-to-income ratio. Employment Status. Age. Documents to gather. Improving your chances of being approved for a personal loan.

What is the checklist for personal loan?

o Identity proof (PAN card, Voters ID, Passport, Aadhaar, etc.) o Address proof (Driving license, Passport, Aadhaar, etc.) For salaried individuals, provide income proof of the last 2 years' ITR/Form 16 and the latest 3 months' salary slip. Additionally, submit bank statements of the last 12 months.

What is checked before giving a loan?

However, most lenders check credit scores, credit history, loan repayment capacity, salary, and overall creditworthiness in a loan application. Each lender has their own loan qualification criteria. Make sure to research the eligibility criteria before applying for the loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is LOAN CONDITION SUBMISSION CHECKLIST?

The LOAN CONDITION SUBMISSION CHECKLIST is a document used in the loan application process that outlines required conditions and documentation that must be submitted to move forward with the loan approval.

Who is required to file LOAN CONDITION SUBMISSION CHECKLIST?

Borrowers seeking a loan are typically required to file the LOAN CONDITION SUBMISSION CHECKLIST, along with lenders or mortgage brokers managing the loan application process.

How to fill out LOAN CONDITION SUBMISSION CHECKLIST?

To fill out the LOAN CONDITION SUBMISSION CHECKLIST, accurately complete all sections by providing requested information and attaching necessary documentation supporting the conditions listed. It's advisable to review the checklist carefully to ensure all items are addressed.

What is the purpose of LOAN CONDITION SUBMISSION CHECKLIST?

The purpose of the LOAN CONDITION SUBMISSION CHECKLIST is to ensure all necessary information and documents are collected systematically to facilitate the loan approval process and reduce delays.

What information must be reported on LOAN CONDITION SUBMISSION CHECKLIST?

The LOAN CONDITION SUBMISSION CHECKLIST typically requires information such as personal identification details, income verification, credit history, asset documentation, and any other conditions specified by the lender.

Fill out your loan condition submission checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Condition Submission Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.